Loans are senior and secured, so they are generally at the head of the queue if there is a default. That gives loans an advantage over high yield bonds and equities in the companies we loan money to when defaults are a concern. As I’ve said before, this advantage is why I think loans have more than one road back to par even as the global economy feels the pain inflicted by COVID-19.

Loans are senior and secured, so they are generally at the head of the queue if there is a default. That gives loans an advantage over high yield bonds and equities in the companies we loan money to when defaults are a concern. As I’ve said before, this advantage is why I think loans have more than one road back to par even as the global economy feels the pain inflicted by COVID-19.

Road 1: The market recovers normally over 12 months. See arithmetic behind Road 1 below.

Road 2: There is a wave of defaults, but enterprise values exceed the par value of the loan outstanding. New capital is raised to repay loans at par to prevent lenders from getting upside beyond par.

Road 3: There is a wave of defaults, and no outside capital is raised; lenders get the equity upside, and if enterprise values are more than par, then loans recover more than 100% eventually.

The arithmetic behind Road 1:

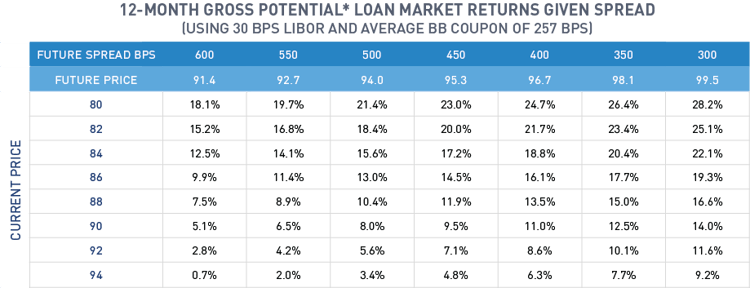

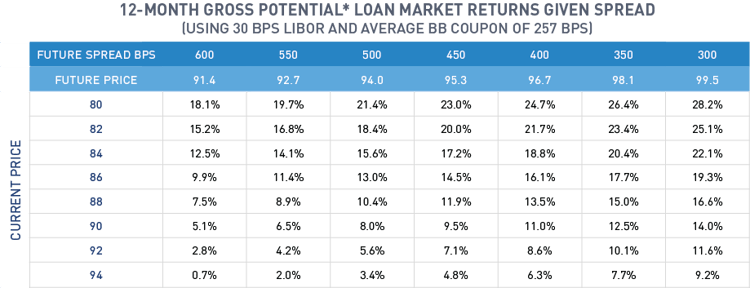

If the United States and the globe recover from the COVID-19 crisis over the next 12 months, loans could offer both an attractive yield and an attractive total return from current levels. With LIBOR set to 30 basis points1 and at current prices, three-year loan yields are generally 6%-9%. But the total return opportunity could be much greater than that due to current price discounts. If we assume loan discounts narrow as prices move back toward par (as they did after the 2008 financial crisis when LIBOR was also minimal), returns could be a multiple of today’s yields.

We are not assuming default losses in this exercise, which would negatively impact returns, as default rates within each return scenario could vary. We calculate a default loss range generally from 1% to 3% depending on starting price and actual default rates.

The table below displays the arithmetic for potential* gross index-level returns for BB-rated loans based on current prices and assuming a variety of possible future prices and spreads.

*This is a summary of the arithmetic that might be associated with a loan market recovery over the next 12 months. There is no assurance or implication that such a recovery will occur. Default losses, which would generally be 1% – 3%, are not shown in the table because they would vary. This does not represent the expected performance of loans or any investment product.

*This is a summary of the arithmetic that might be associated with a loan market recovery over the next 12 months. There is no assurance or implication that such a recovery will occur. Default losses, which would generally be 1% – 3%, are not shown in the table because they would vary. This does not represent the expected performance of loans or any investment product.

Scenario analysis has inherent limitations and should not be viewed as predictive of future events. It relies on opinions, assumptions and mathematical models, which can turn out to be incomplete or inaccurate. Actual results will be different.

Any investment that has the possibility for profits also has the possibility of losses.

1LIBOR assumption: LIBOR goes down to 30 basis points for one year and rebounds after 12 months as the economy normalizes. At such low rates, the prevalence of LIBOR floors will likely increase.

MALR025201

Loans are senior and secured, so they are generally at the head of the queue if there is a default. That gives loans an advantage over high yield bonds and equities in the companies we loan money to when defaults are a concern.

Loans are senior and secured, so they are generally at the head of the queue if there is a default. That gives loans an advantage over high yield bonds and equities in the companies we loan money to when defaults are a concern.