TIPS seem to be en vogue. Why the interest in this relatively unexciting, high-quality asset class? Some of the recent attention can be attributed to strong TIPS performance so far this year versus last year. But I also suspect that forward-looking investors are intrigued by the asset class as they keep a close eye on some looming market changes.

Energy Prices Rising

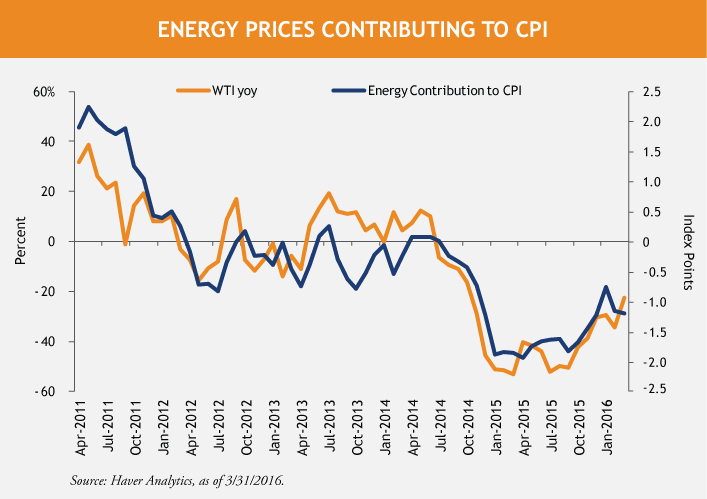

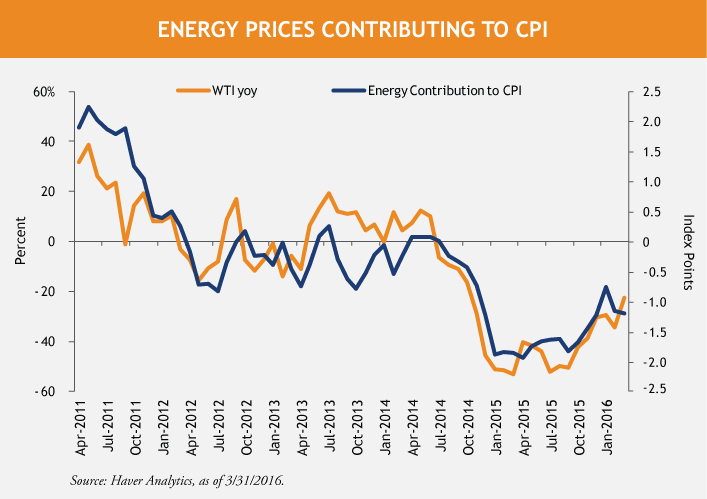

Energy prices have finally started to bounce back. And while it’s too soon to count on higher energy prices for the long-term, TIPS and energy prices have an interesting relationship.

TIPS are indexed to the Consumer Price Index for Urban Consumers non-seasonally adjusted (CPI-U). Shelter, food, transport, energy & medical care prices make up almost three-fourths of this index. Obviously, over the past year, the energy component has been a significant drag, while shelter costs have steadily risen since 2010.

If we begin to realize energy price appreciation, CPI will rise and in turn TIPS could benefit from higher coupon payments due to the inflation adjustment on the principal. If the energy component in CPI-U were to increase 5% year-over-year, using the historical weights of the energy component, we would expect a .4-.6% contribution to CPI-U. If you believe that oil has bottomed, TIPS could stand to benefit.

West Texas Intermediate (WTI), also known as Texas light sweet, is a grade of crude oil used as a benchmark in oil pricing.

Inflation Expectations Increase

Inflation is expected to be at approximately 1.6% over the next 10 years*. The five-year average on 10-year breakevens (calculated by subtracting the 10-year TIPS real yield from the 10-year nominal yield on a Treasury) is just above 2% (2010-2015). If the 10-year breakeven inflation rate were to rise to 2%, we would expect TIPS to outperform nominal Treasurys.

Inflation is expected to be at approximately 1.6% over the next 10 years*. The five-year average on 10-year breakevens (calculated by subtracting the 10-year TIPS real yield from the 10-year nominal yield on a Treasury) is just above 2% (2010-2015). If the 10-year breakeven inflation rate were to rise to 2%, we would expect TIPS to outperform nominal Treasurys.

In an environment where rising inflation is accompanied by low growth, we would expect real yields to rally and TIPS to have a positive return while nominal Treasury bonds may have a flat or even negative return. In an environment where rising inflation is accompanied with higher growth, TIPS are still likely to outperform nominal Treasurys, but could lose value as real interest rates rise with breakeven inflation. In this situation, an investor might want a more flexible TIPS strategy that has the ability to hedge interest rate risk and employ long breakeven strategies. A pure long TIPS position might lose value with higher real rates, but an investor that is long breakevens could benefit.

*Bloomberg data

MALR15062

Any investment that has the possibility for profits also has the possibility of losses.

Commodity trading involves substantial risk of loss. Past performance is no guarantee of and not necessarily indicative of, future results.

Inflation is expected to be at approximately 1.6% over the next 10 years*. The five-year average on 10-year breakevens (calculated by subtracting the 10-year TIPS real yield from the 10-year nominal yield on a Treasury) is just above 2% (2010-2015). If the 10-year breakeven inflation rate were to rise to 2%, we would expect TIPS to outperform nominal Treasurys.

Inflation is expected to be at approximately 1.6% over the next 10 years*. The five-year average on 10-year breakevens (calculated by subtracting the 10-year TIPS real yield from the 10-year nominal yield on a Treasury) is just above 2% (2010-2015). If the 10-year breakeven inflation rate were to rise to 2%, we would expect TIPS to outperform nominal Treasurys.