1. 2024 was a year of strong performance for the loan market. Are we in for more of the same this year?

Yes, we think the loan market may see another year of strong performance. Macroeconomic conditions are supportive and corporate health looks solid. Though rates haven’t come down as quickly as many in the market expected, higher borrowing costs have been well absorbed due to operating strength and many companies’ ability to further improve margins through disciplined cost containment programs. As long as macroeconomic conditions remain supportive, we expect relatively limited defaults and default losses in 2025. In such an environment, we believe loan funds can earn strong coupons and move along at par, with some better-capitalized companies enjoying revenue and margin strength.

However, if less supportive macroeconomic conditions prevail, then companies carrying the heaviest interest burden may see operational strength start to falter, particularly among those that benefited from low borrowing costs in 2024 due to very strong demand and limited supply.

2. Do you think strong technical demand in the loan market will continue into 2025?

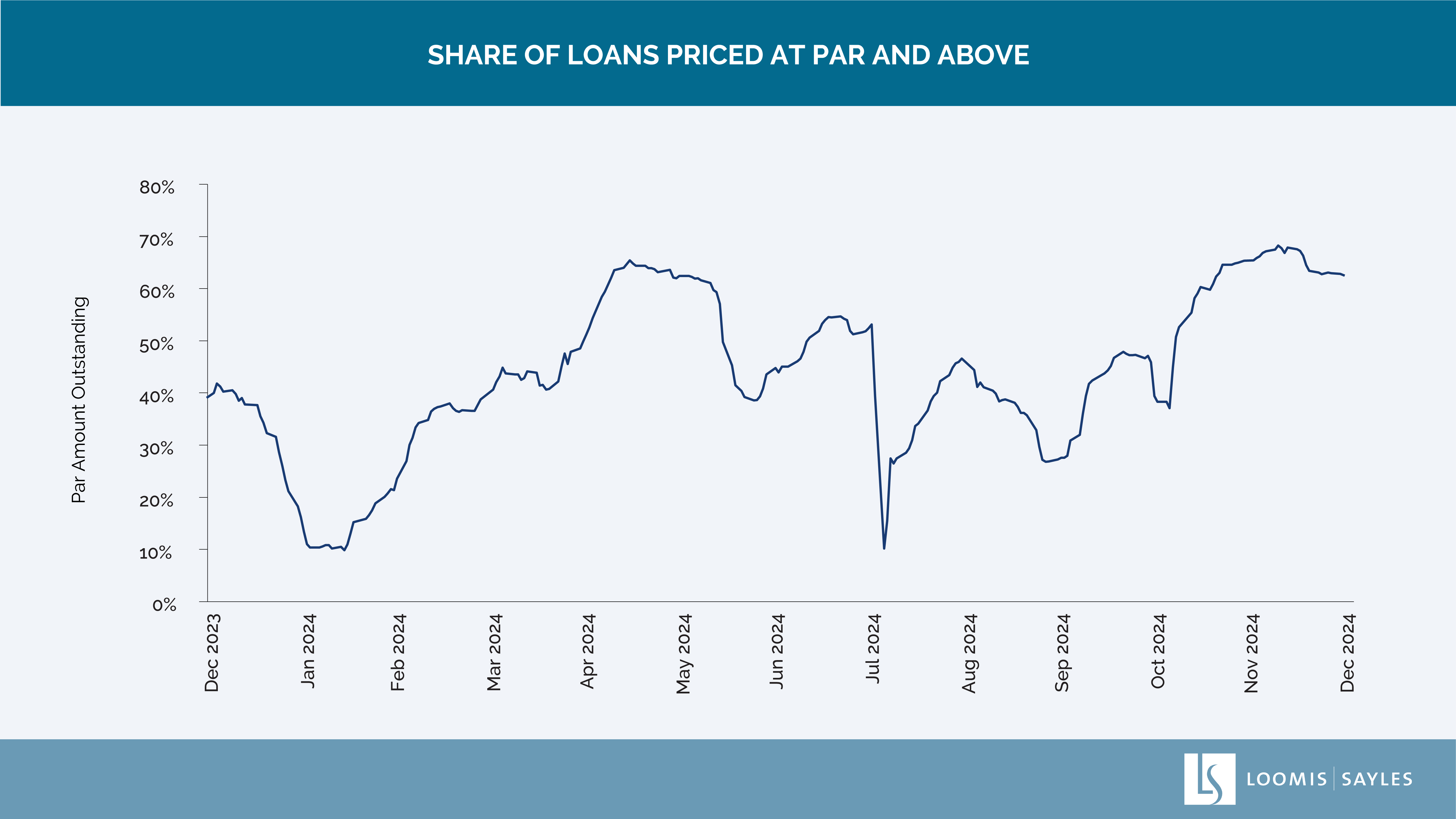

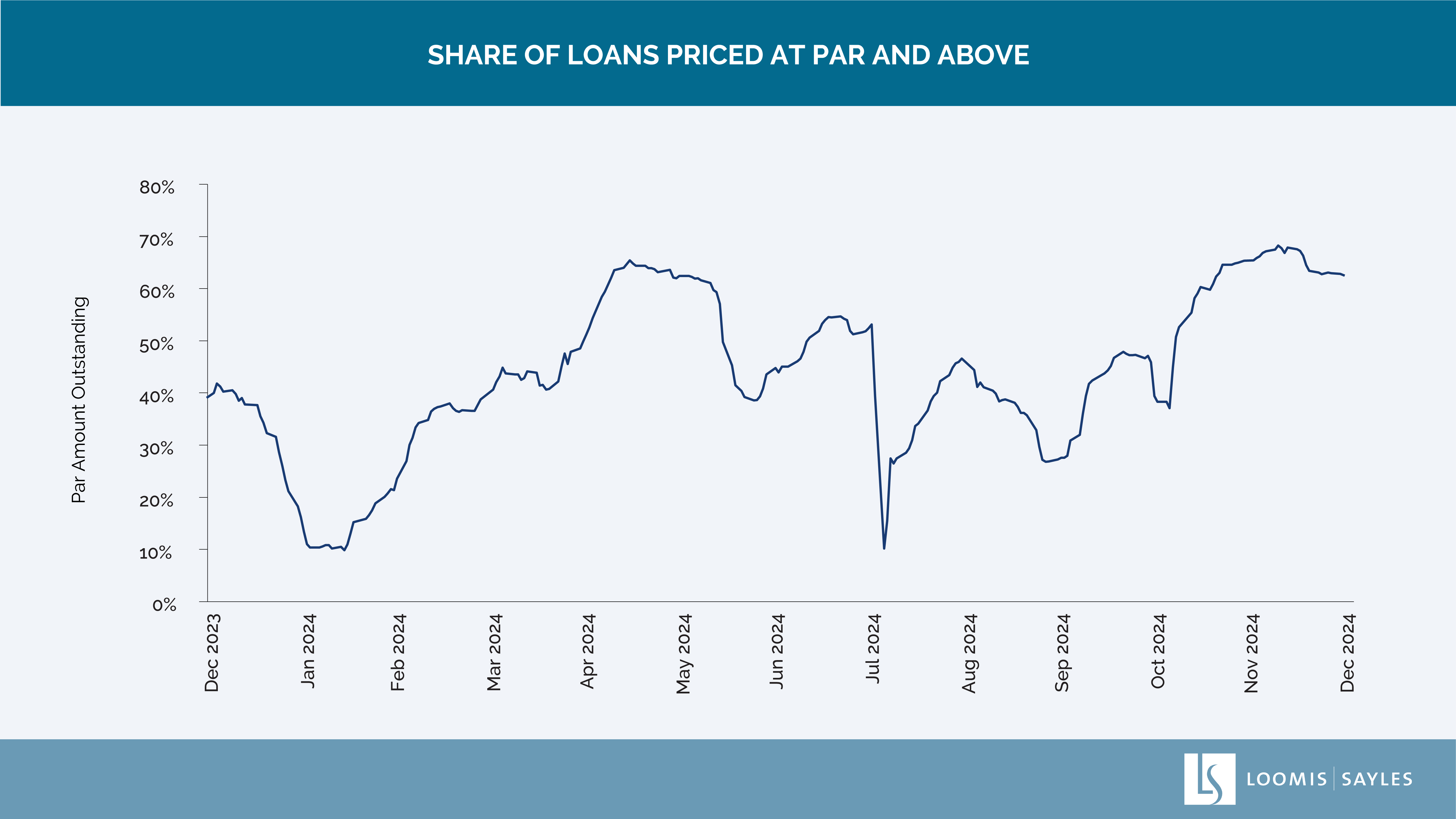

We do. The Federal Reserve (Fed) is expected to continue easing monetary policy and markets are open. We think this will drive more M&A activity and new money issuance in the loan market, which will likely be met with enthusiastic investor demand. We believe this dynamic creates potential buying opportunities, especially as most well-performing businesses are seeing their debt offered above par in the secondary markets.

3. Do you foresee any challenges for the loan market this year?

If the risk-on environment continues, we think high demand for loans will make it challenging for loan investors to obtain a yield pickup over benchmark indices. Spreads between higher- and lower-quality loans have compressed, and we believe investors are less compensated for taking on risker loans than in previous years. With risk appetite still strong, we believe it is important to understand the credit story behind each loan and consider the risk-adjusted potential return.

Chart sources: PitchBook | LCD; Morningstar LSTA US Leveraged Loan Index, data through 31 December 2024.

The chart presented above is shown for illustrative purposes only. Some or all of the information on this chart may be dated, and, therefore, should not be the basis to purchase or sell any securities. The information is not intended to represent any actual portfolio. Information obtained from outside sources is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or redistributed without authorization.

Past performance is no guarantee of future results.

WRITTEN BY:

Michael Klawitter, CFA, Portfolio Manager

Heather Young, CFA, Portfolio Manager

SAIFeooz4qid