I believe oil prices will likely remain under pressure through the end of the year. There has been exceptional growth in demand for oil over the last 12 months, but inventories have refused to budge as supply remained elevated. US supply has been falling but until recently has been largely offset by higher OPEC production (i.e. Saudi Arabia, Iraq and Iran).

GDP and demand expectations

Strong gasoline sales have been driving overall demand numbers higher, even accounting for the abysmal demand for diesel. Over the past month, global GDP expectations for 2017 have turned down. If GDP expectations continue to drive lower, oil prices could see a downdraft over the next three months.

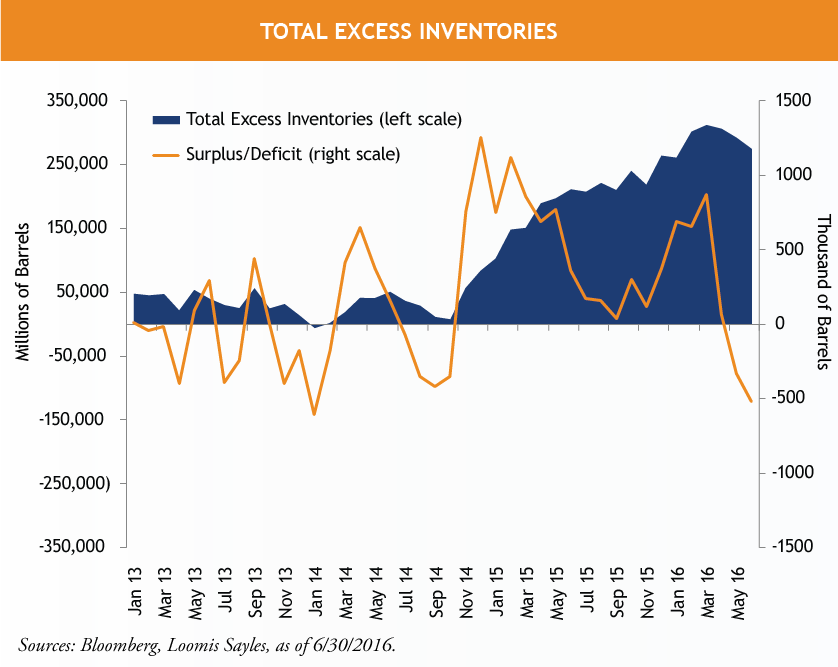

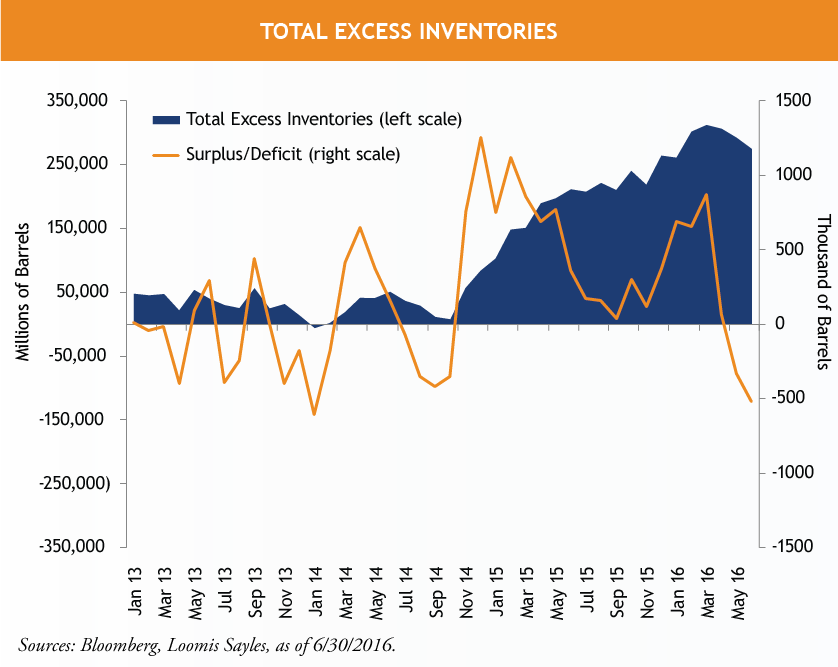

Seasonality and inventory

Gasoline demand typically peaks during the third quarter, when people hit the road for summer vacations. As we get into late fall, demand for petroleum product will likely fall considerably, allowing refiners to shut down operations for maintenance. IIf product inventories are high (as they are now) and product margins are low (as they are now), refineries could shut more capacity for longer resulting in unrefined oil inventories rising faster than expected. Currently, inventories are highest in Europe, Asia and the US. As the chart above shows, the world still has over 300 million barrels of excess inventories.

