1. Emerging markets (EM) corporate spreads have almost recovered to year-end 2019 levels, as strong issuance was met with even stronger investor demand. Do you see this trend continuing into 2021?

Yes, we see several factors that could drive EM corporate spreads tighter from here. The global economic recovery is the most important factor in our view. We believe widespread fiscal and monetary support and vaccination campaigns around the world could support a strong recovery. Additionally, spread levels have remained wide to historical ranges. EM high yield and investment grade both currently offer yield premiums versus their counterparts in developed markets; we believe this will attract yield-hungry investors to the asset class. Surprise upward growth revisions in Q4 2020 would also tend to support spread tightening.

We acknowledge that valuations are more challenged. Absolute yields have fallen, but considering the case for recovery, EM spreads likely have room to tighten toward their historical average range.

2. What is your outlook for emerging market foreign exchange (EMFX)? Is now the time to get into EMFX?

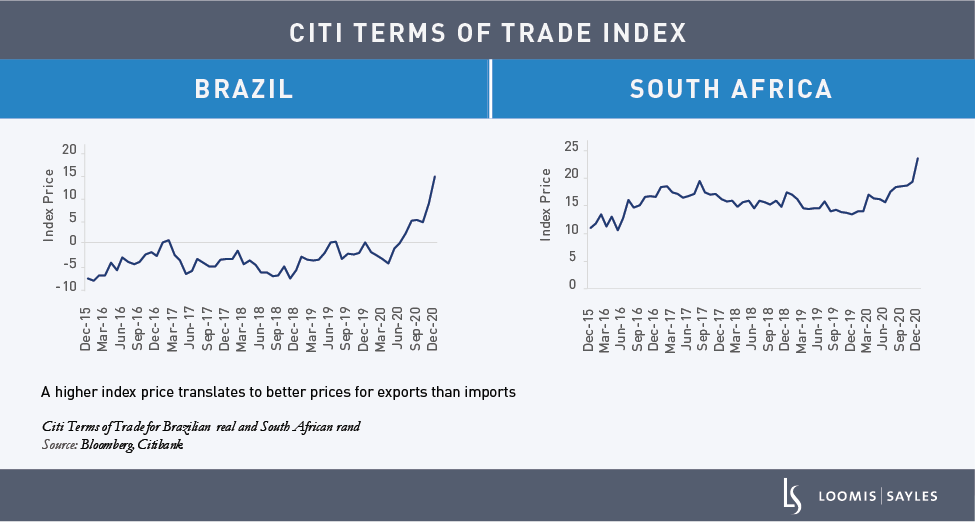

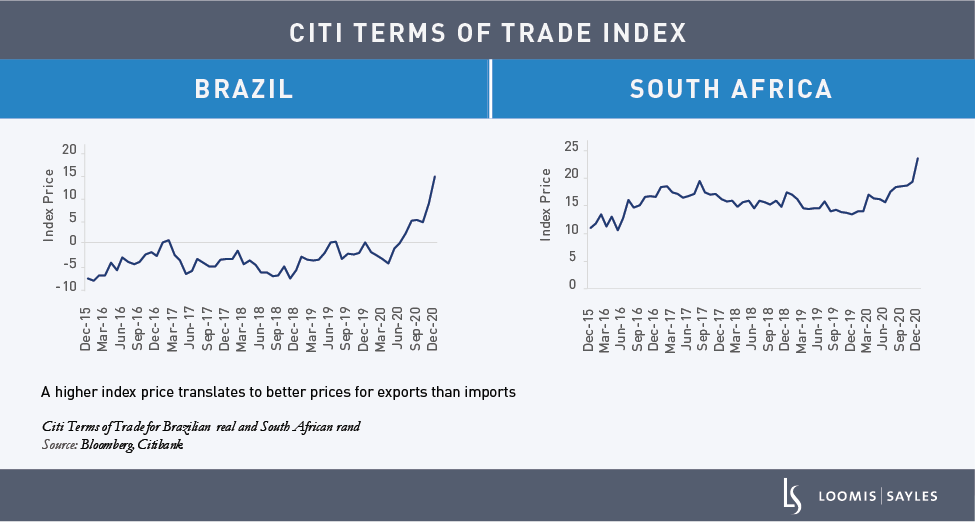

After a volatile year, we have an optimistic view of EM currencies for 2021. Risk sentiment has remained strong, and we currently consider many currencies undervalued. We believe the US dollar will continue to weaken in 2021 as the economic recovery gains momentum. This macro backdrop combined with higher prices for metal and food commodities could provide a nice tailwind for many currencies, such as the Brazilian real and the South African rand. Terms of trade[1] have already improved significantly in these countries, as shown in the charts below. This should encourage economic growth, helping to support stronger currencies. The Turkish lira’s volatility made headlines during the last quarter of 2020, but a recent shift toward more orthodox economic policies from Turkey’s central bank could lead the lira to a better path in 2021.

