We expect emerging market (EM) fixed income asset classes to continue to perform well in 2020. Though the sector appears to be starting from less attractive valuations than a year ago, in a low-yielding world, we see opportunity for relative performance in credit and local rates and a tactical tailwind for EM currencies. We estimate a marginal pickup in global growth in 2020 to approximately 3.3%, led by an acceleration in EM growth to about 4.5%, which should benefit EM assets. Phase one resolution of the US-China trade deal should be an incremental positive for EM economic activity.

From a fundamental perspective, EM corporate leverage has remained well-contained despite indications of slowing earnings growth through much of 2019. Sovereign debt levels remain elevated, but countries with the worst imbalances have been improving. Importantly, sovereigns have broadly benefited from the potential for monetary policy changes in the low-rate global environment and even some possible fiscal policy moves.

Technical factors for the EM corporate sector should be favorable. We anticipate lower supply versus 2019 and continued support from domestic buyers.

China recently implemented various policy initiatives to encourage better capital allocation and associated fixed-asset investment. We expect this development to support the global commodity price outlook, which would likely be positive for EM commodity-related sovereigns and corporate issuers.

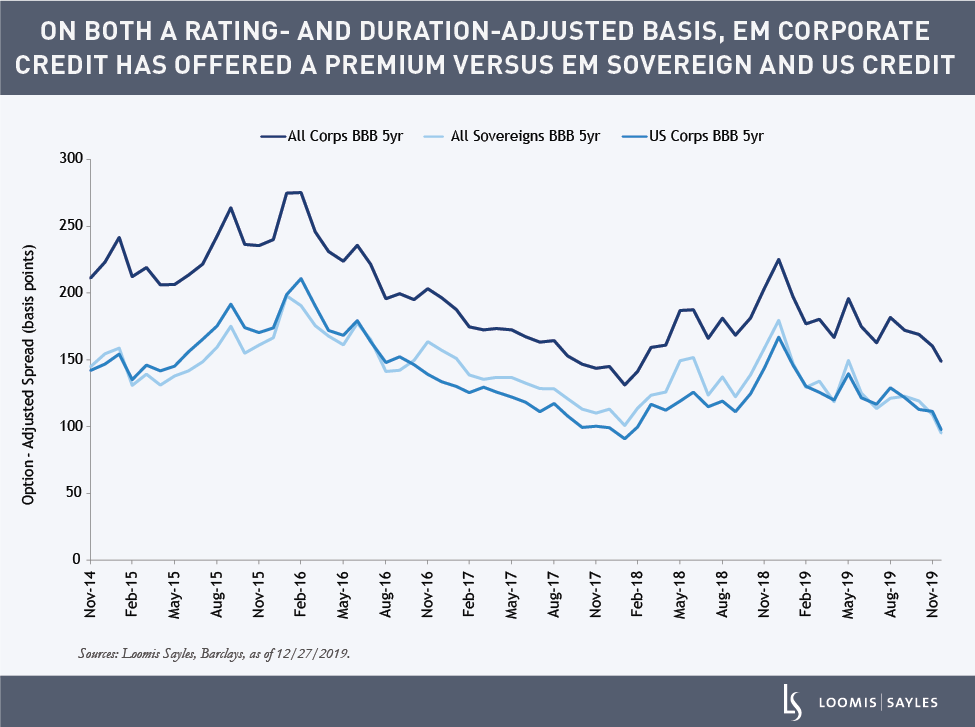

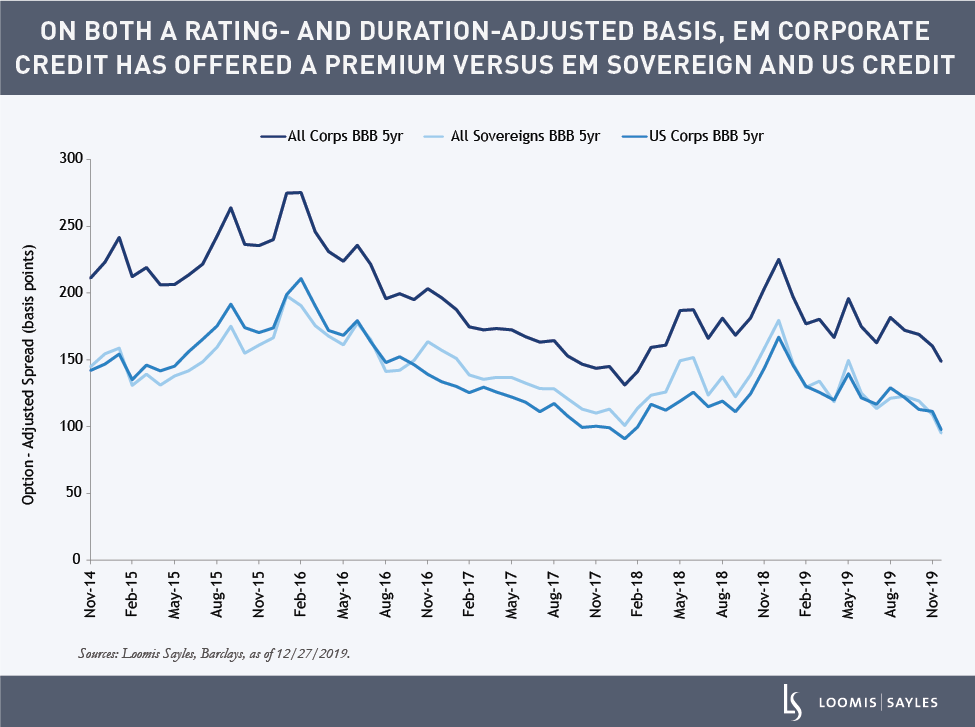

In the EM credit sector, the yield premium of corporate securities persists. With an income objective, we currently prefer EM corporate issues to sovereign credit.

MALR024677

Past performance is no guarantee of future results.