In the fourth quarter, emerging market (EM) assets posted modest to flat gains. This left investors, many of whom were hopeful for a year-end rebound, disappointed. The recovery in EM was stalled by both macro and country-specific factors:

- Selloff in US high-yield bonds dampened investor sentiment

- Spreads widened, driven by a prolonged weakness in commodities and the Brazil sovereign downgrade

- Idiosyncratic events in South Africa continued to fuel volatility in FX and bond markets

Currency

In Q4, the JP Morgan GBI-EM Global Diversified Index was down -0.10% in USD terms. The flattish returns were driven by a large divergence in EM foreign exchange performance.

In Q4, the JP Morgan GBI-EM Global Diversified Index was down -0.10% in USD terms. The flattish returns were driven by a large divergence in EM foreign exchange performance.

Two Asian currencies were the top performers in the 4th quarter. Both Indonesia (13.55%) and Malaysia (4.35%) posted strong gains, after being down in late September.

Underperformance was led by South Africa, down -16.33%. The South African rand sold off following President Zuma’s surprise replacement of the country’s Finance Minister, Nene, with an unknown politician, Van Rooyen. The appointment was ill received by markets and external and internal pressures forced Zuma to reverse course and name former Finance Minister, Gordhan, to the post.

Sovereign USD Debt

The JP Morgan Emerging Markets Bond Index Global (EMBIG) ended the fourth quarter up 1.55%. Returns in the sovereign credit space were led by high yield, up 2.77%, which largely outperformed investment grade, up 0.87% for the quarter.

The JP Morgan Emerging Markets Bond Index Global (EMBIG) ended the fourth quarter up 1.55%. Returns in the sovereign credit space were led by high yield, up 2.77%, which largely outperformed investment grade, up 0.87% for the quarter.

Investors responded optimistically to political change in Argentina and Venezuela. Argentina was up 11.23% and saw positive gains following Macri’s Presidential win. Investors are hopeful the president elect will improve economic policy and implement key reform. In Venezuela, bonds returned 15.38% following the election of the opposition party to Congress, viewed as a necessary first step in curbing President Maduro’s power.

Weighing on performance was South Africa, (-3.40%), selling off on news of Finance Minister Nene’s dismissal, and Brazil, (-2.67%) declining on investor fears of faltering economic growth and political uncertainty.

Emerging USD Corporate Debt

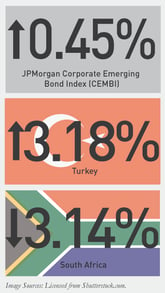

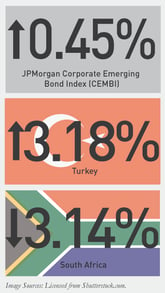

The JP Morgan Corporate Emerging Bond Index (CEMBI) returned 0.45%, with high yield (0.87%) outperforming investment grade (0.18%).

The JP Morgan Corporate Emerging Bond Index (CEMBI) returned 0.45%, with high yield (0.87%) outperforming investment grade (0.18%).

In Q4, Europe was the top performing region, up 2.79% with gains lead by Russia (3.03%) and Turkey (3.18%). Financial companies drove returns in both countries.

Performance was again dragged down by South Africa (-3.14%), as corporates traded down on negative political news.

Looking across sectors, real estate, (2.49%), was the top performing sector, with high yield Chinese property names contributing positively. The worst performing sector was Metals and Mining, (-4.56%), which has been crushed by on-going depressed commodity prices.

Equities

In Q4, the MSCI Emerging Markets Index returned 0.65% , stabilizing following the massive 18% downturn in the previous quarter.

2016 Outlook

Looking ahead, it’s difficult to be optimistic on the emerging market asset class. Much of what plagued 2015-- a deep, prolonged retreat in commodities, faltering global growth, a strong US dollar, and an uncertain US rate hiking cycle -- may worsen throughout 2016. Although the macro backdrop for EM remains mixed, EM market technicals remain positive. New supply is expected to be light and the re-pricing on EM assets may offer those investors who are sitting in high cash positions a more balanced entry point for risk accumulation in 2016.

MALR014720

In Q4, the JP Morgan GBI-EM Global Diversified Index was down -0.10% in USD terms. The flattish returns were driven by a large divergence in EM foreign exchange performance.

In Q4, the JP Morgan GBI-EM Global Diversified Index was down -0.10% in USD terms. The flattish returns were driven by a large divergence in EM foreign exchange performance. The JP Morgan Emerging Markets Bond Index Global (EMBIG) ended the fourth quarter up 1.55%. Returns in the sovereign credit space were led by high yield, up 2.77%, which largely outperformed investment grade, up 0.87% for the quarter.

The JP Morgan Emerging Markets Bond Index Global (EMBIG) ended the fourth quarter up 1.55%. Returns in the sovereign credit space were led by high yield, up 2.77%, which largely outperformed investment grade, up 0.87% for the quarter. The JP Morgan Corporate Emerging Bond Index (CEMBI) returned 0.45%, with high yield (0.87%) outperforming investment grade (0.18%).

The JP Morgan Corporate Emerging Bond Index (CEMBI) returned 0.45%, with high yield (0.87%) outperforming investment grade (0.18%).