Oil’s back below $30 and suddenly it feels like 2016 all over again.

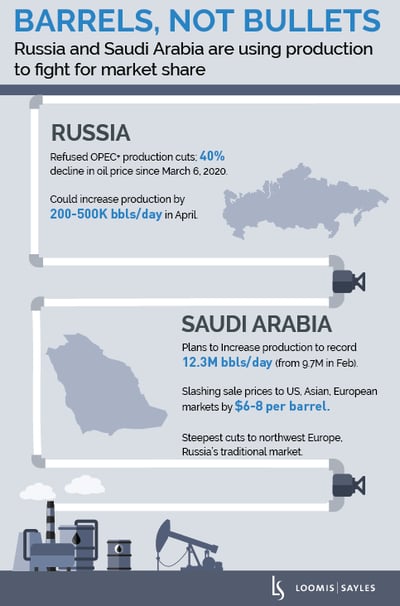

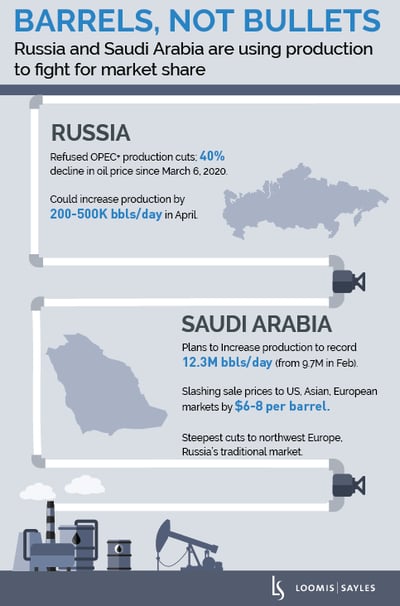

Only it’s not. Saudi Arabia’s 2015-2016 production boom was a war on US shale. This time, Saudi Arabia is waging a war for market share against Russia and the US. It’s a war with no winners, least of all US fracking.

Shale response – sharp drop expected from an industry on shaky ground

Russia and Saudi Arabia had hoped that shale production would soon max out, letting them step in to meet demand with their reserves and production. They are no longer willing to wait after seeing US shale production grow by 50% over the past four years amid tepid demand growth. US shale producers are once again tasked with cutting production. Estimates for the drop range from 650,000 barrels per day to 2 million.1 A drop of 2 million barrels per day would mean crude prices below $45 per barrel for two years and severe pain for US producers. I believe this is realistic if Saudi boosts to maximum capacity in the midst of weak demand. It would likely take multiple years to work off that inventory surge.

Not many levers to pull

The US shale industry as a whole needs prices in the $50-$55 range to maintain production while spending within cash flow. Shale companies had generally budgeted for $50 oil heading into 2020. Most companies have hedges in place to insulate them from low prices through 2020. After that, even companies with stronger balance sheets would see leverage shoot higher with oil below $45 per barrel. Since the sharp drop in oil prices, we have seen management teams start to slash budgets to protect their balance sheets, cutting capital expenditures by about 40% on average. Many have also announced production cuts but have not yet provided updated production guidance.

I expect further production cuts, ranging from 30%-50%, over the coming weeks as companies digest the current oil price and look for ways to survive the downturn. If oil prices remain at or below the low forties, I would expect a significant amount of company credit ratings to get downgraded to high yield. Defaults could spike as companies look to restructure or opportunistically lower debt levels at discounted prices.

1Sources: US Energy Information Administration and IHS Markit, respectively.

Commodity, interest and derivative trading involves substantial risk of loss. This is not an offer of, or a solicitation of an offer for, any investment strategy or product. Any investment that has the possibility for profits also has the possibility of losses.

MALR025098