To kick off 2025, Loomis Sayles will feature forward-looking views on key segments of the fixed income market. Seasoned experts with knowledge and experience in each sector will answer three questions that drill into major themes for the year ahead. Keep an eye out for each installment as the series rolls out over the next few weeks.

To set the stage, we’re starting with Craig Burelle, Global Macro Strategist, Credit, and his views on the macro backdrop.

1. Markets have been pricing in a soft landing in the United States for more than a year now. Last year, you agreed with this view. Do you still?

We do. We are not expecting the US economy to roll over anytime soon, but growth should slow from levels that exceeded our expectations throughout 2024. The US is starting the year from a position of economic resilience. Credit spreads are tight, financial stocks have performed well, the Fed has cut rates and nominal GDP remains in the 4.5%-5.0% range. Consumers are still spending, earnings growth appears likely to broaden across sectors, and while the labor market is cooling, it has avoided a significant pickup in layoffs thus far. We expect these factors to support financial conditions and corporate health as we move through 2025, and we believe the credit cycle will continue progressing in mid-to-late expansion.

What’s changed? We think downside risks have increased. US policy—trade, fiscal and monetary—is a major wild card for 2025. Inflation’s decline has been slower than anticipated. We believe a less dovish Fed could put the brakes on disinflationary momentum, as could extensive US tariffs. There is growing risk that core inflation could stall above the Fed’s target, which could result in higher rates and a hawkish repricing of Fed expectations. Some of that risk is reflected in markets already, but we’ll be monitoring developments closely.

2. What do you think is going to be the key driver of the credit cycle in 2025?

We say it often, but we believe profits drive the cycle. It’s the key indicator underpinning a company’s ability to borrow, spend and hire labor. We’re now five quarters removed from the profits recession of 2023. Encouragingly, we think earnings growth will be more inclusive across sectors in 2025. In our view, technology and communications will continue reporting strong growth, while formerly lagging sectors like industrials and materials should start to grow profits again. Our expectations for profit growth are not quite as bullish as consensus, but close. Bottom up consensus expectations for S&P 500 earnings are currently optimistic at just over 12% year over year. Those estimates are likely to come down a bit, but we expect them to stay firmly in positive territory (unless there’s a significant shock).

Overall, corporate fundamentals appear solid. We anticipate limited downgrades and a very mild default rate of approximately 3.0% in 2025, which should fuel investor risk appetite in the months ahead.

