Loan-only capital structures have gotten some negative attention lately. Critics caution that loan-only structures leave senior-loan investors vulnerable because there is no subordinated debt below them if the company goes bankrupt. This, they say, can mean lower recovery values for loan holders. We think this view is misleading and incorrectly emphasizes a company’s capital structure instead of its overall value.

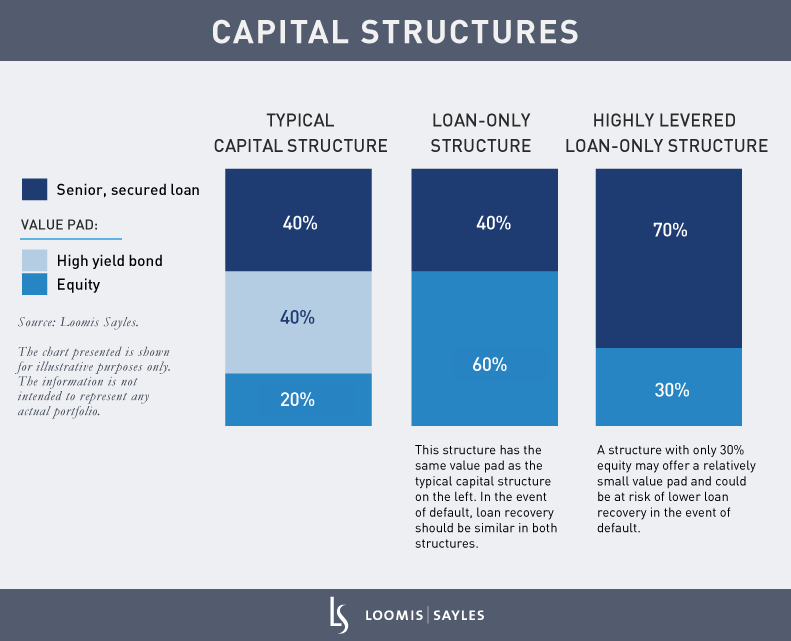

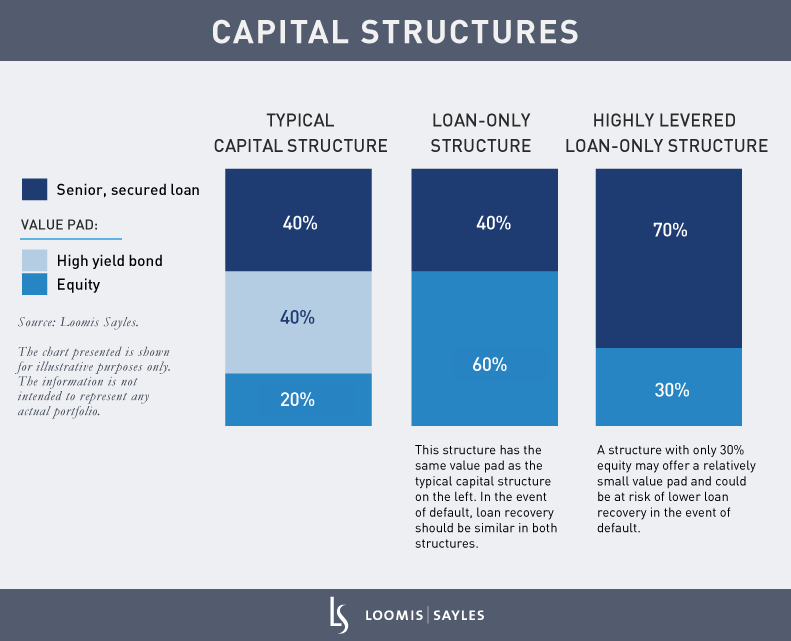

As a rule, senior, secured loans sit at the top of the corporate capital structure and are secured by a company’s assets. This means that loan owners get repaid first if a company enters bankruptcy. Subordinated high yield corporate bonds are next in line, with equity at the bottom. A typical corporate capital structure (see above) has about 40% senior loan debt, 40% subordinated bond debt and 20% equity. A loan-only structure has no subordinated bond debt; equity is the only value underlying the loans.

Focus on the value pad

Subordinated bonds do not guarantee better recovery if a company enters bankruptcy. In our view, what really matters is the amount of enterprise value and how much excess capital is available to support the loan (the value pad). Enterprise value measures a company’s worth regardless of capital structure. A larger enterprise value versus the value of the loan can afford more protection to loan investors against potential loss.

All else being equal, we believe a company with only equity beneath its loans is preferable to one with a mix of bonds and equity. Remember, the presence of bonds in a capital structure doesn’t necessarily change the recovery outcome for loan holders, but they can increase the chance of default if the company misses an interest or principal payment on those bonds. Therefore, we prefer a capital structure with less overall chance of default.

The rise of loan-only issuers

The share of loan-only issuers in the loan market has expanded in recent years. New companies too small to attract the high yield bond market have instead sought financing through the loan market. Some believe smaller companies are more at risk of lower default recoveries, and they tend to receive lower ratings. As a result of the tilt to smaller issuers, lower-rated loans have increased as a percentage of the S&P/LSTA Leveraged Loan Index.

As loan-only issuers gain market share, we want to reiterate that their lack of bonds doesn’t mean these companies inherently have lesser value and can’t support the loans they have. Loan investors must do their due diligence and focus on enterprise value to understand a credit's value pad. Don’t mistake the presence of bonds in a corporate structure as a signifier of better recovery prospects than structures without them.

MALR023654