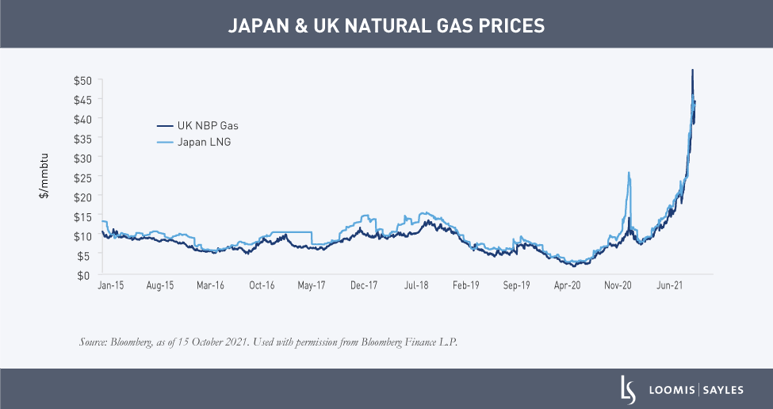

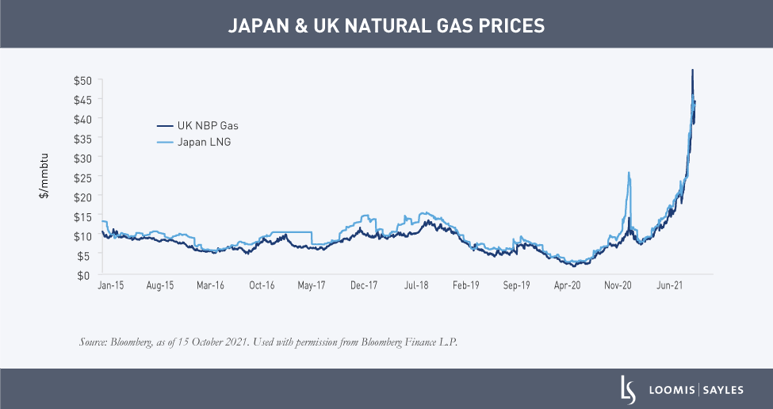

The worldwide spike in natural gas, coal and power prices has put Europe and China at risk of industrial shutdowns. While the situation seems to have surprised the market, it’s been more than nine months in the making. Here’s a look at the factors behind the surge and what could happen next.

How did we get here?

It began with the cold winter in Asia and Europe last year. The weather drained gas inventories to very low levels across the globe. Countries typically rebuild their inventories during the spring shoulder season, but couldn’t this year because of the following reasons:

- Lack of spare capacity in the liquid natural gas (LNG) market. Low gas prices over recent years and fears of LNG oversupply has stifled investment in new natural gas supplies. As a result, LNG facilities are managed to meet existing contracts and have little capacity to respond to supply constraints.

- Tighter supply flow from Russia. Russia has reduced its natural gas exports, a move it blamed on a processing plant outage and lower Russian production. However, some have speculated that Russia may be trying to pressure Germany into approving the Nord Stream 2 gas pipeline. The pipeline would run from Russia to Germany via the Baltic Sea.

- Disappointing gas production in Europe. Investment in the North Sea has been very low over the past decade, leading to lower local offshore production in the region. Meanwhile, the giant Groningen gas field in the Netherlands is slowly being shut down due to earthquakes.

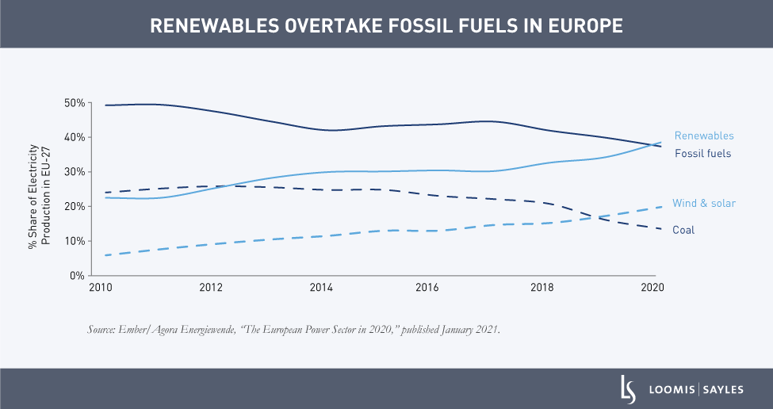

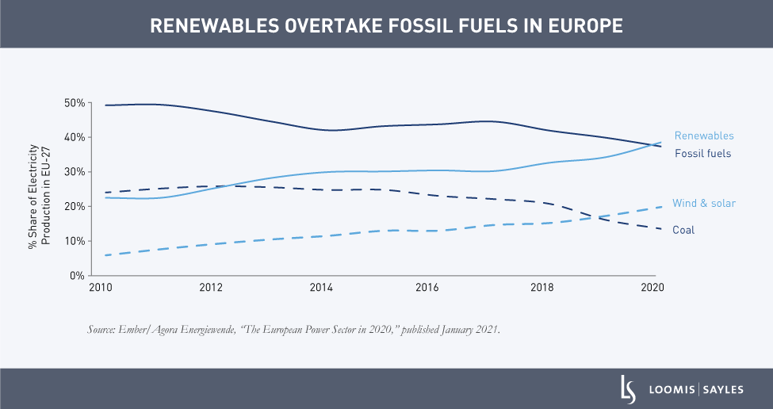

I believe the long-term transition toward renewable energy sources has exacerbated the current situation. Europe and China have reduced their coal generation capacity in favor of renewable energy sources like wind and solar power. However, renewable energy production has disappointed this year, forcing many countries to rely more on natural gas power generation. In my view, if gas inventories reach very low levels and coal is unavailable, some may have to switch to oil-powered generation. However, the ability to do so will be limited. At current elevated prices, I believe it makes more economic sense to burn diesel versus natural gas or coal.

What’s the solution?

In my view, there is no short-term solution to this energy crisis. Even if coal and oil generation facilities come back online, I believe the impact would likely be marginal due to the lack of coal availability and oil generation capacity. I think gas and coal prices will remain high for at least the next year as countries restock inventories and secure supplies for winter 2022/2023.

In the meantime, I believe the best-case scenario is a warm winter that would ease the demand for gas. However, if this winter is colder than normal and renewable energy generation continues to disappoint, we could see significant rationing of electric capacity to industrial facilities in Europe and Asia.

While the market appears to have priced in the direct impact of higher energy prices, I don’t believe it has factored in the potential knock-on effects that the shortage could have on industrial and economic activity. Industrial shutdowns have already begun in China and the UK. If the shutdowns become more widespread, I believe they could disrupt global supply chains (already under stress from the pandemic) and put the global economy at risk of a slowdown.

License to reproduce Ember/Agora Energiewende chart here.

MALR027975

Commodity, interest and derivative trading involves substantial risk of loss. This is not an offer of, or a solicitation of an offer for, any investment strategy or product. Any investment that has the possibility for profits also has the possibility of losses.

Information obtained from outside sources is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or redistributed without authorization.