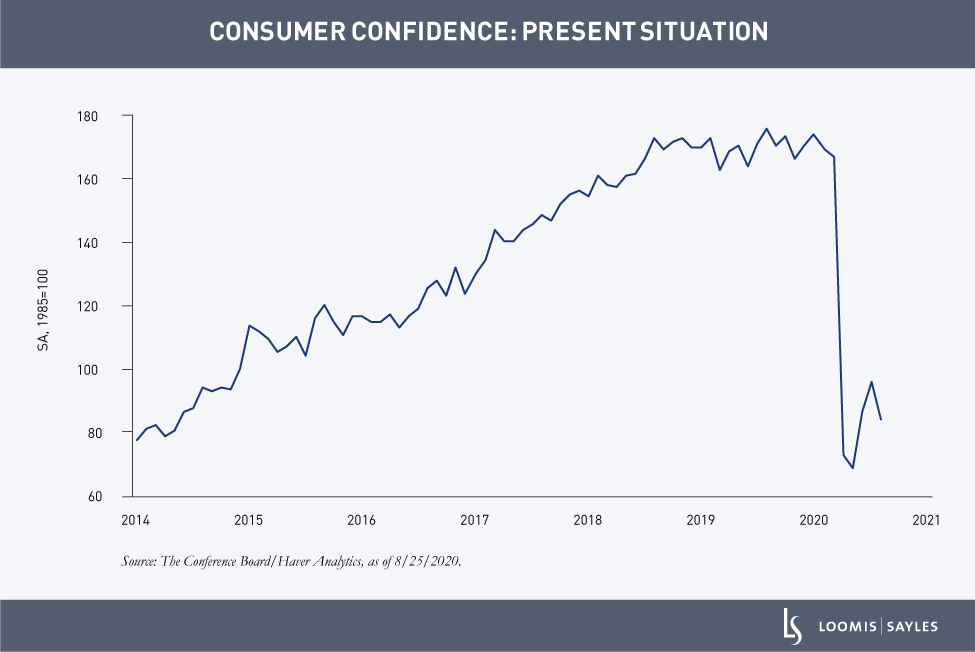

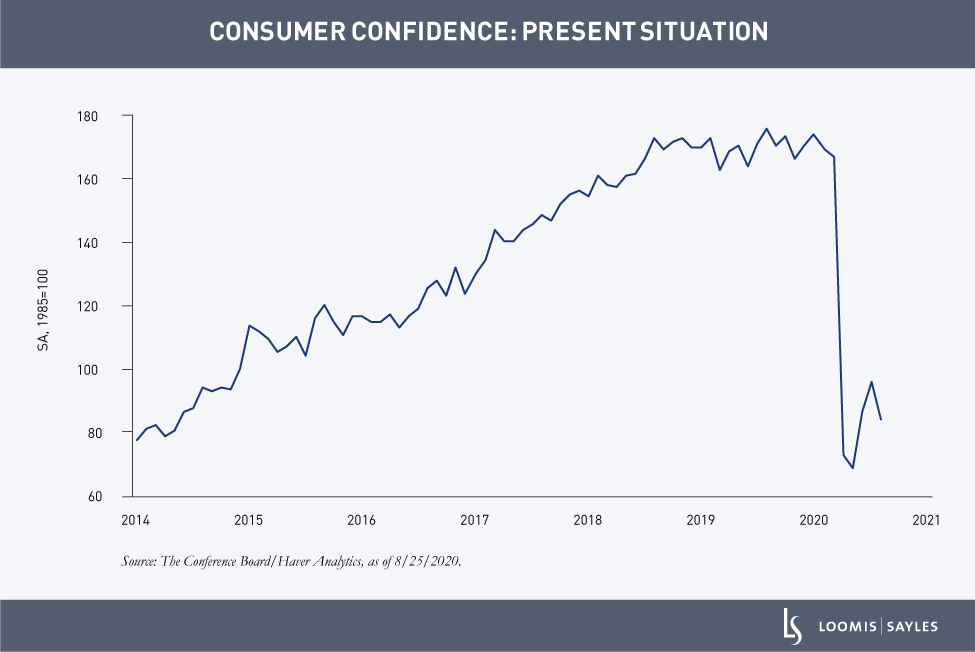

Consumers are traditionally the engine of the US economy, and I believe consumer confidence is an important indicator of consumer intentions. The August reading of the Conference Board’s Consumer Confidence Index suggests that consumers are not feeling optimistic.

The present situation

The Consumer Confidence Index has two components: the present situation and expectations. The present situation component assesses consumer confidence about current conditions. This component declined sharply in February through May, reflecting virus concerns and the unprecedented collapse in employment and national income. After encouraging gains in June and July, the component fell again in August. As you can see below, consumer confidence in the present situation remains quite depressed, reflecting the continuing crisis.

Consumer expectations

The expectations component assesses forward expectations of consumer confidence. This component avoided a precipitous drop during the pandemic—perhaps because people viewed the pandemic as temporary. But optimism may be fading. After rising in April, May and June, the expectations component fell 17.2 index points in July, one of the largest declines in the past 20 years. It fell another 3.7 index points in the August reading, taking the component to the lowest point since October 2016. Consumers do not appear upbeat about the future.

Low consumer confidence can translate to lower spending

I’m particularly concerned about the expectations component because consumers are unlikely to spend if they’re not confident in the future. I expect consumer spending to rise substantially in Q3 from the low levels reached in the first half of this year. However, the drop in both components of consumer confidence signals that the recovery may be running out of steam.

MALR025928

Market conditions are extremely fluid and change frequently.

This blog post is provided for informational purposes only and should not be construed as investment advice. Any opinions or forecasts contained herein reflect the

subjective judgments and assumptions of the authors only and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. Information, including

that obtained from outside sources, is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or

redistributed without authorization. This information is subject to change at any time without notice.