1. With spreads having tightened so much over the past year, do you still see value in emerging markets?

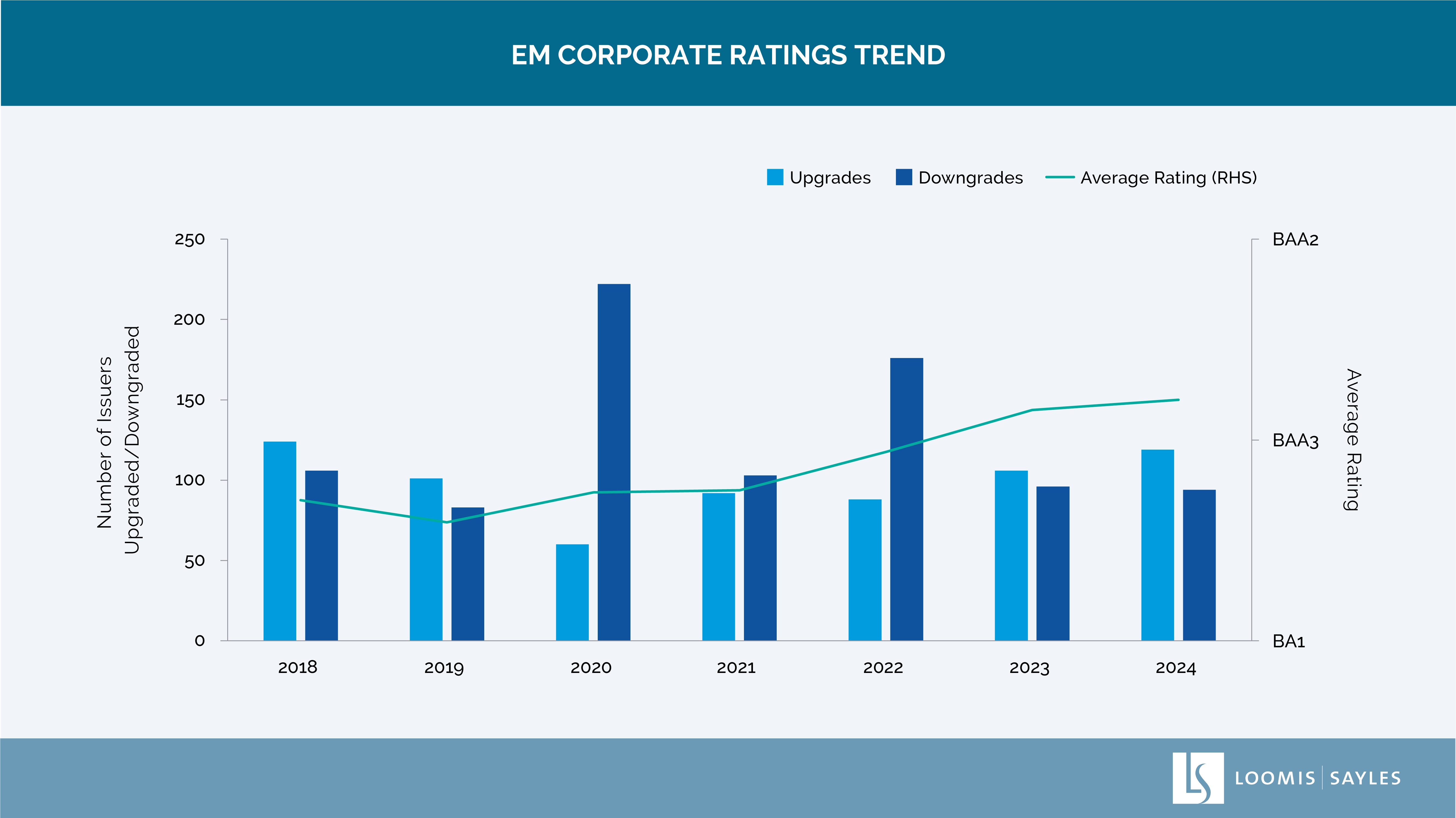

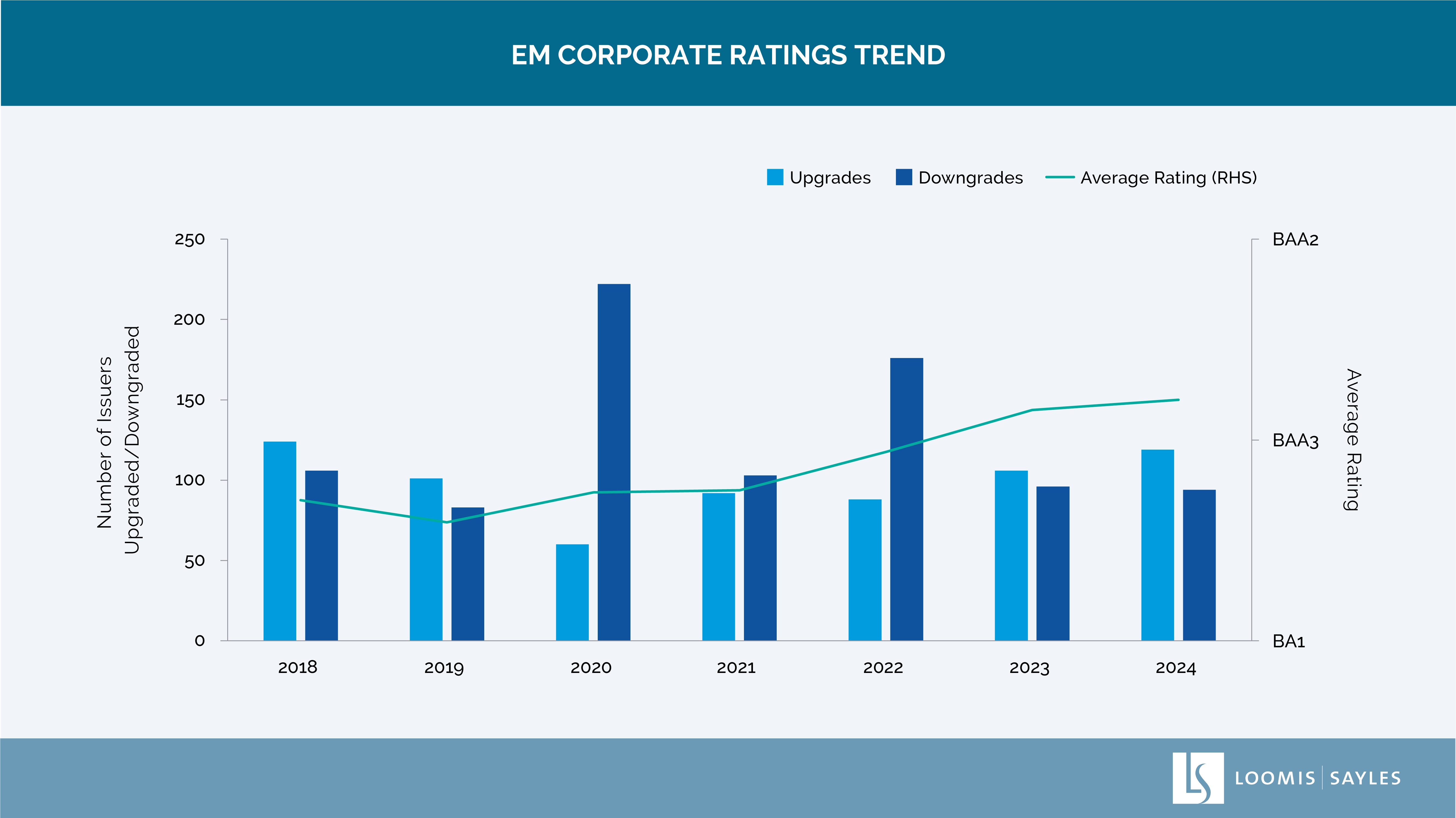

We do. Optically, emerging market (EM) spreads may look tight, however we continue to see value owing in part to the asset class's positive net ratings trend. In 2024, a myriad of factors contributed to sovereign and corporate upgrades in EM in Europe, the Middle East, Latin America and Asia—excluding China. Notable upgrade markets included Turkey, and the GCC (Gulf Cooperation Council). Improved standalone corporate credit fundamentals also played a key role in the positive ratings momentum. We continue to identify value in the space, especially compared to many developed market indices.

Chart source: JP Morgan & Bloomberg, as of 31 December 2024.

The chart presented above is shown for illustrative purposes only. Some or all of the information on this chart may be dated, and, therefore, should not be the basis to purchase or sell any securities. The information is not intended to represent any actual portfolio. Information obtained from outside sources is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or redistributed without authorization.

Another factor contributing to our favorable view of value in EM is the asset class's striking resilience in 2024. Investors had entered the year focused on the potential volatility of scheduled elections in many large, core EMs. While we did see some volatility as markets anticipated elections, in general we saw market dynamics normalize very quickly. Even geopolitical tensions did not induce a spike in EM volatility. This speaks to the durability that we are now coming to almost expect in EMs.

2. Do you think this resilience is susceptible to the many unknowns surrounding US government policies as 2025 progresses?

