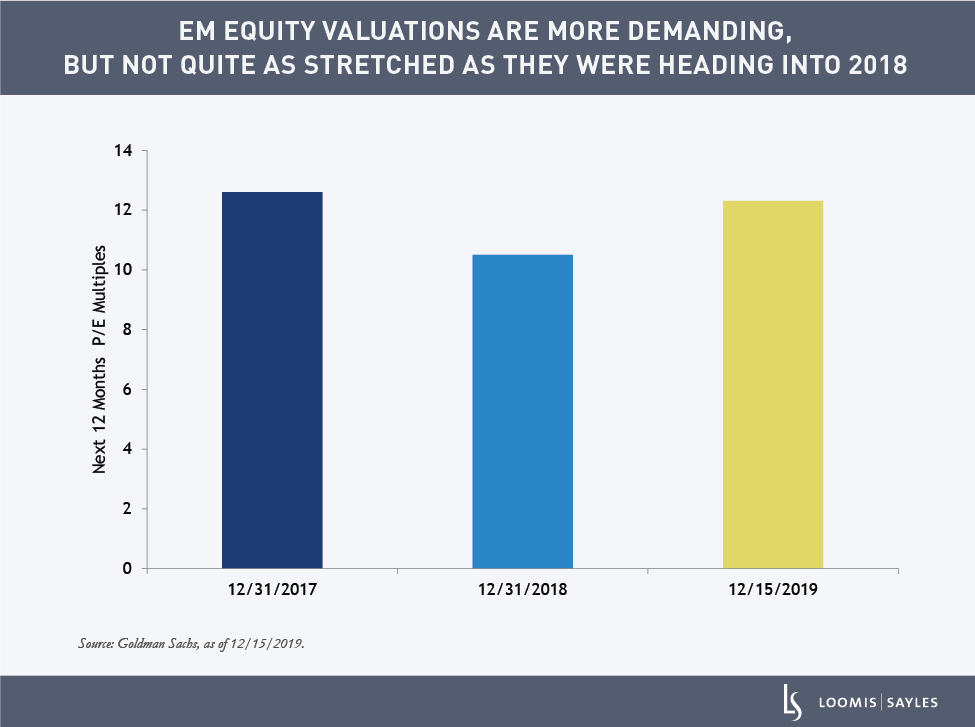

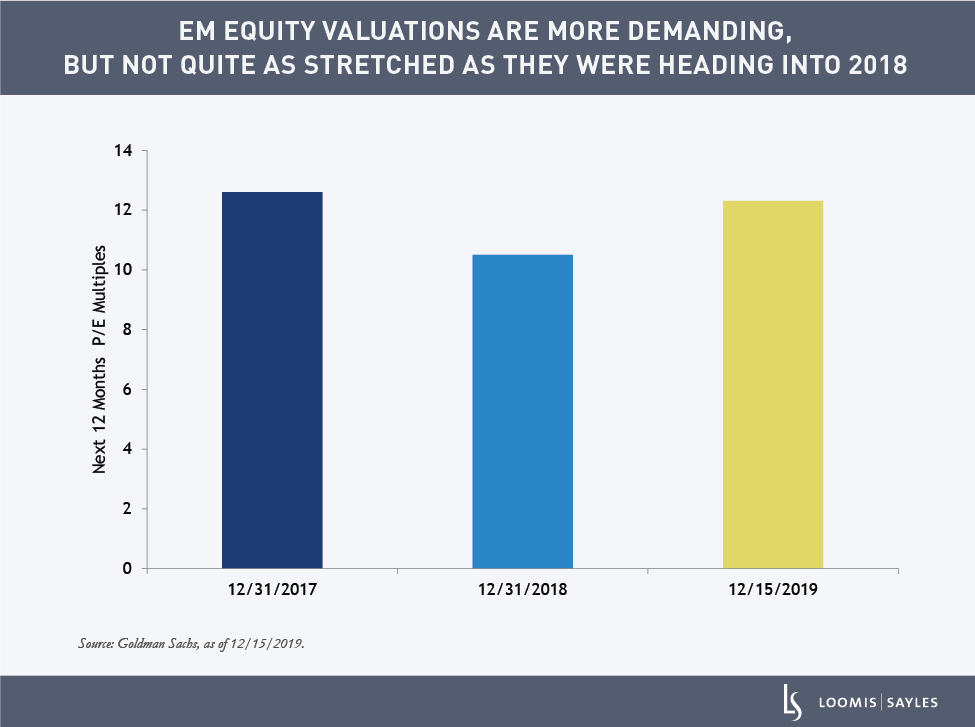

We are bullish on emerging market (EM) equities for 2020 given valuations, continued low interest rates and cyclical and structural growth in many of these countries.

We are not sanguine on China-US trade tensions. While there might be some breakthroughs, structural issues will likely remain. However, China has room for fiscal and monetary stimulus and will likely support domestic demand in case of a slowdown. Earnings generated by companies in Brazil should continue to do well despite weak headline macro growth. Increasing consumer confidence, reforms and potential investment will likely be supportive. While India is going through a significant slowdown, we are optimistic about its economy for 2020. The country’s shadow banking crisis appears to be in its late stages and liquidity should resume due to government and regulatory measures.

We expect further rate cuts in several EM countries in 2020, as well as neutral-to-easing monetary policy by the major developed market central banks. A concern for EM growth is the timely transmission of monetary policy by EM financial systems.

MALR024666

Market conditions are extremely fluid and change frequently.

This blog post is provided for informational purposes only and should not be construed as investment advice. Any opinions or forecasts contained herein reflect the

subjective judgments and assumptions of the authors only and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. Information, including

that obtained from outside sources, is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or

redistributed without authorization. This information is subject to change at any time without notice.