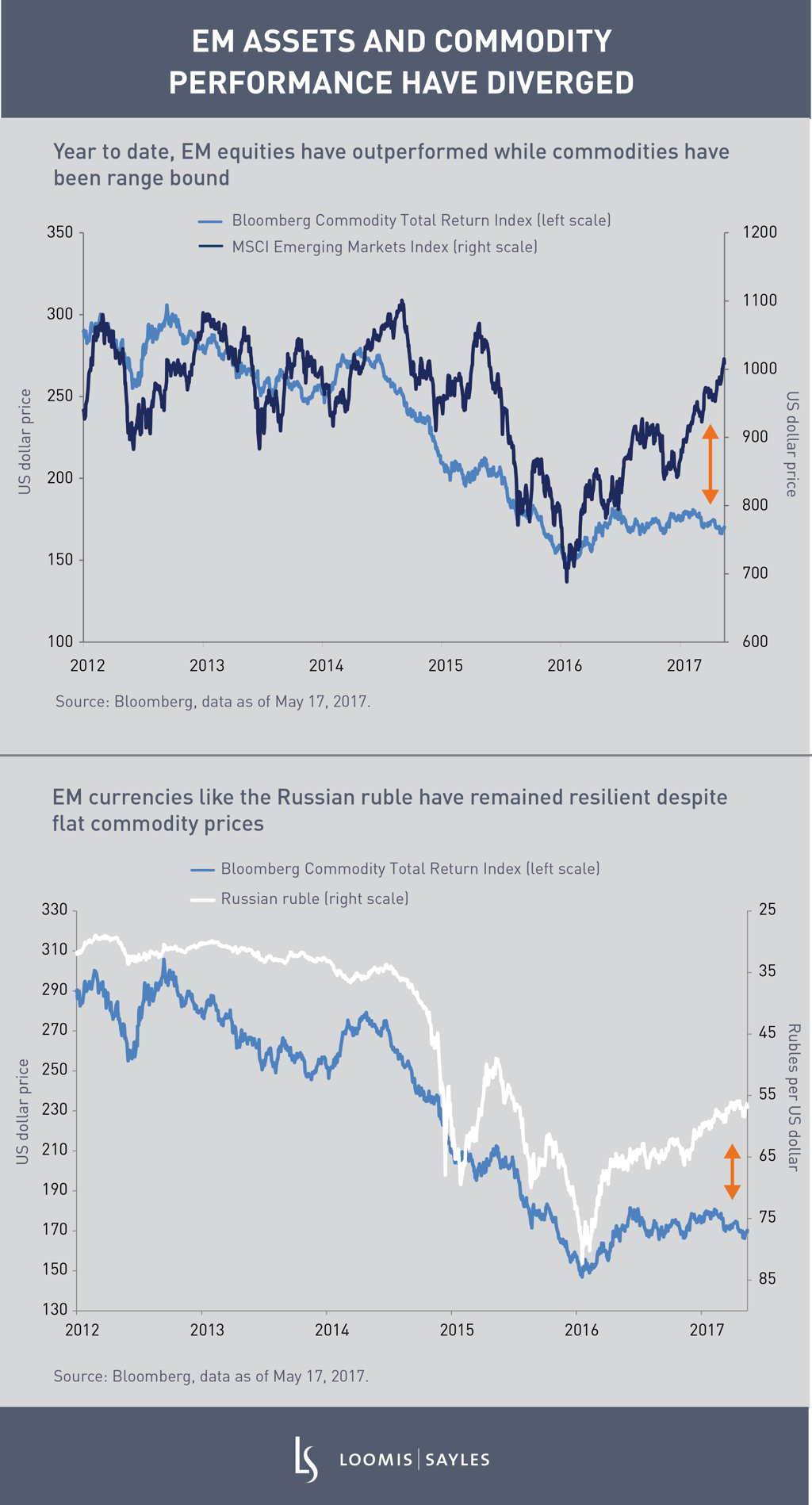

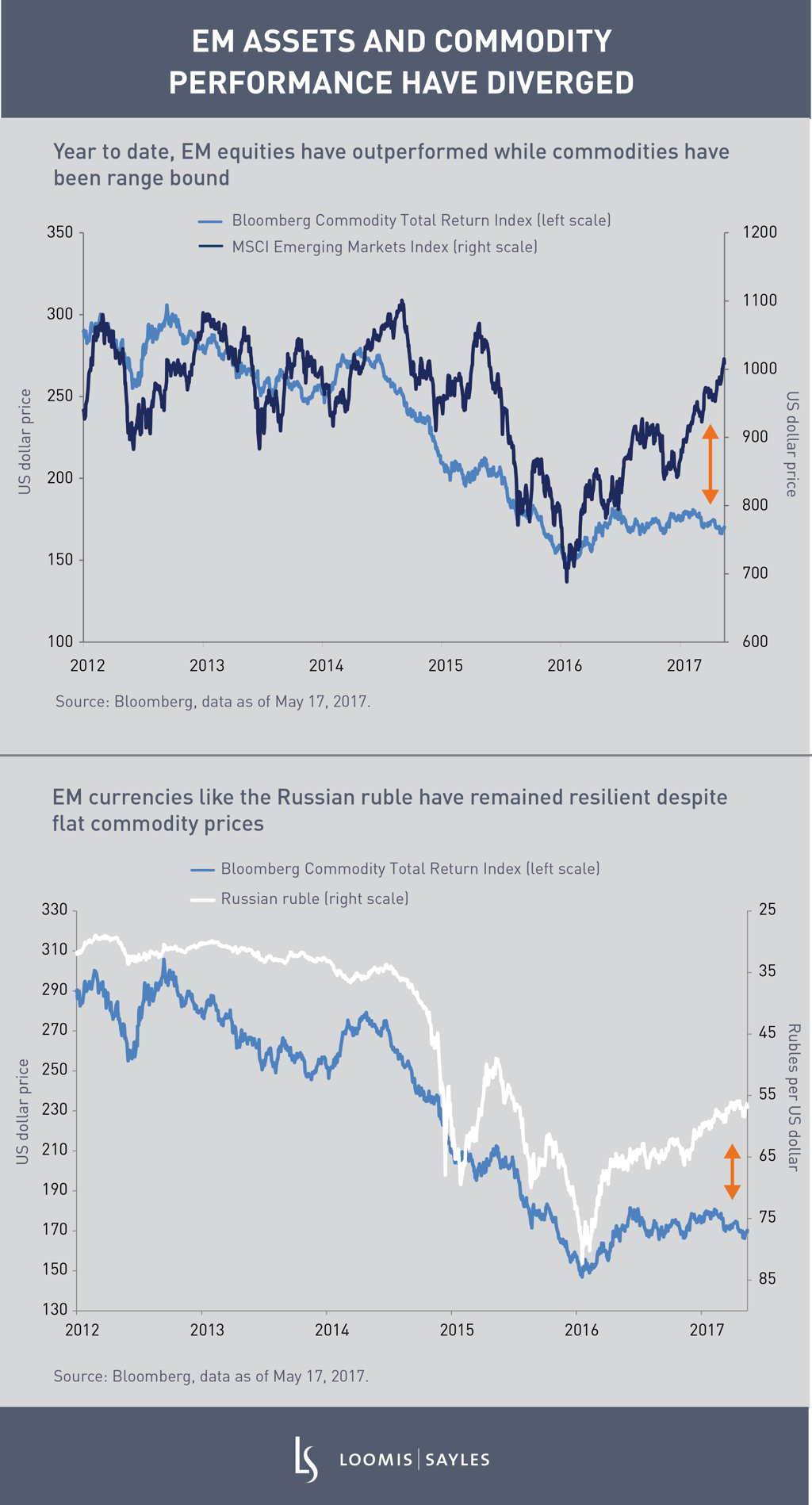

Emerging market (EM) assets were hit hard by the crash in commodity prices in 2014-2015, but so far this year, EM and commodity performance have diverged. EM is one of the top-performing asset classes across global markets despite flat commodity prices. This doesn’t square with the market rule of thumb that EM tends to perform in line with commodity prices. I believe strong EM performance can continue if we begin to see global demand for commodities materialize; otherwise, this divergence could reverse.

Three main factors have supported EM assets this year:

- Lower commodity price volatility: The 60-day historical volatility of the Bloomberg Commodity Total Return Index has dropped from 16.5% to roughly 9% over the past year. This has helped EM assets because sudden, large swings in the price of oil or any other key commodity tend to disrupt economic growth. Recently, low volatility has been more important than price levels themselves: EM businesses and households have generally functioned just fine whether oil is at $100/barrel or $50/barrel.

- Improving global growth forecasts: In mid-April, the International Monetary Fund raised its 2017 forecast to 3.5%, marking its first upward revision to short-term global growth expectations in six years. Within many EM countries, growth and other economic fundamentals have rebounded.

- A “just right” US dollar and interest rates: Global appetite for risk, including EM assets, has been bolstered by the range-bound US dollar and Treasury yields, along with a measured Fed and diminished expectations for sharply increased US government spending.

Commodity Prices Need Global Demand to Rise

We invest in a world with constantly changing correlations, so while a weaker US dollar would have been associated with commodity price strength in previous markets, thus far in 2017 the opposite has been true. Since the weaker dollar has not drawn investors back to the commodity space, in the coming months we will need to see global demand perk up to help drive commodity prices. Many industrial metals are coming off tighter supply balances while energy and grain markets have continued to work off the larger supply balances from 2016, which could keep prices down in the short term.

Overall, I believe the trajectory of EM performance is only sustainable if global demand helps commodity prices break higher.

Past results are no guarantee of, and not necessarily indicative of, future results.

Commodity interest and derivative trading involves substantial risk of loss.

This is not an offer of, or a solicitation of an offer for, any investment strategy or product. Any investment that has the possibility for profits also has the possibility of losses.

Indexes are unmanaged and do not incur fees. It is not possible to invest directly in an index.

MALR017616