Wary investor sentiment, seasonal trading activity in loans, and a big institutional seller have combined to drive down loan prices over the last few weeks. The press has been all over this, using covenant-lite and loan-only narratives with which we disagree. We don’t see a sensational story here. The recent decline was mostly due to technical factors amplifying global macroeconomic worries.

Not a typical risk-off event

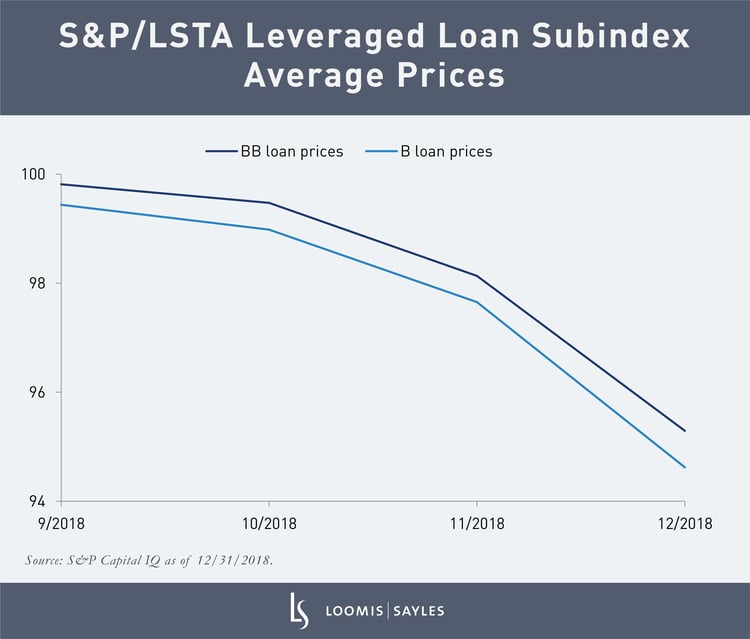

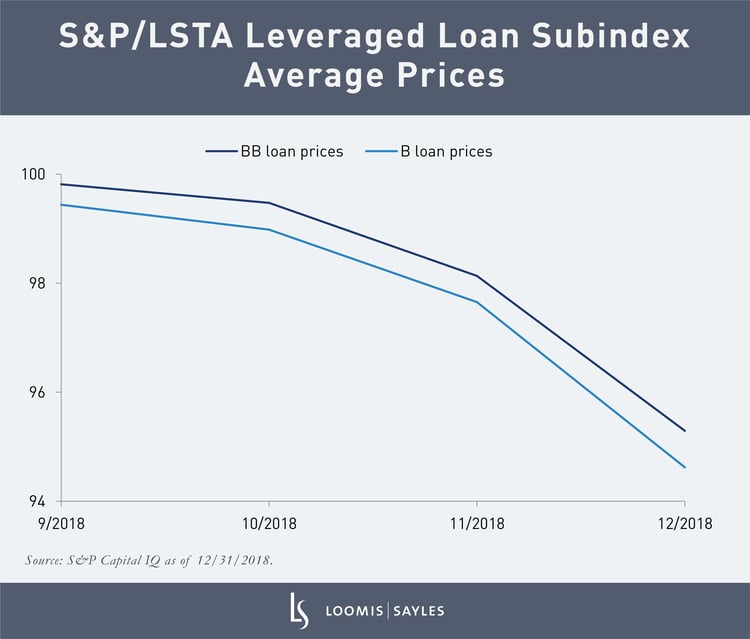

BB rated loans and B rated loans dropped almost equal amounts during the fourth quarter of 2018, which, historically, does not signal a typical risk-off event.[i] This is partly because a very large institutional investor was liquidating its loans before year-end 2018, most of which were high-quality loans. The market was aware of this fact and many buyers tried to take advantage of price concessions on those loans. This activity drove higher-quality loan performance down.

With higher-quality loans down, it was hard for lower-quality loans to stay up, especially with bonds and stocks also falling. Further, collateralized loan obligations (CLOs) had reason to wait to buy in order to maximize discounts from motivated year-end sellers, driving loan prices down even more.

Just a swoon or an ominous indicator?

We think the recent decline is just a temporary swoon. The factors above seem to indicate liquidation mechanics rather than genuine credit fear. Assuming we are right, loans appear cheap and CLOs will likely drive prices back up sometime in 2019.

[i] BB rated loans are higher quality than B rated loans. In a typical risk-off event, B rated loans fall more than BB rated loans.

Past performance is no guarantee of future results.

MALR022907