A synchronized pickup in global economic activity has lifted the spirits of businesses, consumers and investors worldwide. Though many equity markets are near 52-week highs and credit spreads are near multi-year lows, corporate profits are now growing again in most countries. This profit rebound, along with our expectation that global growth will continue to strengthen, could help higher-yielding credit products generate excess returns over government bonds.

The US and UK are in later stages of expansion than Europe, but corporates in each region can still perform well if growth and business conditions continue to improve as we expect. Within EM, individual country performance will likely be driven by political and economic idiosyncratic developments, but broadly speaking, EM assets can benefit from the fundamental improvement we see globally.

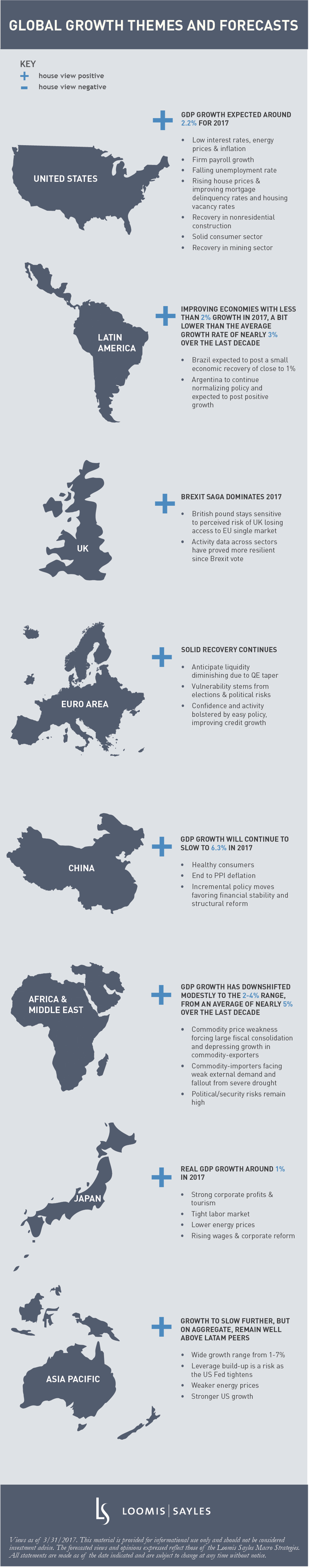

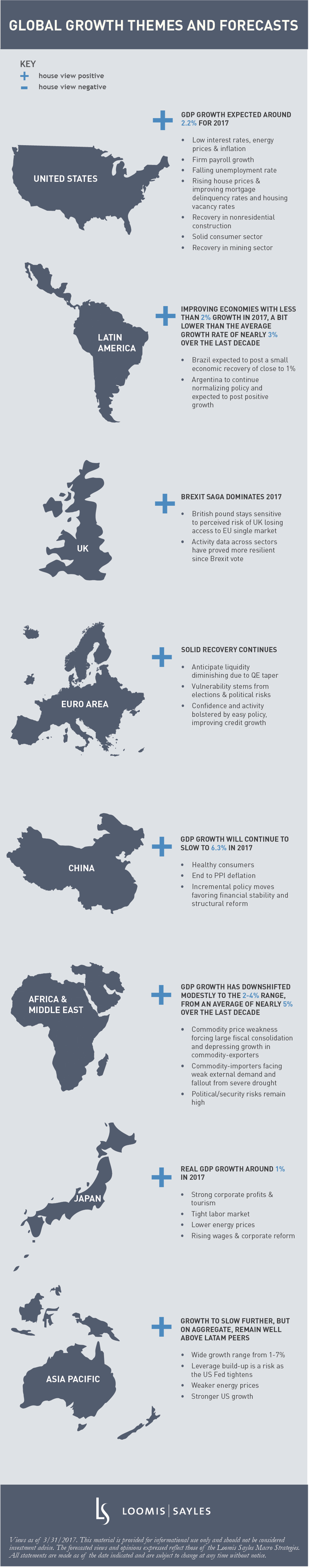

Read on for a visual snapshot of our key themes across the globe.

MALR017091

Market conditions are extremely fluid and change frequently.

This blog post is provided for informational purposes only and should not be construed as investment advice. Any opinions or forecasts contained herein reflect the

subjective judgments and assumptions of the authors only and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. Information, including

that obtained from outside sources, is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or

redistributed without authorization. This information is subject to change at any time without notice.