When it comes to thinking about opportunities and risks in emerging markets (EM), old habits die hard. Investors and news articles tend to treat EM like one homogenous opportunity set, glossing over the range of underlying asset classes, regions, countries and currencies—each with distinct characteristics.

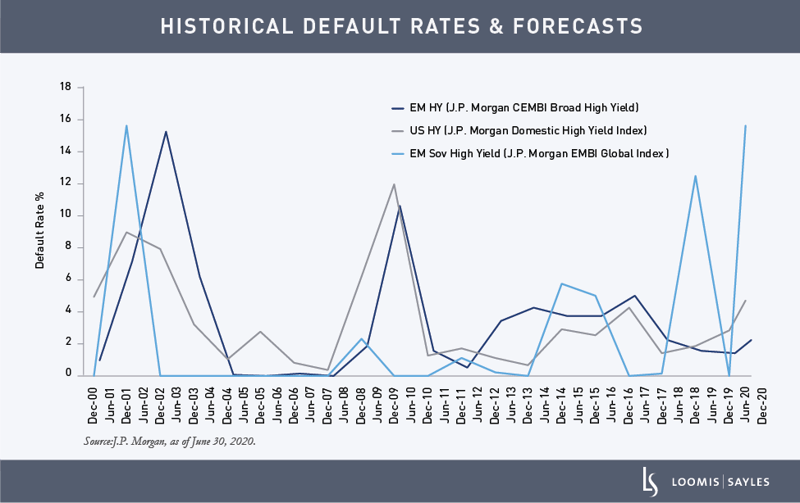

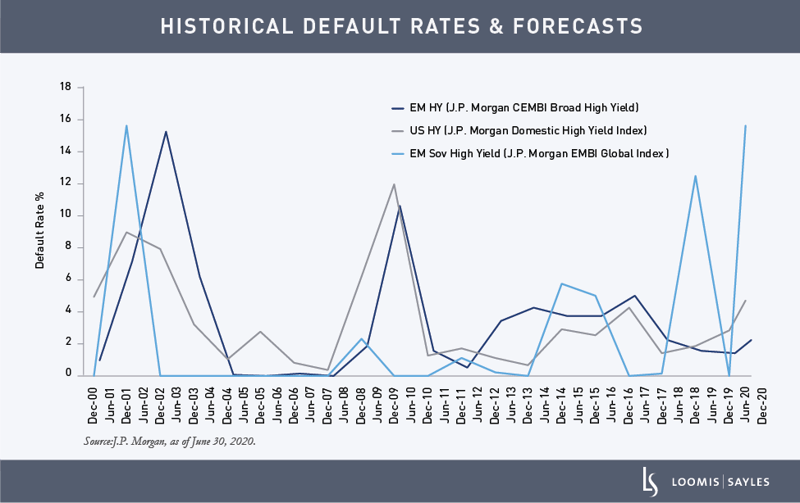

Take defaults in the EM debt space as a recent example. Some headlines are proclaiming a surge in EM debt downgrades and losses related to COVID-19 and weaker global growth. But we believe this is an oversimplification. EM sovereign debt and EM corporate debt have performed very differently since the pandemic. The default rate for the EM sovereign high yield index hit 15.8% as of June 30, 2020, reflecting the stress on sovereign balance sheets. EM high yield corporates, which often have diverse global revenue streams, defensive cost strategies and prudent debt management, have fared better and reported a 2.3% default rate as of June 30.

For more about the distinctions between EM sovereign and EM corporate debt, read our latest paper:

MALR026020

Market conditions are extremely fluid and change frequently.

This blog post is provided for informational purposes only and should not be construed as investment advice. Any opinions or forecasts contained herein reflect the

subjective judgments and assumptions of the authors only and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. Information, including

that obtained from outside sources, is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or

redistributed without authorization. This information is subject to change at any time without notice.