2015 kicked off with a rocky start for emerging markets: pending US rate hikes, falling commodity prices, quantitative easing in Europe, and idiosyncratic country risks all soured investor sentiment and caused the US dollar to soar. This led to substantial weakness in emerging market (EM) foreign exchange, pummeling US-based investors in many local currency bond markets. Despite that pain, EM credit performed well, and along with EM sovereign debt, posted positive gains.

EM hard currency debt remains supported by central bank policy which continues to be accommodative overall.

- In the US, dovish Fed policy has remained constructive for EM, with Yellen’s comments in March signaling gradual Fed tightening, which in turn, has encouraged investor risk-taking

- In Europe, the aggressive QE bond buying program out of the European Central Bank has pushed euro zone yields down, increasing the attractiveness of EM debt

- The global disinflationary environment, fueled by sluggish growth and low oil prices, has also been supportive of EM credit, allowing central banks to cut rates or delay hikes.

Currency

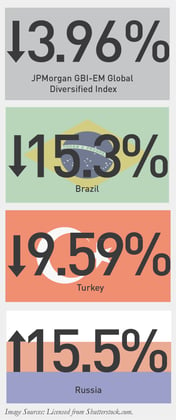

The JP Morgan GBI-EM Global Diversified Index was down -3.96% for Q1 2015. The currency component of the index was down -6.33%, negating all gains made in the local bond markets, which broadly rose 2.53%.

The JP Morgan GBI-EM Global Diversified Index was down -3.96% for Q1 2015. The currency component of the index was down -6.33%, negating all gains made in the local bond markets, which broadly rose 2.53%.

Brazil was hit hardest in the first quarter, down -15.33%. It was the Brazilian real’s precipitous fall, -17%, that fueled underperformance. Increasing lack of confidence in the Rousseff administration’s involvement in the Petrobras corruption scandal, coupled with a stagnant economy, led investors to flee the currency.

Another major underperformer was Turkey, down -9.59%. The country’s weak performance was driven entirely by a decline in the lira, down -10.11%. The lira fell over concerns as to the autonomy of its central bank, as it faces considerable political pressure from Turkey’s President, Recep Erdogan.

Notably, Russia made a strong recovery in Q1, up 15.52%. During Q1, the ruble returned 4.38% and bonds posted double-digit gains, up 11.91%. The stabilization of oil prices, reduced geopolitical concerns over the conflict with Ukraine, and an oversold market fueled the country’s first-quarter rebound.

Sovereign USD Debt

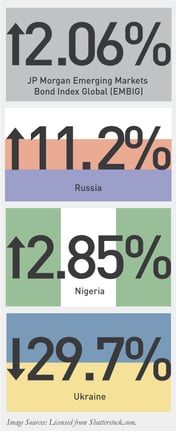

The JP Morgan Emerging Markets Bond Index Global (EMBIG) closed up 2.06% for the first quarter. We continue to see a divergence in returns between the investment grade and high yield segments, with the higher=quality component of the index returning 2.72% and the high yield segment returning .24%. The decline in US interest rates during Q1 favored the higher-quality, longer-duration investment grade segment and was the largest driver of performance.

The JP Morgan Emerging Markets Bond Index Global (EMBIG) closed up 2.06% for the first quarter. We continue to see a divergence in returns between the investment grade and high yield segments, with the higher=quality component of the index returning 2.72% and the high yield segment returning .24%. The decline in US interest rates during Q1 favored the higher-quality, longer-duration investment grade segment and was the largest driver of performance.

Bucking the trend was Russia, up 11.21% after its downgrade and precipitous fall in late 2014. Positive headlines on Ukraine peace talks and a stabilization of energy prices offered relief to the oversold market.

Nigeria, a country beaten down by 2014’s petro plunge, made positive gains in Q1 closing up 2.85%. Although concerns over political instability and oil prices continue to stress the market, Nigerian bonds rebounded leading up to its presidential election, which marked the first peaceful transition of power from one elected official to another in the country’s history.

The worst performer for the quarter was Ukraine, down -29.70%. Investor concerns mounted over the nation’s foreign debt restructuring plan. At the end of March, Ukrainian debt traded around 40 cents to the dollar, signaling a sizable cut in principal and reduction in coupon payments.

Emerging USD Corporate Debt

The JP Morgan Corporate Emerging Bond Index (CEMBI) closed up 2.36% for the first quarter, with both the investment grade and high yield components posting strong results, 2.39% and 2.29%, respectively.

Russia once again led the pack in quarterly gains, returning 12.41%. While economists fear Russia’s economy will slip into recession due to low oil prices and sanctions, attractive valuations and low debt levels for the recently downgraded country spurred demand. The Russian recovery largely drove outperformance of the metals and mining sector, up 3.61%, making it the top sector in the index.

Equities

The MSCI Emerging Markets Index returned 2.22% at the end of the first quarter.

The MSCI Emerging Markets Index returned 2.22% at the end of the first quarter.

China continues to be the top-performing EM equity market, with the Shanghai Composite returning 15.99% in US dollar terms. While foreign investors continue to question China’s growth prospects, local investors confident of government stimulus to achieve targets continue to pour money into the system. China’s large index weighting masked many falling markets in EM for the quarter, particularly European and Latin markets where weak currencies translated into losses for US dollar investors.

2015 Outlook

The remainder of 2015 will likely be categorized by differentiation in emerging markets. Investor fear over Fed rate hikes, US dollar strength and low oil prices will likely continue to create performance-wide dispersion of return. But keep in mind—EM tides can turn quickly, themes can reverse and yesterday’s losers can be tomorrow’s winners.

MALR013223

Market conditions are extremely fluid and change frequently.

This blog post is provided for informational purposes only and should not be construed as investment advice. Any opinions or forecasts contained herein reflect the

subjective judgments and assumptions of the authors only and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. Information, including

that obtained from outside sources, is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or

redistributed without authorization. This information is subject to change at any time without notice.