1. Net leverage in the euro investment grade (IG) credit market reached all-time highs in 2020. About €47 billion of the market was downgraded to high yield during the year. What are your expectations for credit metrics going forward? How much of the market may still be at risk for downgrades?

We expect to see an improvement in credit metrics starting in the second quarter of 2021, based on comparisons to last year and an anticipated recovery in economic activity as the COVID-19 vaccine is distributed. We believe the first quarter is likely to show further deterioration in credit metrics given the ongoing shutdowns and timing of the vaccine rollout. Leverage deterioration varies significantly by sector and appears broadly dependent on exposure to COVID-19-related shutdowns, with some sectors unscathed and others hit much harder.

Given our outlook for a significant bounce in economic activity in 2021, we expect fallen angel risk to be low. However, if the economic downturn is prolonged, we believe there is a large volume of IG names that may be at risk of downgrade. Within high yield, we expect the default rate to be lower in Europe versus the US, largely due to the European Central Bank’s support of the corporate bond market. The ECB does not directly buy high yield bonds, but its participation in the IG market provides indirect support to the high yield market.

2. How do valuations look in the euro and sterling credit markets? Do you expect any opportunities or risks to arise as the Brexit process draws to a close?

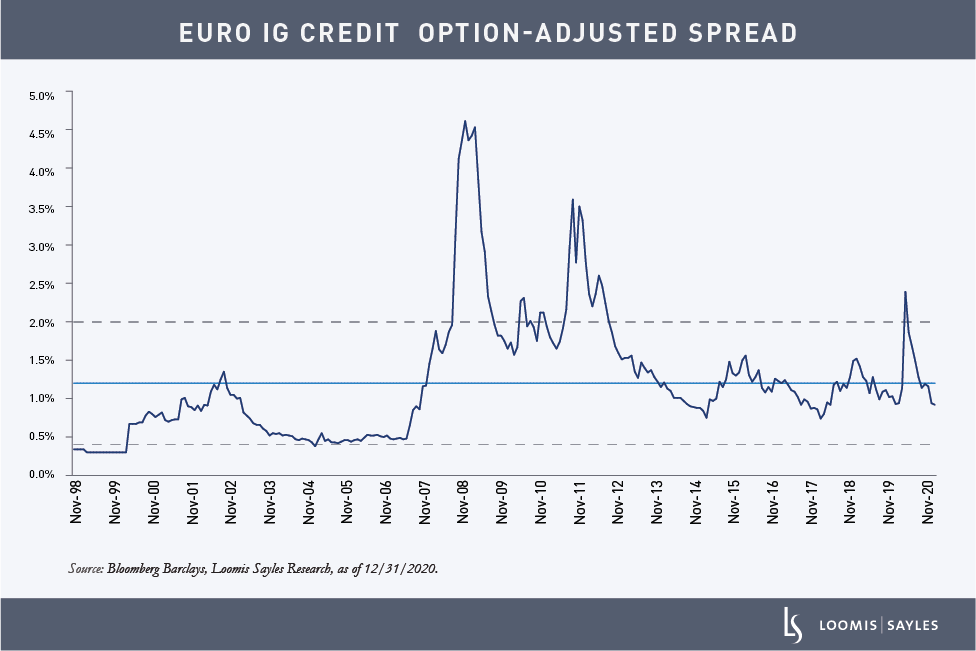

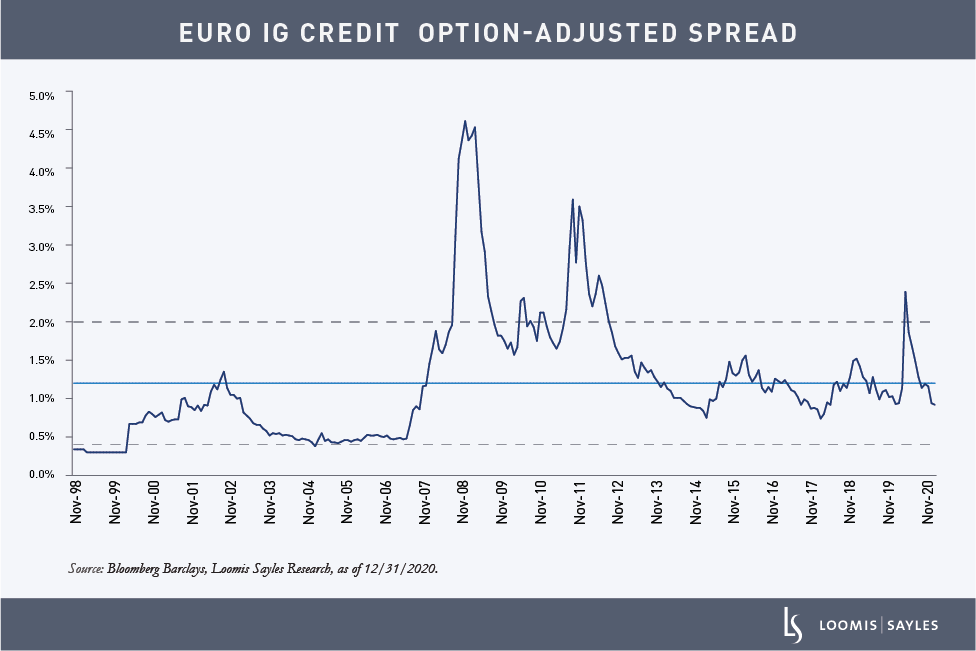

The premiums in these markets have collapsed as the markets have rallied. However, improving company fundamentals and economic activity suggest the cycle is firmly in recovery and spreads may grind tighter. We believe COVID-19-exposed names and those in lower parts of the capital structure can offer a significant premium and should continue to compress as investors reach for potential yield. We believe the technical picture remains supportive—the ECB will continue to buy corporate bonds, supply is expected to decline in 2021 after a busy 2020, and cross-currency headwinds should diminish with euro corporates less rich than US corporates.

Now that the UK and Europe have agreed on a limited trade deal for the post-Brexit world, we expect the UK premium in credit, which had already mostly disappeared, to become non-existent. The UK faces significant, concurrent headwinds stemming from the change in its trading relationship, the COVID-19 shock, the Scottish independence issue, migration policy changes, and the prospect of fiscal tapering. We believe these issues could create opportunities in 2021. While we don’t expect near-term corporate bond buying from the Bank of England given successful Brexit negotiations, it remains a tool in the BOE’s arsenal that the market is unlikely to forget.

3. Any key themes you’ll be watching in 2021?

ESG remains a key focus for the euro and sterling markets. We expect ESG bond supply to increase in 2021, through a combination of green, social and sustainable bonds. ESG-related disclosure is becoming increasingly important across the UK and the European continent. As the market pays more attention to ESG, we expect valuations to adjust. Over time, we believe issuers with weaker ESG scores may be forced to pay a premium to sell their bonds—possibly as soon as this year.

MALR026579