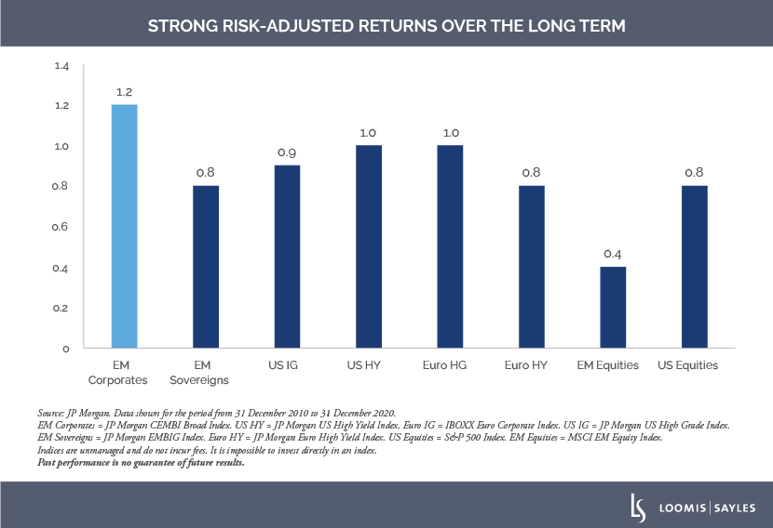

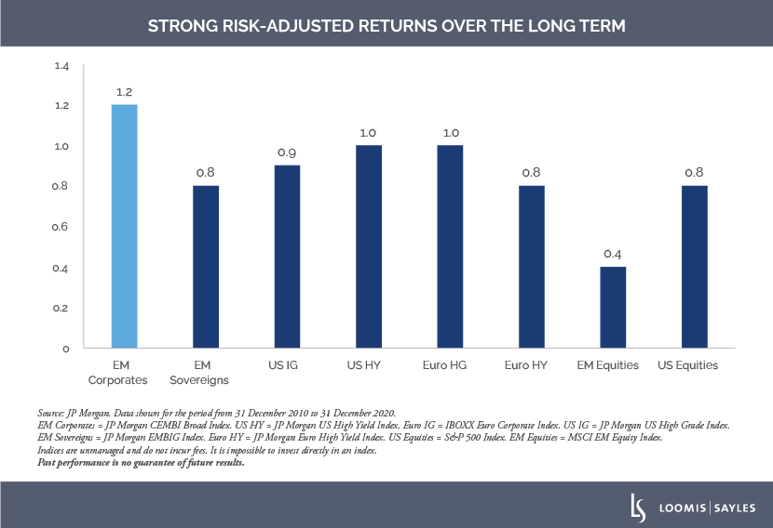

For some time, bond investors have been yield hungry, even starved. In such an environment, emerging market (EM) corporate debt has stood out for its potential yield premiums. However, this characteristic is only part of a broader favorable picture. Consider that on a risk-adjusted basis, EM corporate debt has bested other major asset classes over the long term. With its strong risk/reward and incremental spread, we believe EM corporates offer an investment opportunity for a variety of objectives, including total return, income and liability matching.

Within the broader EM debt universe, we believe EM corporates have a particularly strong value proposition. Here are some reasons why:

- Over time, the EM corporate universe has become more robust with an expansion of sectors and issuers. At five times the size of the EM sovereign segment, the EM corporate debt universe consists of approximately 1,000 corporate and quasi-sovereign issuers. This has meant more choices for investors.

- EM corporate credit ratings often belie underlying business metrics because, according to ratings agency methodology, companies generally cannot be rated above their sovereign rating. So on a fundamental basis, some EM corporates can be significantly higher quality than their credit ratings indicate.

- In contrast to bond issuers in developed markets, we believe EM corporate bond issuers are more often driven to achieve an investment grade rating. Comparatively, EM corporates tend to issue debt for productive purposes rather than financial engineering.

- Looking at defaults in recent years, EM high yield (HY) sovereigns have outpaced that of EM HY corporates. In 2020, the default rate for EM sovereign HY issues increased by double digits compared to a fairly benign 3.5% for EM HY corporates.

