After a year defined by rising costs and cautious optimism, our latest survey of Loomis Sayles credit analysts suggests that corporate health is regaining its footing. The results from our October CANDIs survey point to broad-based improvement across key fundamentals, including easing cost pressures, healthier balance sheets and less pressure on profit margins.

While late-cycle dynamics remain visible, the data show encouraging signs of progress. Companies appear to be managing costs more effectively and benefiting from a broadening of earnings growth across sectors. Together, these trends suggest that the current late-cycle environment is likely to persist into 2026.

|

About the CANDIs Once a quarter, we survey Loomis Sayles’ credit research analysts to assess their bottom-up views of approximately 30 different industries. We quantify their responses using a proprietary tool known as the CANDIs—an acronym for Credit Analyst Diffusion Indices (click here to learn more). The process culminates in a forum that brings together our credit analysts and top-down global macro strategists to discuss the CANDIs’ output through the lens of the credit cycle. The results can be an indicator of how key corporate health metrics may trend over the next six months. |

Broad improvement across key indicators

Following two uneven quarters, the October 2025 CANDIs show encouraging directional progress. Nearly every component improved quarter over quarter. Analysts cited lower cost pressure, reduced leverage and better credit outlooks as signs that fundamentals are stabilizing.

The composite reading aggregating outlook, margins and pricing power rose nearly nine points to 38.9, a notable rebound that suggests momentum may be turning. It remains below the neutral 50 level, but the trajectory matters most as these key indicators are now moving in a more constructive direction.

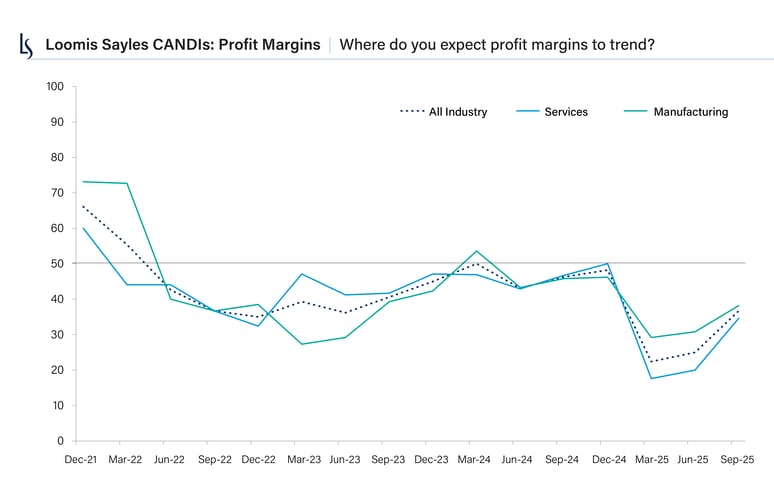

Costs cooling, margins steady

The sharpest positive shift this quarter came from input and supply chain costs, which fell more than ten points from the June survey. Analysts noted that cost pressures appear to have peaked across much of the manufacturing complex. Tariff rollbacks and supply chain normalization helped ease inflation risks, and stabilization in areas like consumer products, food and beverage, and lodging added support.

Although few expect margins to expand further, compression appears limited. Realized S&P 500 Index margins remain near multi-year highs—around 13%—providing a comfortable cushion for companies to absorb modest cost headwinds in our view.[i]

Chart source: Loomis Sayles Credit Analyst Diffusion Indices, as of 10 October 2025. For the profit margins component, readings above 50 indicate a rising trend. The chart presented above is shown for illustrative purposes only. Some or all of the information on this chart may be dated, and, therefore, should not be the basis to purchase or sell any securities. The information is not intended to represent any actual portfolio. Information obtained from outside sources is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or redistributed without authorization.

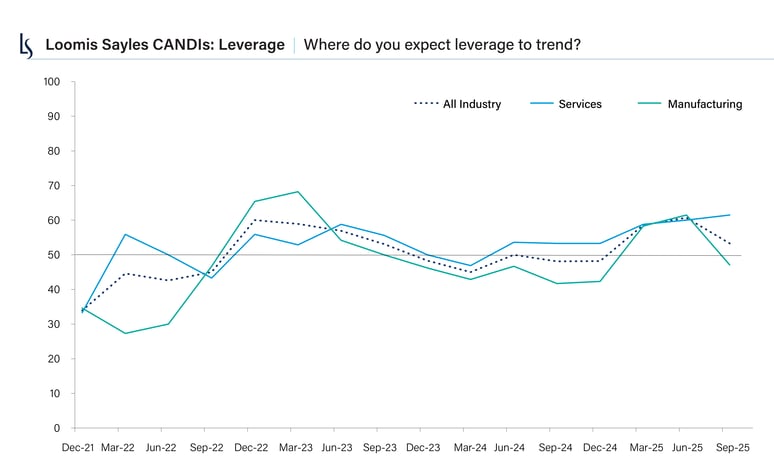

Pricing power and leverage trends

Pricing power, a key input to both corporate earnings and inflation, ticked up modestly but remains subdued. Many companies still face challenges passing higher costs on to end users. From a macro standpoint, that’s welcome news—it suggests muted CPI risk and supports the Federal Reserve’s case for continued rate cuts.