3. Where are you seeing potential opportunities in this environment?

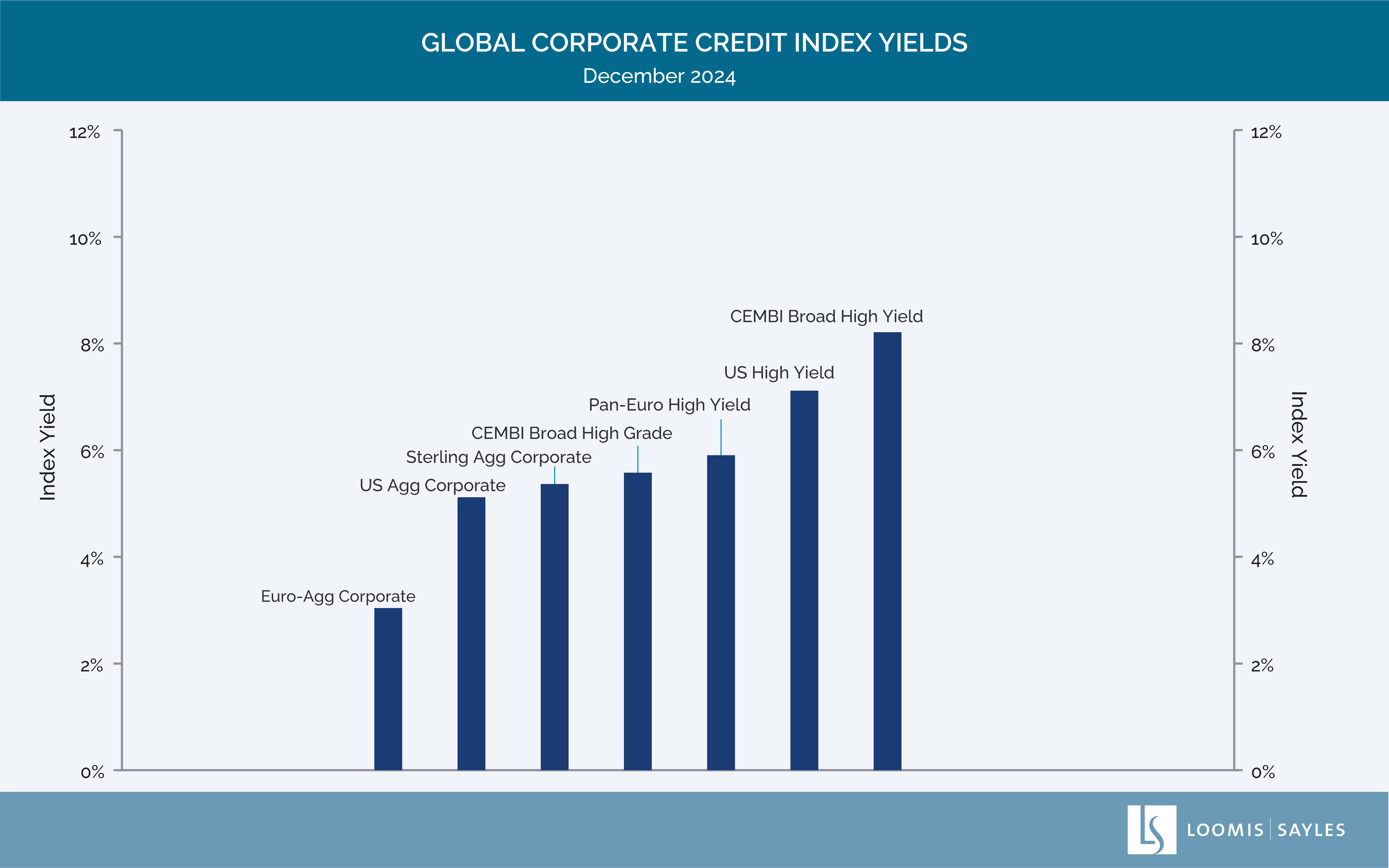

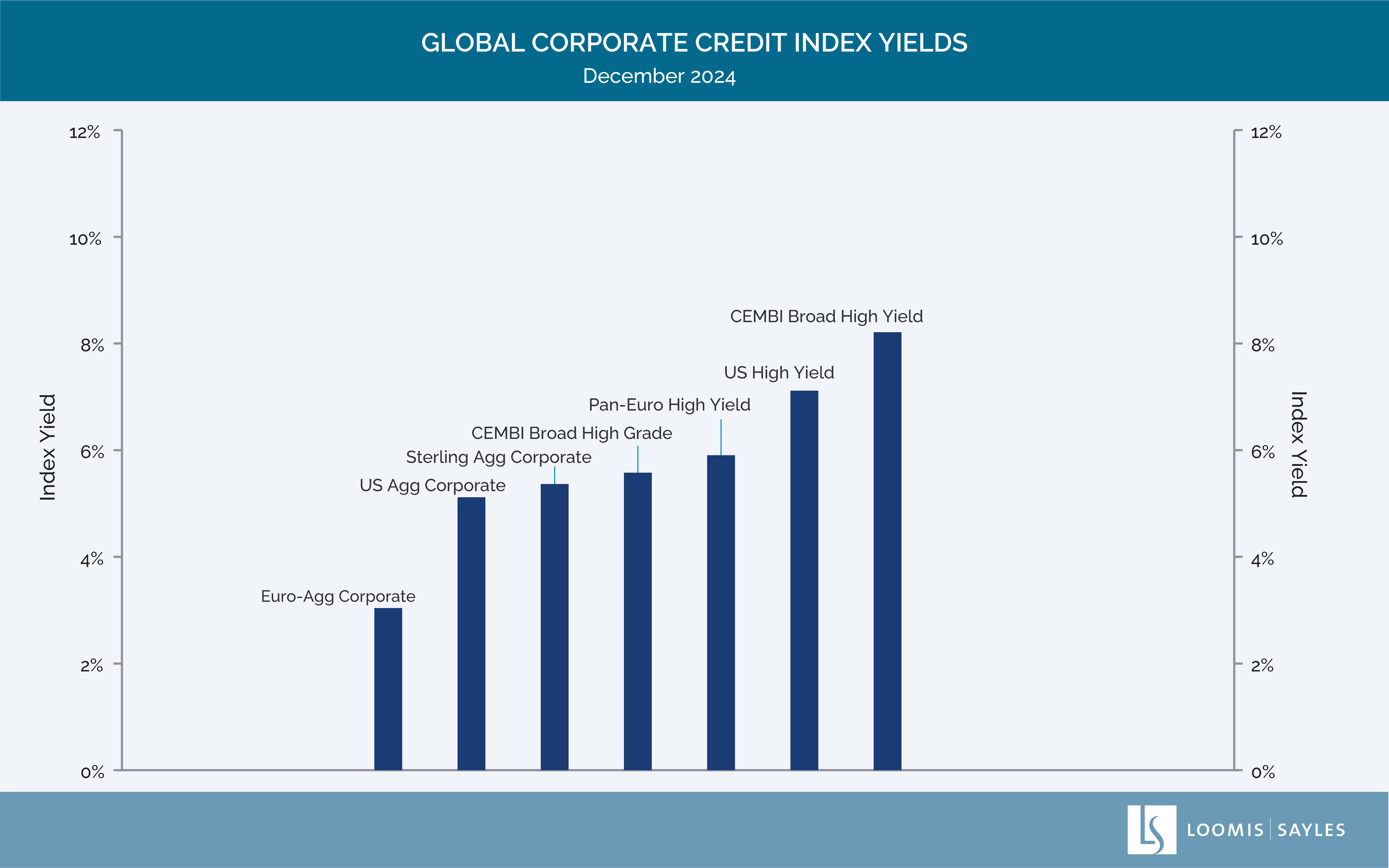

In US credit, all-in yields are high and likely to support demand for credit. Yes, spreads are tight, but we wouldn’t rule out further spread compression from current levels. We see potential opportunity in credit markets outside of the US, where valuations look compelling and sentiment is more muted than in US markets.

Chart source: Refinitiv Datastream, Bloomberg, JP Morgan, S&P Global, data as of 13 December 2024.

The chart presented above is shown for illustrative purposes only. Some or all of the information on this chart may be dated, and, therefore, should not be the basis to purchase or sell any securities. The information is not intended to represent any actual portfolio. Information obtained from outside sources is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or redistributed without authorization.

Past performance is no guarantee of future results.

In foreign exchange markets, we see potential for US dollar momentum to continue over the near term. We expect lots of uncertainty around tariffs and trade negotiations, and will be watching closely for signs of changing tides. With the US dollar at rich valuations, we believe further depreciation of foreign currencies could provide attractive entry levels.

In our view, risk assets have priced in a tremendous amount of optimism for the year ahead. We are optimistic too, but want to acknowledge that our starting position is more challenging than last year. There are many unknowns at play, particularly when it comes to the new US administration. Ultimately, we believe fundamentals will drive asset performance, and right now most fundamentals are looking pretty good.