By Andrea DiCenso, Alpha Strategies Portfolio Manager and Peter Yanulis, Alpha Strategies Portfolio Manager

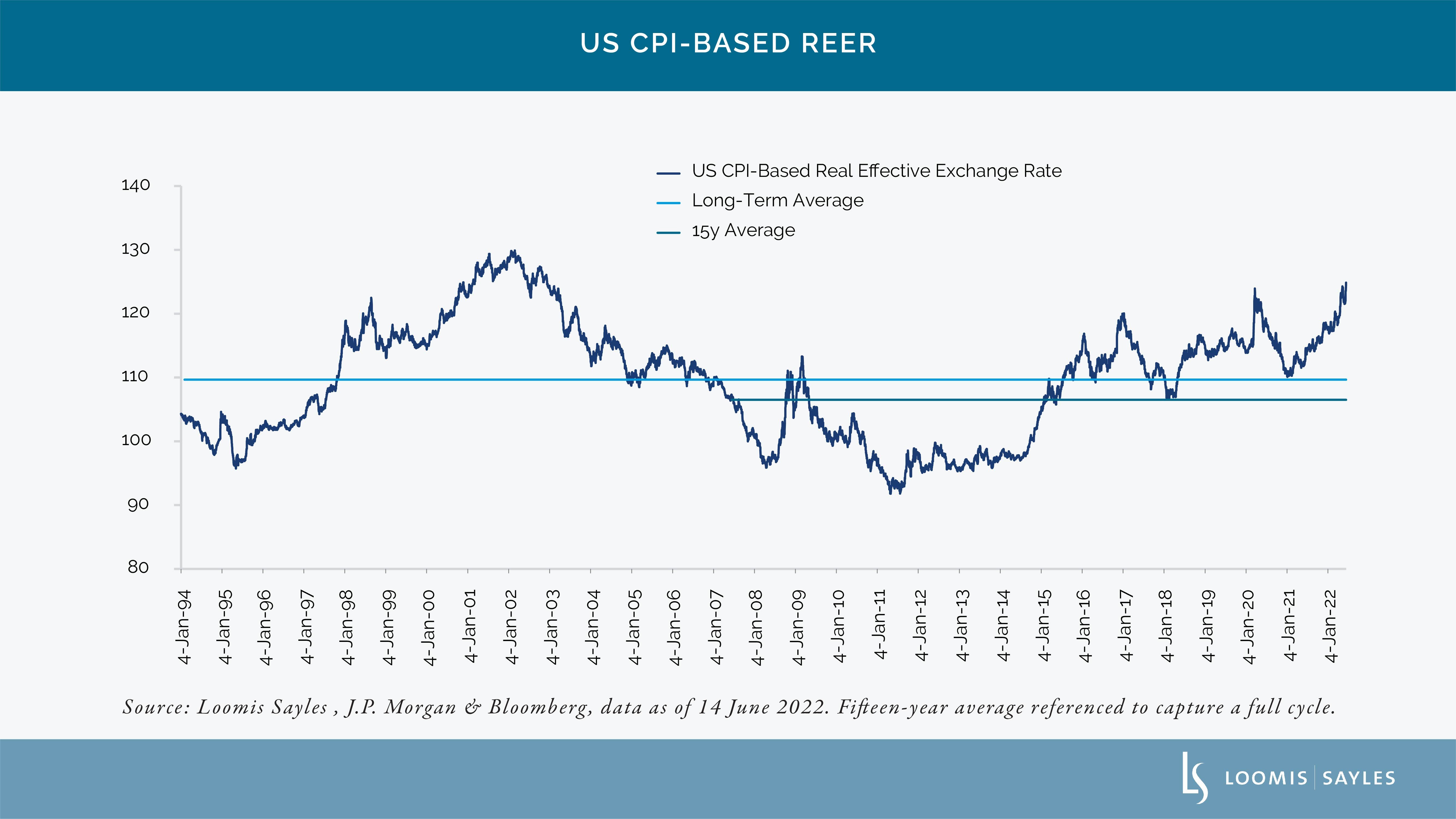

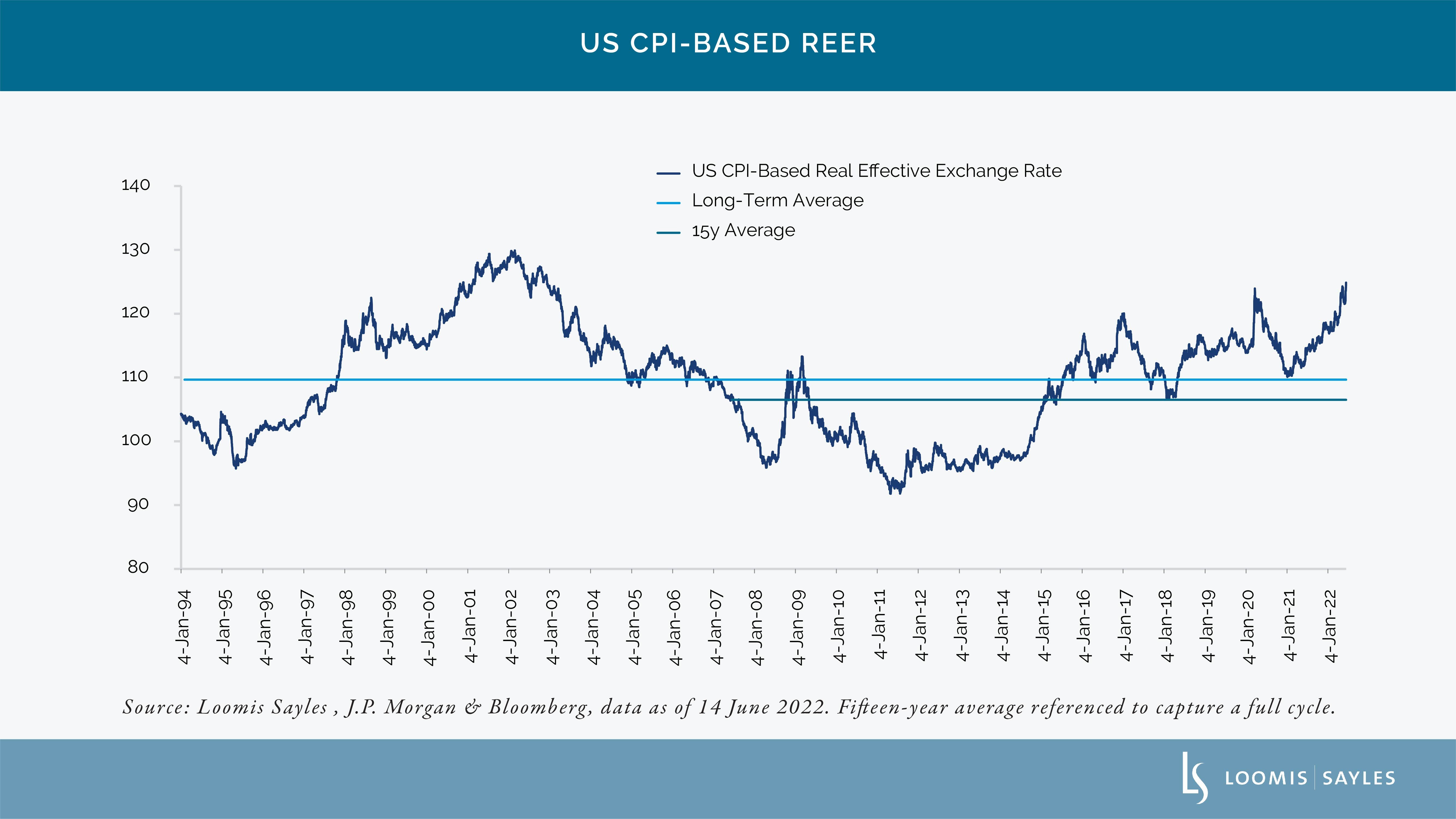

We have seen an extension of the US dollar bull market as global central banks move forward with quantitative tightening against a backdrop of weakening global growth and rising late-cycle risks. Surging global inflation and relative economic strength in the US have tightened financial conditions, lifting the US dollar to 20-year highs in real terms. By our estimate, the US dollar real effective exchange rate (REER) is currently screening between 10% to 15% rich compared to historical averages.

Emerging market debt positioning, which tends to be influenced by dollar strength/weakness, has been extremely bearish at these levels. However, we see potential for the dollar to enter a period of sustained depreciation. Based on historical data, dollar cycles last an average of six to nine years,[i] and we are approaching the tenth year of this dollar bull market. Could this be the turning point?

Dollar regimes tend to be very persistent in our view. Thus, if we enter a period of depreciation, we’d expect it to endure over a longer period of time. We believe peak global inflation and strong growth in Asia may cause the dollar to stabilize, if not depreciate, in the year ahead. We believe a sustained dollar bear market in the next 6 to 12 months would be a strong tailwind for emerging market debt assets, particularly if non-US growth momentum recovers from today’s distressed levels.

[i] Druck, Magud & Mariscal for the IMF, “Collateral Damage: Dollar Strength and Emerging Markets’ Growth,” published 29 July 2015.

MALR029152