Oil supply

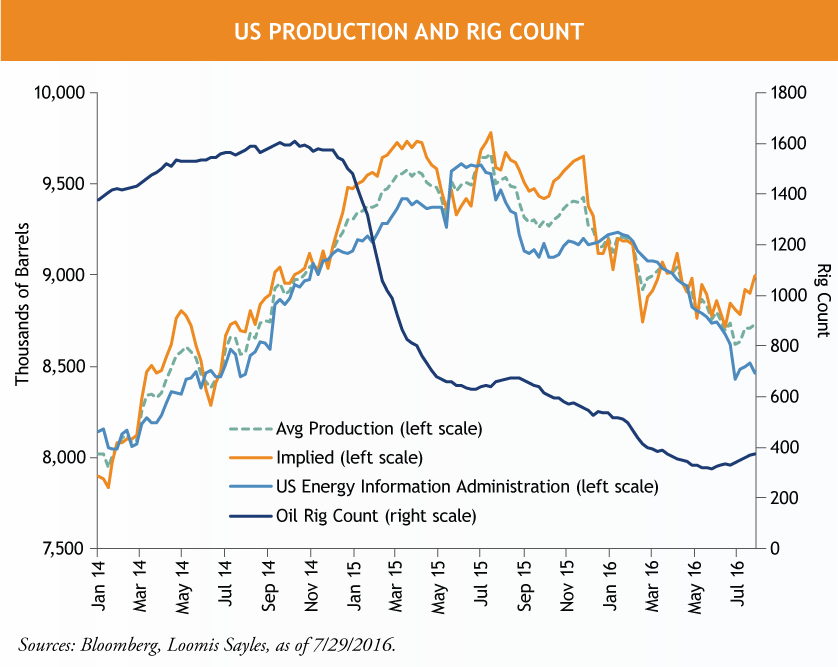

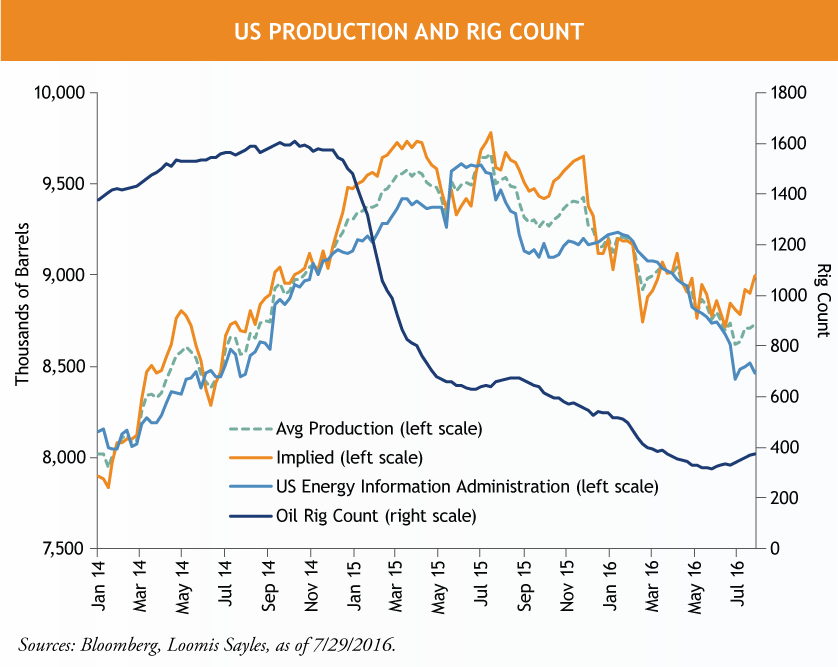

- US oil supply has no doubt fallen since the beginning of the year. But over the last month or so, production declines seem to have stalled. The quick rise in oil prices to $50 per barrel during the second quarter caused rig counts to edge higher. It also encouraged producers to finish “drilled-uncompleted” wells that had not yet undergone the hydraulic fracking process so currently they are ready to start producing oil or gas.

- OPEC is producing at record levels, despite losses from Nigeria and Libya.

- Rest of world production has flat lined as projects with long lead times continue to be completed and offset declines.

Geopolitical issues

Nigeria militancy: The Niger Delta Avengers (NDA) continues on their mission of blowing up oil infrastructure. Consequently production is down close to 500,000 barrels per day since the end of 2015, according to Bloomberg. Recently, the Nigerian government agreed to restart amnesty payments to another militant organization, the Movement for the Emancipation of the Niger Delta (MEND). Though MEND is separate from the NDA and has condemned NDA's assault on the oil infrastructure in news coverage, I believe this is a step in the right direction to help repair relations with people of the Niger Delta.

Libya civil strife: Libya presents a much more complex problem than Nigeria, in my opinion. The country is essentially divided into two rival governments, the east and the west, along with multiple small actors controlling oil production facilities, ports etc. The UN has been involved in establishing a unity government, albeit with limited success, and is trying to get the interested parties to agree to a common agenda to get oil production and exports started. There have been some positive developments as all parties have met multiple times and have come to a few agreements. If the situation continues to improve, I think could see Libya adding 400,000-700,000 barrels per day (back up to their stated capacity) in short order.

MALR 15607

Past results are no guarantee of, and not necessarily indicative of,future results.

Commodity interest and derivative trading involves substantial risk of loss.

This is not an offer of, or a solicitation of an offer for, any investment strategy or product. Any investment that has the possibility for profits also has the possibility of losses.