How might the new administration make good on its promise of a lower corporate tax rate? The House has proposed funding the cut with a new border tax on imports (BAT). While taxing imports may sound straight forward, there are many less obvious details that need to be hashed out including, specifically, whether or not imported crude oil would be exempt from this BAT.

Crude oil imports

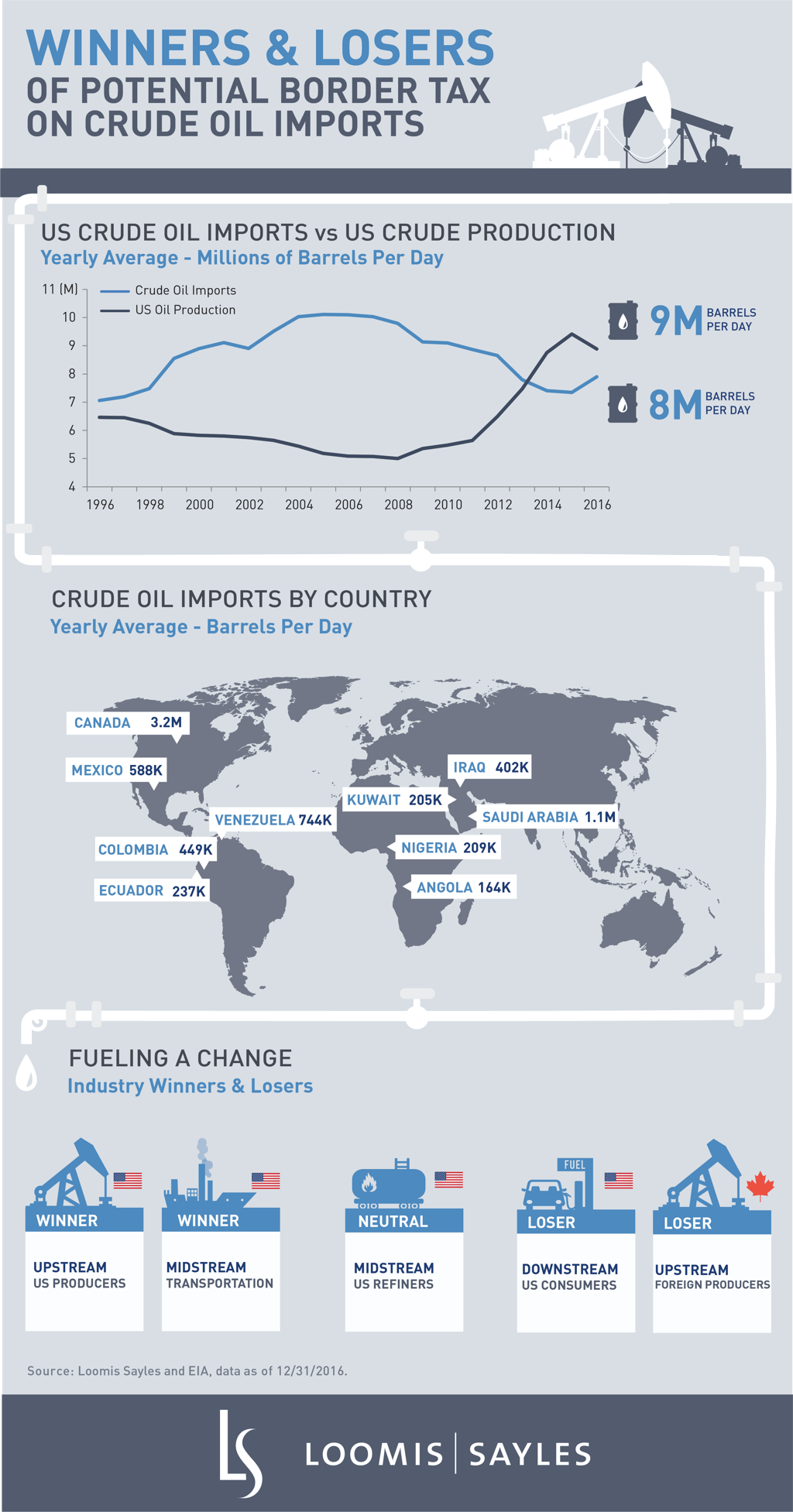

Growing US oil production from the booming shale industry over the past few years has allowed the US to reduce its reliance on imported crude oil from the Middle East, Canada and Mexico. However, the US still imports over 7 million barrels per day. While OPEC accounts for a significant amount of the imports (34%), Canada and Mexico combine to account for a larger share at 44% of imports.

While things between the US and Mexico have appeared frosty since President Trump assumed office, relations with Canada have been more favorable with Trump signing an executive order to advance the Keystone pipeline. Additionally, White House press secretary Sean Spicer has indicated that the administration would favor a border tax that would likely apply only to countries where the US has a trade deficit, which would include Mexico, but not Canada.

Implications of a tax on imported crude

If crude oil imports are taxed, the increased cost would potentially be passed on to consumers through higher gasoline prices. US refiners processing a higher percentage of imported crude would be disadvantaged versus US refiners that predominantly process US crude and wouldn’t be burdened by the tax. This preference would likely then cause domestic oil prices to rise, incenting domestic producers to increase production.

Eventually, as US producers ramp up production, domestic crude oil prices, and by extension gasoline prices, would likely come back down. However, over the near term, gasoline prices will likely increase along with the rate of the import tax, with a 20-25% tax increasing gasoline prices by $0.26-0.33 per gallon, as the US still imports a large amount of crude oil.

Our views

Winners

|

|

US Oil Producers

|

Domestic crude oil prices would likely rise by tax rate with the higher cost producers potentially the biggest beneficiaries given the greater leverage to higher oil prices.

|

|

US Midstream Companies

|

The anticipated increase in US prices would lead to an increase in US production potentially benefiting US midstream companies as the higher production would increase the need for additional infrastructure.

|

| Neutral |

US Refiners

|

While initially inland refiners sourcing US crude would be poised to benefit, the BAT would generally be neutral for US refiners over the long run as lower demand from higher gasoline prices would be offset by lower competition from imports and a lower tax rate.

|

| Losers |

| US Consumers |

Tax on imported crude oil prices would directly increase gasoline prices and hurt low income consumers. Since the federal gasoline tax has not increased since 1993 despite the need to increase the tax to fund infrastructure, this is a major impediment.

|

| Foreign Producers |

Although we believe Canadian production would be exempt, Canadian producers would have the most to lose from a BAT as approximately 99% of Canadian exports are to the US and most of Canada's pipelines are to the US and are meant to feed US refiners.

|

MALR016684

Past results are no guarantee of, and not necessarily indicative of, future results.

Commodity interest and derivative trading involves substantial risk of loss.

This is not an offer of, or a solicitation of an offer for, any investment strategy or product. Any investment that has the possibility for profits also has the possibility of losses.