The US job market continues to plow ahead, leading many to believe Fed rate hikes are coming later this year. However, the pace of hikes may be slower than expected. The Fed is facing a “dollar dilemma” as it evaluates US economic outperformance.

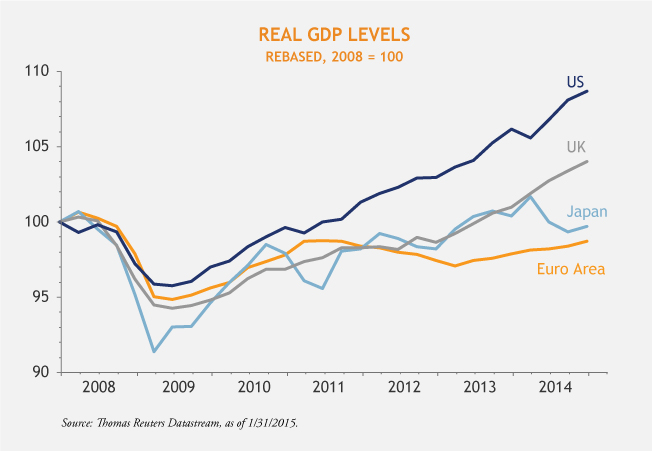

What’s to love: The US is still leading developed market growth

On the one hand, the Fed sees the stronger dollar as a reflection of the outperformance of the US economy.

After the 2008 financial crisis, the US was quick to recognize bad loans, allow defaults, re-capitalize the banking sector and implement aggressive monetary easing. Though the recovery and subsequent expansion has been halting and sluggish at times, the US economy has outperformed its major developed market peers post-crisis thanks largely to this tough prescription. Within the US, consumers are expected to lead the economy toward a 3% GDP growth rate this year.

What’s not to love: Excessive US dollar strength might delay rate hikes

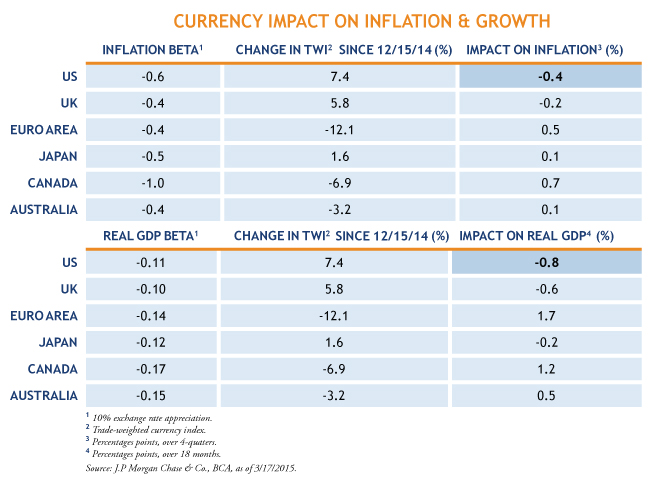

On the other hand, the strong dollar can lower inflation, hurt exporters and dampen overseas profits.

In a press conference on March 18, Fed Chair Janet Yellen noted that the strong dollar is one factor that “is holding down import prices, and at least on a transitory basis, pushing inflation down.”

If dollar appreciation goes too far too fast, it can put a drag on the economy by weakening the export sector and dampening inflation. This may ultimately cause the Fed to be a little more dovish on the margin than it otherwise would. The Fed may choose to tread carefully later this year in order to avoid tightening too quickly.

MALR013204