On the balance sheet side, leverage readings improved overall, especially within manufacturing industries, which moved closer to a neutral reading near 50. Services companies remain more highly levered, a typical late-cycle dynamic, but even there the upward trend has moderated.

Chart source: Loomis Sayles Credit Analyst Diffusion Indices, as of 10 October 2025. For the leverage component, readings above 50 signal a rising level of fundamental deterioration. The chart presented above is shown for illustrative purposes only. Some or all of the information on this chart may be dated, and, therefore, should not be the basis to purchase or sell any securities. The information is not intended to represent any actual portfolio. Information obtained from outside sources is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or redistributed without authorization.

Manufacturing leads, services lag

The survey highlights a growing divergence between the two sides of the economy: manufacturing and services. Manufacturing fundamentals improved meaningfully since June, with better readings on margins, outlook and consumer health. Input cost pressures subsided, and leverage declined—a constructive setup for continued recovery.

Services, by contrast, remain under more strain. Leverage increased slightly from already high levels, and while outlook scores improved, they still lag those in manufacturing. Analysts noted that some service sector companies are struggling to maintain pricing power as consumers become more value-conscious. Even so, the general tone from both sectors is one of stabilization, not deterioration.

Sector snapshots from the survey

Our credit analysts provided valuable context across industries this quarter:

- Homebuilders continue to monitor tariff impacts on lumber and materials costs. Margin pressure persists due to incentives needed to spur sales while order pipelines have declined.

- Autos stand out as a weak link. Elevated tariffs, rising consumer delinquencies and weakening demand fundamentals are pressuring profitability.

- Financials remain healthy. Banks' investment banking and wealth management revenues are strong, and credit quality is stable.

- Retailers could face intensifying price competition. Large chains such as Walmart are cutting prices and increasing promotional activity to defend market share, limiting pricing power across mid- to lower-end retailers.

- Aerospace is a bright spot. Improving supply chains and operational execution are spurring production rates higher. Higher production rates are improving profitability and cash flows, which are deleveraging the balance sheets at both Boeing and Airbus.

- Airlines continue to report healthy demand, with travel spending and bookings steady despite macro uncertainty. Third-quarter results showed a steady month-to-month improvement in unit revenue—a trend that appears to have continued into the fourth quarter based on company guidance.