Gauging potential capital market volatility is constantly on our radar. Looking ahead, we foresee the unknowns surrounding the new administration’s tariff policies as potential triggers. In our view, these tariffs are a global issue that will likely have rippling implications for EMs. However, similar to the administration’s policies in 2018, we believe EMs can adapt. Geopolitical risks are to be expected in capital markets, and here too we are projecting relative EM stability.

We expect to see most of the ramifications in the Treasury market. Maybe we see a 10-year Treasury that fluctuates by approximately 100 basis points after US Federal Reserve action or comments. In our view, this could be something that might impact returns and likely drive sentiment month-to-month or day-to-day. We think it's going to be an ongoing factor, especially in a data-dependent environment when we have so many policies that are, as yet, undefined.

3. Can you summarize your outlook?

From a macro perspective, the backdrop of monetary easing should be supportive of EM, while the disinflationary pathway may be near its end in many countries. We think divergences here will be key to watch.

We believe there will likely be structural growth stories that provide tailwinds for select economies and EM economic growth in aggregate will continue to outpace that of developed markets. With regard to China, we expect growth to remain uneven, but potential stabilization in housing and additional fiscal stimulus to buffer tariff-related headwinds present an upside risk. Importantly, many core EMs have internal growth engines that we believe could offset weakness from a softer global demand backdrop. The carry advantage offered in EM has been reduced with the move lower in spreads, but the asset class's continued advantage versus developed markets should drive investor interest. We believe EM debt stands to benefit from investors hunting for yield and looking for diversification.

WRITTEN BY:

Elisabeth Colleran, CFA, Portfolio Manager, Emerging Market Debt

SAIFhkpzmfok

Diversification does not ensure a profit or guarantee against a loss.