Investor risk aversion battered emerging market (EM) assets during the third quarter. Local currency and hard currency markets both posted negative gains and EM equities posted double digit losses.

The carnage in emerging markets during Q3 was largely driven by China, with prolonged depressed commodity prices and US dollar strength also contributing to declines. The August market meltdown was led by the Chinese stock market collapse, its precipitous fall triggered massive selling across global equity markets, spiking volatility and moving investors out of risk and EM. The delayed Fed rate hike, a reaction to market turmoil, kept investors defensively positioned with many calling into question the prospects for global growth.

The convergence of these difficult macroeconomic conditions accelerated EM capital outflows, which worsened on the heels of Brazil’s downgrade to junk by S&P and lead to a re-pricing of EM assets in the third quarter.

Currency

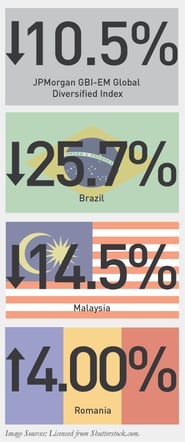

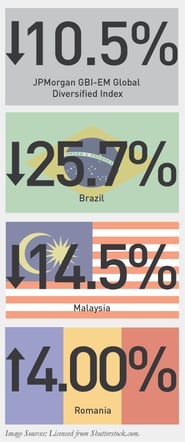

In Q3, the JP Morgan GBI-EM Global Diversified Index was down -10.54% in USD terms. The rout in commodity prices played a key role, with high beta currencies plunging on low oil and negative sentiment.

In Q3, the JP Morgan GBI-EM Global Diversified Index was down -10.54% in USD terms. The rout in commodity prices played a key role, with high beta currencies plunging on low oil and negative sentiment.

Latin America, down -16.19%, was the index’s worst regional performer in Q3. Underperformance was led by Brazil, down -25.66%, which is struggling with ballooning inflation, a looming recession and a government that lacks the political capital to restore fiscal order.

High beta Asian currencies were also delivered a blow in the third quarter. Both Malaysia, down-14.48%, and Indonesia, down -14.15%, have seen capital outflows fueled by global risk aversion and magnified by China-related risk.

Romania was the top performer in the index, up 4.0% at the close of September. European growth has been strong in 2015, making emerging Europe a bright spot in the local markets during Q3.

Sovereign USD Debt

The JP Morgan Emerging Markets Bond Index Global (EMBIG) ended the 3rd quarter down -2.04%. Once again there was a substantial divergence in returns between the investment-grade and high yield segments. The high yield component posted flat returns, outpacing the investment grade segment, which was down -3.13%. High yield was almost entirely supported by the recovery in Ukraine.

The JP Morgan Emerging Markets Bond Index Global (EMBIG) ended the 3rd quarter down -2.04%. Once again there was a substantial divergence in returns between the investment-grade and high yield segments. The high yield component posted flat returns, outpacing the investment grade segment, which was down -3.13%. High yield was almost entirely supported by the recovery in Ukraine.

Ukraine was the top performer in Q3, posting a massive 50.18% gain. Ukraine completed restructuring talks with creditors, bond prices railed on better than expected terms for bondholders.

Argentina was another top performer, up 7.28%. The rally was driven by positioning, as investors bet the new government, elected in October, will resolve the country’s decade long battle with creditors and lift the country out of default.

The worst performer for the quarter was Ecuador, down -18.67%. Bonds have continued to decline as prolonged low oil prices force government spending cuts.

Emerging USD Corporate Debt

The JP Morgan Corporate Emerging Bond Index (CEMBI) returned -2.76% in the third quarter, with high yield, down -5.79% underperforming investment grade, which was down -1.08%.

The JP Morgan Corporate Emerging Bond Index (CEMBI) returned -2.76% in the third quarter, with high yield, down -5.79% underperforming investment grade, which was down -1.08%.

In the 3rd quarter, Russia was the best performing country, up 2.21%. Market volatility in Latin America (Brazil was down-16.86%) and Asia (Indonesia was down -12.06%) rotated investors back into Russia, which has been EM’s second best performer this year.

Looking across sectors, returns were muted. Resilience by the large, highly rated conglomerates in Hong Kong drove returns in the diversified sector, up 0.33%.

Equities

The MSCI Emerging Markets Index was the major underperformer in Q3, down a blistering -17.77%. The massive downturn was led by Chinese equities; the Shanghai composite was down -29.69% over the same period.

The MSCI Emerging Markets Index was the major underperformer in Q3, down a blistering -17.77%. The massive downturn was led by Chinese equities; the Shanghai composite was down -29.69% over the same period.

2015 Outlook

Looking ahead to the end of 2015, the landscape for EM assets is challenged, with investor sentiment remaining cautious. The fundamental backdrop for many emerging countries has deteriorated, which has also lead to substantial asset re-pricing. Valuations, especially in EM foreign exchange, are looking increasingly attractive and Q3’s spread widening offers opportunity for tightening into yearend.

Year-to-date, EM credit has outperformed developed market credit, and the delayed Fed rate hike may provide a more favorable macro backdrop into year-end. Investors, sitting in cash, may also use recent market turmoil to selectively add more risk into their portfolios. For a lasting recovery in EM, investors will continue to look for a catalyst to trigger fundamental improvement and sustained growth.

MALR014149

In Q3, the JP Morgan GBI-EM Global Diversified Index was down -10.54% in USD terms. The rout in commodity prices played a key role, with high beta currencies plunging on low oil and negative sentiment.

In Q3, the JP Morgan GBI-EM Global Diversified Index was down -10.54% in USD terms. The rout in commodity prices played a key role, with high beta currencies plunging on low oil and negative sentiment.  The JP Morgan Emerging Markets Bond Index Global (EMBIG) ended the 3rd quarter down -2.04%. Once again there was a substantial divergence in returns between the investment-grade and high yield segments. The high yield component posted flat returns, outpacing the investment grade segment, which was down -3.13%. High yield was almost entirely supported by the recovery in Ukraine.

The JP Morgan Emerging Markets Bond Index Global (EMBIG) ended the 3rd quarter down -2.04%. Once again there was a substantial divergence in returns between the investment-grade and high yield segments. The high yield component posted flat returns, outpacing the investment grade segment, which was down -3.13%. High yield was almost entirely supported by the recovery in Ukraine. The JP Morgan Corporate Emerging Bond Index (CEMBI) returned -2.76% in the third quarter, with high yield, down -5.79% underperforming investment grade, which was down -1.08%.

The JP Morgan Corporate Emerging Bond Index (CEMBI) returned -2.76% in the third quarter, with high yield, down -5.79% underperforming investment grade, which was down -1.08%. The MSCI Emerging Markets Index was the major underperformer in Q3, down a blistering -17.77%. The massive downturn was led by Chinese equities; the Shanghai composite was down -29.69% over the same period.

The MSCI Emerging Markets Index was the major underperformer in Q3, down a blistering -17.77%. The massive downturn was led by Chinese equities; the Shanghai composite was down -29.69% over the same period.