As the global recovery kicks into gear, there are signs of shortages and delays causing pricing pressure. It appears that aggregate demand may be rebounding faster than aggregate supply.

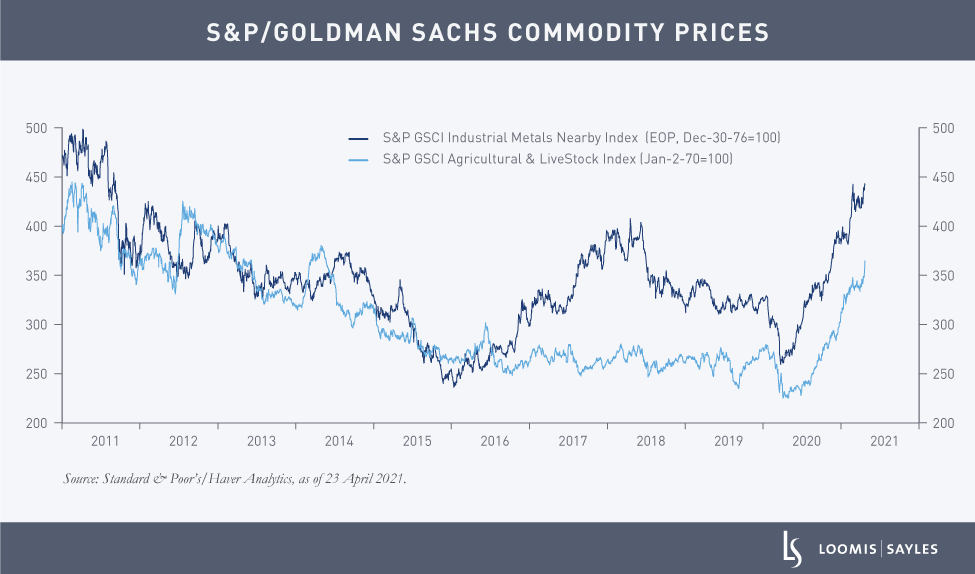

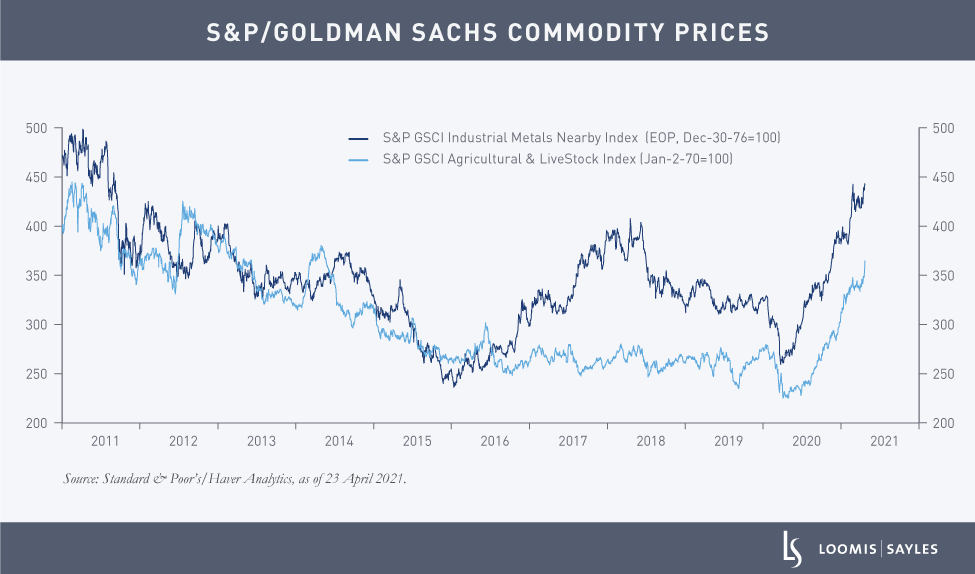

Commodities, which often have inelastic short-term supply, have met surging demand and transportation limitations, resulting in price spikes. The chart below shows daily data for S&P/Goldman Sachs commodity prices for industrial metals and agriculture/food products. Industrial metal prices, which are typically an indicator of global manufacturing demand, are currently at a decade high. Agriculture/food prices are currently at the highest level since the middle of the last decade.

Price pressure likely to fade as production accelerates

I believe this inflation is transitory. As the pandemic recedes, production is likely to accelerate, and greater supply would relieve the upward pressure on prices. It is not unusual for inflation to pop in the early stages of a recovery and then fade. I think we’re likely to see that pattern again.

MALR027189

Commodity, interest and derivative trading involves substantial risk of loss.

Market conditions are extremely fluid and change frequently.

This blog post is provided for informational purposes only and should not be construed as investment advice. Any opinions or forecasts contained herein reflect the

subjective judgments and assumptions of the authors only and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. Information, including

that obtained from outside sources, is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or

redistributed without authorization. This information is subject to change at any time without notice.