3. 2020 was a tough year for leverage. Are you concerned about leverage or default rates going into 2021?

COVID-19 created significant challenges for EM sovereigns. In 2020, sovereign debt stocks ballooned and fiscal deficits widened. Defaults in the sovereign JP Morgan EMBI Global Bond Index are at the highest level since 2001. Looking ahead, we expect default rates to decline. The most vulnerable countries have, for the most part, restructured their debt. Low interest rates, demand for yield and an improved growth environment should support near-term improvement in sovereign balance sheets.

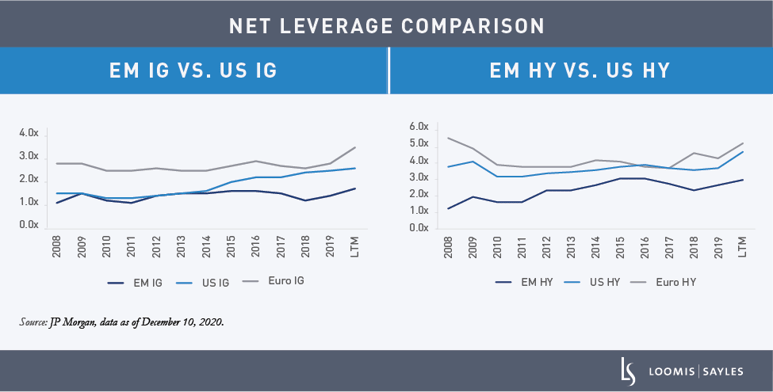

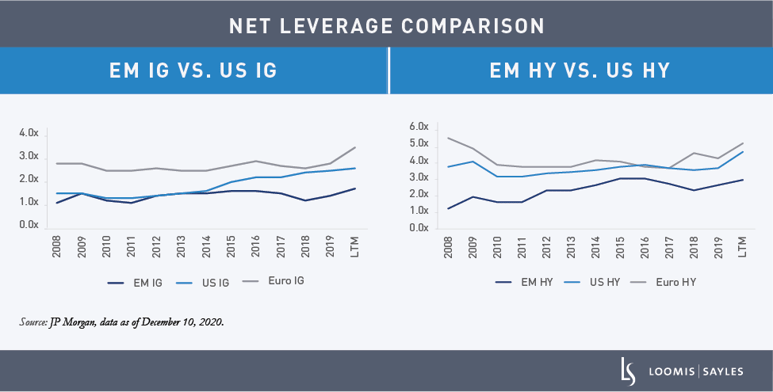

In the EM corporate space, we considered fundamentals to be in good shape before the pandemic. EM corporates have staved off meaningful fundamental deterioration in 2020 with net leverage estimated to move modestly higher across both investment grade (+0.2x) and high yield (+0.3x). EM corporate net leverage has remained meaningfully below developed market levels. The 2020 default rate stood at 3.5%.[2] The sectors hit most by the pandemic (oil and gas, gaming, transport) drove leverage metrics up.

Heading into 2021, we expect the overall trend of deleveraging to resume. The EM corporate default forecast is 2.5%.[3] We see several factors that could help mitigate defaults, including limited at-risk maturities, a constructive macro backdrop and issuer fundamental strength. We also anticipate that more sectors will benefit as the economy normalizes. We saw signs of this during Q3 2020, when many sectors improved upon second-quarter revenues and real estate, industrials and infrastructure reported positive year-over-year growth for the quarter.

[1] The ratio of export prices to import prices.

[2] Source: JP Morgan, as of January 6, 2021..

[3] Source: JP Morgan as of January 6, 2021..

MALR026569

Past market experience is no guarantee of future results.

Indices are unmanaged and do not incur fees. It is not possible to invest directly in an index.

Commodity, interest and derivative trading involves substantial risk of loss.

Market conditions are extremely fluid and change frequently.

Investment recommendations may be inconsistent with these opinions. There is no assurance that developments will transpire as forecasted and actual results will be different. Data and analysis does not represent the actual, or expected future performance of any investment product. Information, including that obtained from outside sources, is believed to be correct, but Loomis Sayles cannot guarantee its accuracy.