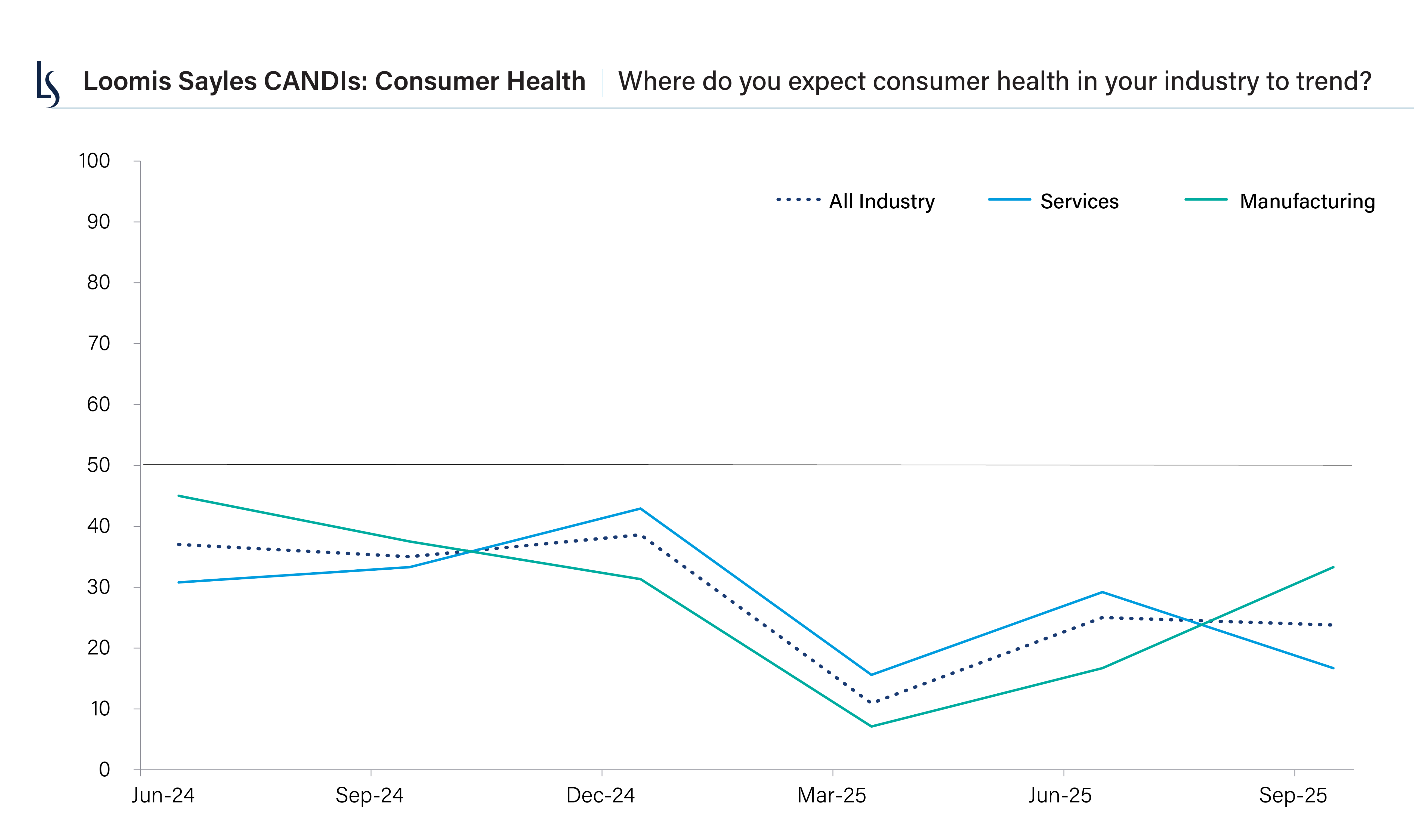

Consumer health still the weak spot

If there is a clear point of concern in the CANDIs, it’s the consumer. One might describe the consumer as “the weakest link” in corporate health, as consumers grapple with price sensitivity, rising household debt, and tighter credit conditions.

Still, we see offsetting strengths. Employment remains stable, wages continue to grow modestly, and discretionary spending on travel and leisure has held up. For now, the consumer remains cautious but resilient—a pattern more consistent with late-cycle behavior rather than outright contraction.

Chart source: Loomis Sayles Credit Analyst Diffusion Indices, as of 10 October 2025. For the consumer health component, readings above 50 indicate a rising trend. The chart presented above is shown for illustrative purposes only. Some or all of the information on this chart may be dated, and, therefore, should not be the basis to purchase or sell any securities. The information is not intended to represent any actual portfolio. Information obtained from outside sources is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or redistributed without authorization.

Broader earnings expansion offers support

Consensus earnings forecasts continue to paint a positive picture for the next several quarters, in our view. After a 9.8% increase in 2024, S&P 500 earnings are expected to grow 8.5% in 2025 and 12%–13% in 2026.[ii]

Importantly, that growth is broadening beyond the “Magnificent Seven.”[iii] The remaining 493 companies in the S&P 500 Index are projected to deliver double-digit earnings growth next year, with small-cap companies poised to outpace large caps for the first time in several years.[iv] We believe this broadening of profit growth should help sustain credit and equity valuations as the expansion matures.

Late-cycle, not end-of-cycle

Taken together, the CANDIs reinforce our view that the US economy remains in a late-cycle expansion. The Federal Reserve has entered a fine-tuning phase of rate cuts, the labor market is cooler but stable and corporate fundamentals are improving across most measures.

For credit investors, valuations remain a challenge: risk premiums and spreads remain tight. Yet momentum is strong, and yield carry remains attractive, in our view. In the near term, we believe modestly adding credit beta could help capture incremental spread tightening and income potential.

If growth does slow meaningfully, the Fed appears ready to offer support. In our view, corporate health is proving to be durable and consistent with a credit cycle that still has room to run.

[i] Source: Bloomberg, as of 10 October 2025.

[ii] Source: Bloomberg, as of 10 October 2025.

[iii] The “Magnificent Seven” refers to seven high-performing and influential companies in the S&P 500 Index: NVIDIA, Apple, Microsoft, Amazon, Meta Platforms, Alphabet and Tesla.

[iv] Source: Consensus earnings estimates, Bloomberg, as of 10 October 2025.

8544003.1.1

Market conditions are extremely fluid and change frequently.

This blog post is provided for informational purposes only and should not be construed as investment advice. Any opinions or forecasts contained herein reflect the

subjective judgments and assumptions of the authors only and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. Information, including

that obtained from outside sources, is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or

redistributed without authorization. This information is subject to change at any time without notice.