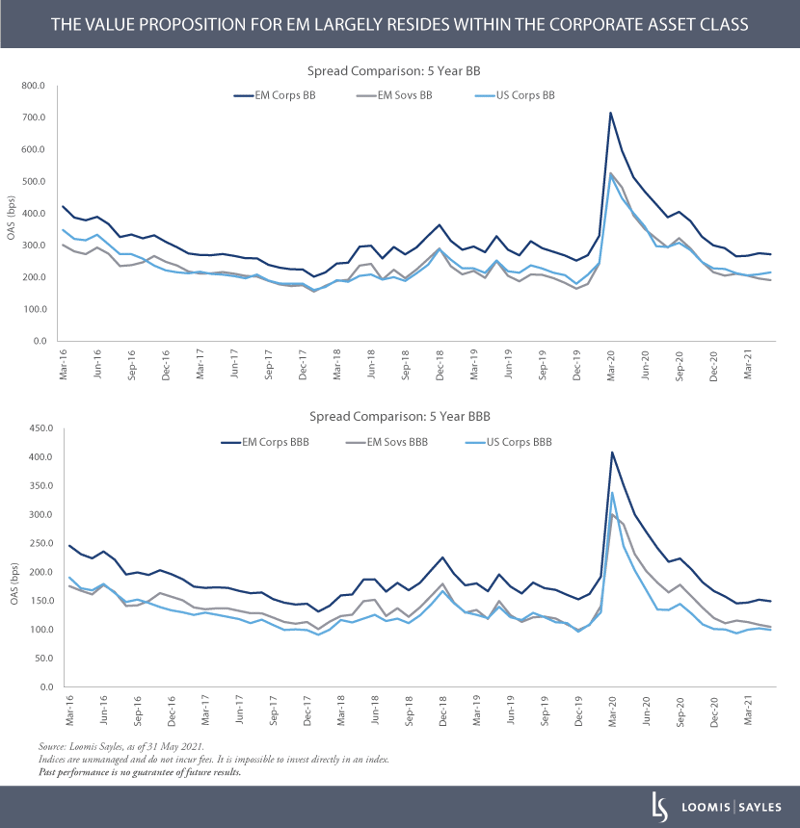

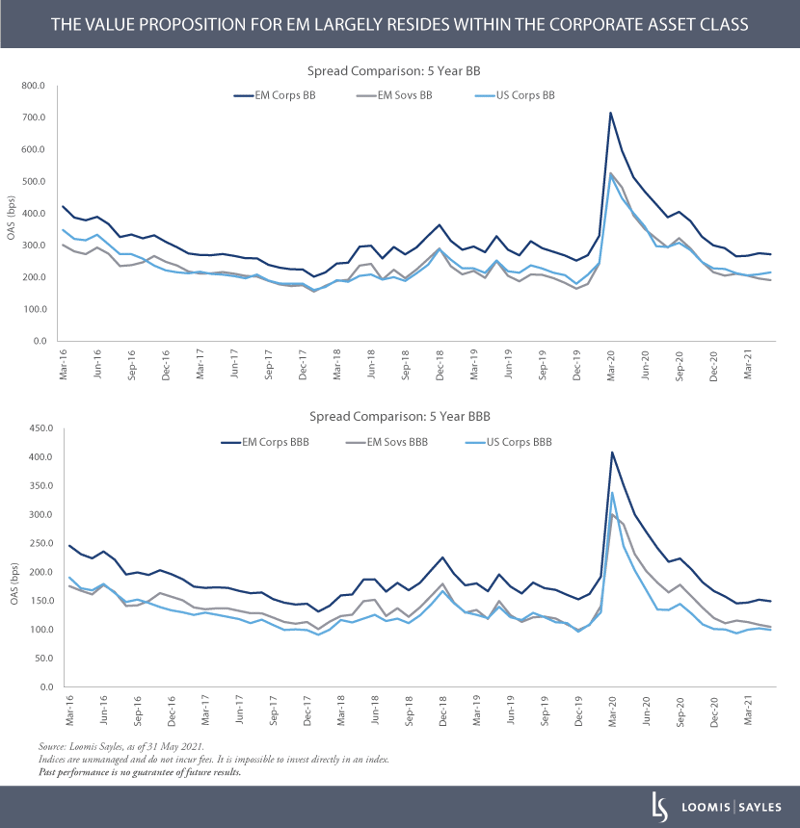

In our view, EM corporate valuations do not reflect these advantages. On a matched-ratings basis, EM corporates have offered a consistent spread premium to their EM sovereign and developed market corporate counterparts (see charts).

During our long history of investing in EM debt, we have found the EM corporate universe to be fertile ground for improving credit stories. In our view, successful investing in EM corporate bonds is all about doing your homework. This includes undertaking deep fundamental research to help identify mispriced credit risk and investment opportunities to extract risk premium or potential alpha.

From multiple perspectives, we believe EM corporate debt is worth consideration.

MALR027402

There is no assurance that developments will transpire as forecasted and actual results will be different. Information, including that obtained from outside sources, is believed to be correct, but Loomis Sayles cannot guarantee its accuracy.

Any investment that has the possibility for profits also has the possibility of losses.

Market conditions are extremely fluid and change frequently.