By Harish Sundaresh, Portfolio Manager, Systematic Investing Strategies & Diqing Wu, Quantitative Analyst

When storage capacity is near its limits, how do oil producers offload their inventory? One way is to incentivize buyers with negative prices. This is precisely what happened on April 20, the day before the May WTI[i] futures contract expired.

Oil with nowhere to go

Currently, pipelines are full, refinery storage is full and third-party storage is almost full. Demand continues to be weak, especially in the wake of COVID-19, and refineries have little reason to take physical delivery. As the expiration date of May WTI futures approached, producers tried to entice buyers to accept deliveries with negative prices.

We don’t see much respite for crude oil in May. We expect excess supply to breach storage limits in the coming weeks, and crude oil prices will likely remain weak as long as the majority of the global economy is locked down. All eyes will be on the next WTI futures contract, which expires on May 19. Prices could go negative again as the contract reaches maturity.

What do negative prices mean for pricing models?

Negative prices could have a serious impact on risk management and option pricing models. For example, the Black-Scholes model[ii] is widely used to determine fair pricing for options. It assumes that the price of any asset is always greater than zero. While that is true of stock prices, it is not necessarily true for hard-to-store commodity assets, as we’ve seen. The CME, the world’s largest financial derivatives exchange, was aware of this possibility and has quickly replaced the Black-Scholes model with the Bachelier model,[iii] another option pricing model that can account for negative prices.

Incorporating negative prices into machine learning

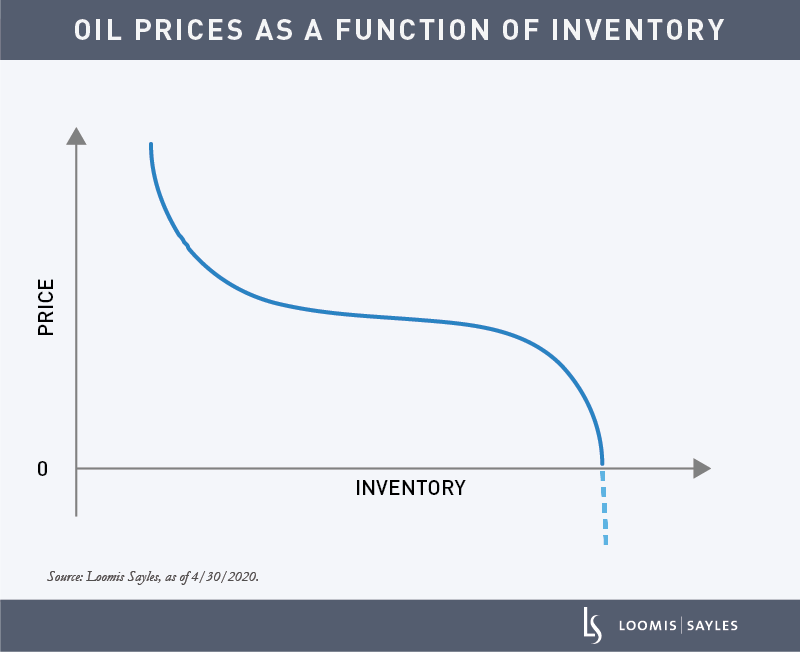

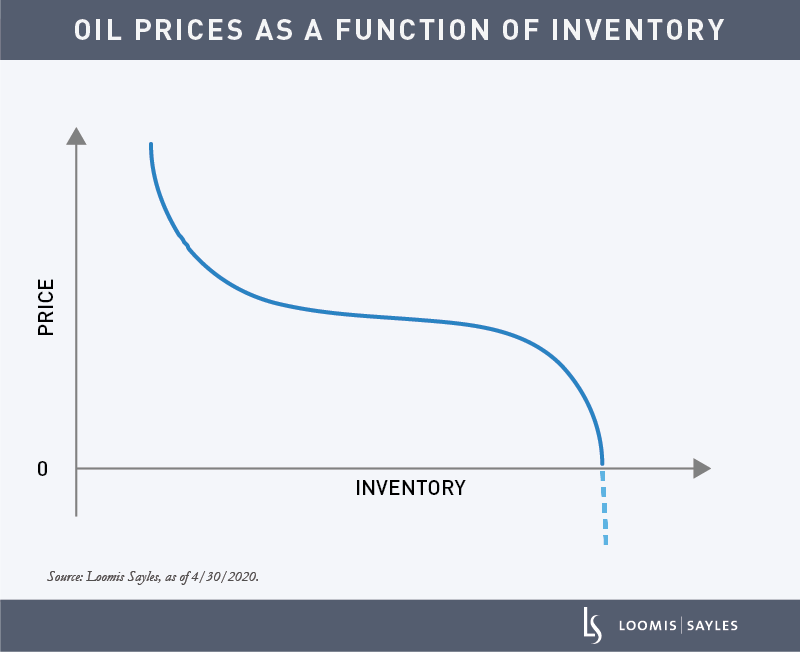

Loomis Sayles’ Systematic Investing Strategies team uses machine learning to model oil prices. The machine models oil prices as a function of inventory in addition to other features. The relationship is non-linear and can be approximated into an inverted S curve as shown below. Historically, that relationship would end at the solid line as prices approach zero. However, now we will retrain and recalibrate our models for deeper tails and negative prices to help measure potential upside and downside risks in the future.

How long could negative prices be a factor?

We have always believed that low oil prices alone are the only cure for low oil prices. In other words, we can only cure the supply problem with low prices that force structural declines in supply for some oil producers. We believe recent curtailments and an OPEC+ cut will not be enough to save the oil market in the very near term. Oil is a hard-to-store spot commodity, meaning supply and demand will have to clear in the spot market. Otherwise, storage will become a problem.

While we are very bearish on crude oil near term, there is potential for a recovery. Oil demand tends to be inelastic and will likely bounce back very quickly once lockdowns are lifted. China demand is almost back to pre-COVID levels and we expect demand in other countries to follow suit. Factor in OPEC+ cuts and structural declines in production, and we may see a balanced market as soon as the third quarter of this year.

[i] West Texas Intermediate, a specific grade of crude oil.

[ii] The Black-Scholes model, also known as the Black-Scholes-Merton (BSM) model, is a widely used mathematical model for pricing an options contract.

[iii] The Bachelier model is a mathematical model of Brownian motion used for valuing an options contract.

Commodity, interest and derivative trading involves substantial risk of loss. This is not an offer of, or a solicitation of an offer for, any investment strategy or product. Any investment that has the possibility for profits also has the possibility of losses.

Performance data shown represents past performance and is no guarantee of, and not necessarily indicative of, future results.

MALR025384