If Joe Biden were to win the US presidential election, his administration is expected to take action on climate change and declare it a national emergency soon after taking office. What kind of action could we expect on oil and gas companies?

I believe Biden would be likely to cancel the presidential permit for the Keystone pipeline and cancel new lease rounds on federal lands. I do not think Biden’s administration would seek a fracking ban, even on federal lands, or cancel the Dakota Access Pipeline given the expensive legal challenges and liabilities associated with these moves. But I would expect a larger push for renewables and incentives for greener energies.

Oil and gas companies likely to withstand the pressure

Though climate-conscious policies aren’t favorable for oil and gas companies, these companies demonstrated their resilience during President Obama’s administration. I don’t believe a Biden administration would destroy the industry. That said, I believe tougher federal energy regulations could pressure the large major oil companies to diversify or change their business models. Federal regulations may also pressure state and regional economies dependent on federal lands used for oil and gas drilling.

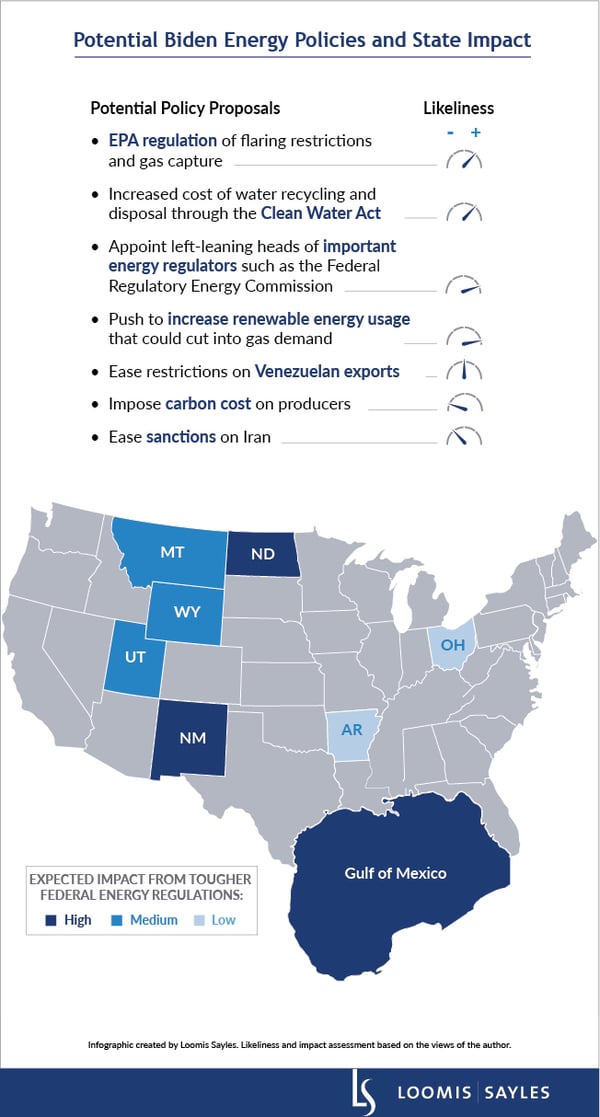

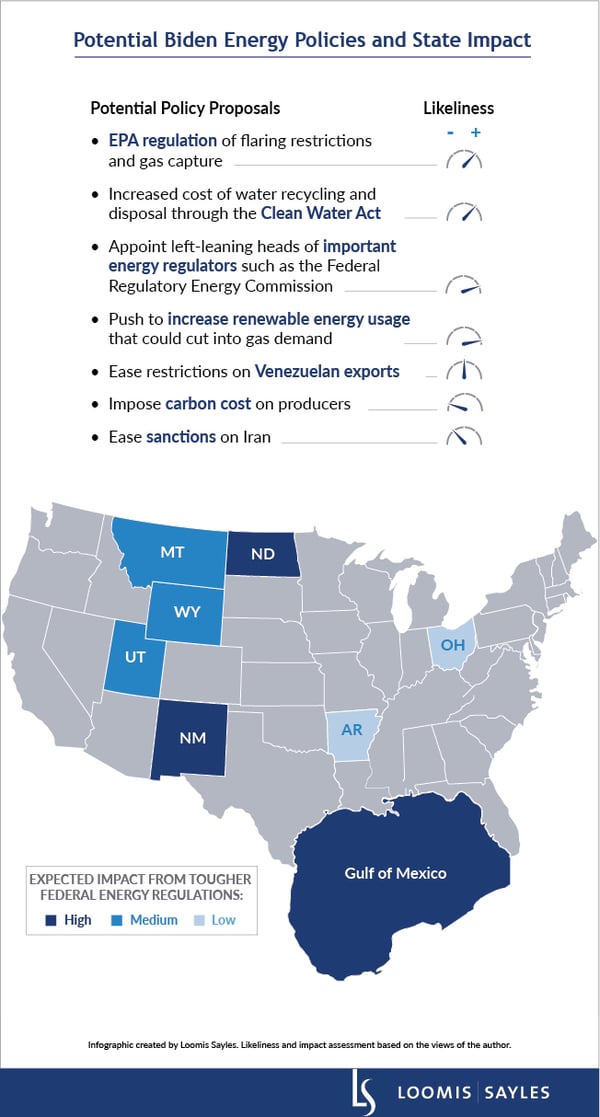

The infographic below summarizes potential policy proposals under a Biden administration and highlights the states and regions facing the greatest potential federal regulatory changes.

Investment recommendations may be inconsistent with these opinions. There is no assurance that developments will transpire as forecasted and actual results will be different. Information, including that obtained from outside sources, is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. Market conditions are extremely fluid and change frequently.

Commodity, interest and derivative trading involves substantial risk of loss.

This is not an offer of, or a solicitation of an offer for, any investment strategy or product.

MALR026221