China’s recovery from the lows of February has been quicker than I anticipated. Stronger-than-expected PMIs and recently reported industrial profits indicate growth is gaining further traction.

China’s economic growth played a big role in the global recovery from the Global Financial Crisis. Now that China has made an impressive recovery, many market participants are expecting other major economies to follow a similar path. However, I see three key differences this cycle that suggest China’s recovery may be on its own trajectory:

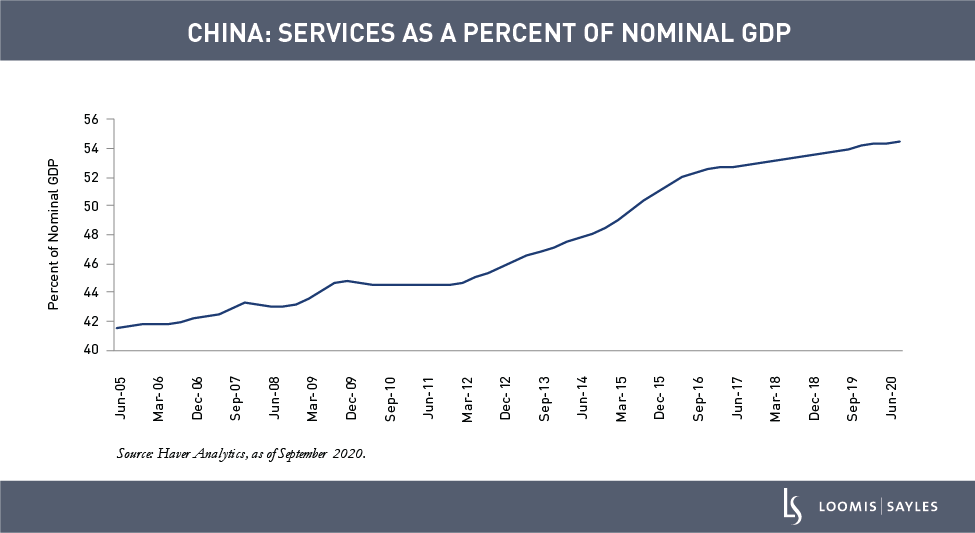

1. The size of China’s service sector

China’s service sector has grown in recent years and increased as a share of total GDP. That said, its service sector remains relatively small compared to other major economies, which suggests it still has plenty of room to grow.

I believe the lift that China can provide to global growth may be smaller this time around due to the increasing share of domestic-oriented services versus traditionally trade-oriented manufacturing activities. Furthermore, because the services sector has been hit particularly hard by the COVID-19 pandemic, countries with larger services sectors are likely to have a different recovery trajectory.

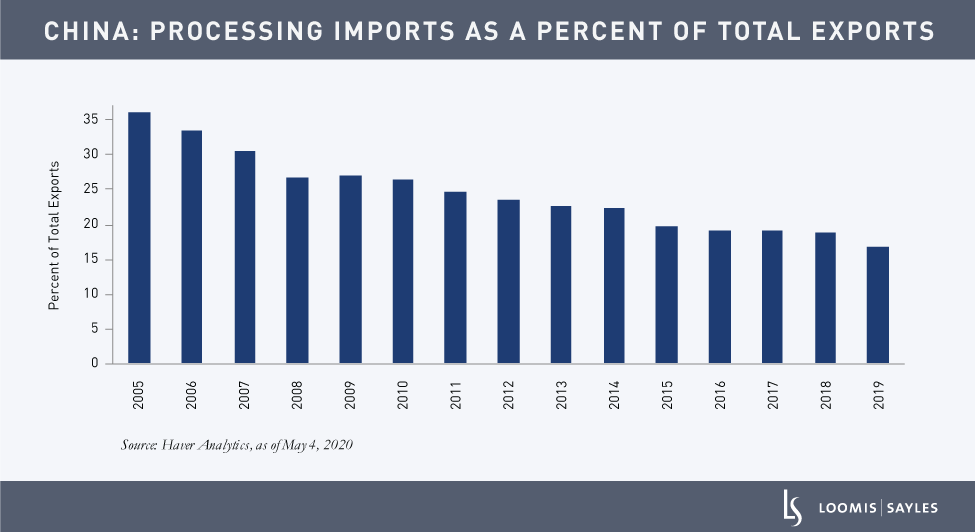

2. Geopolitics

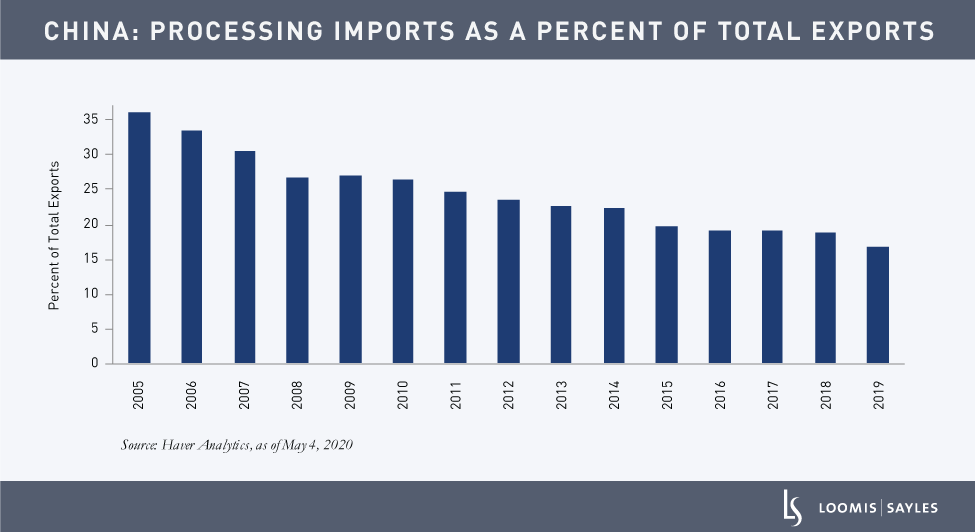

China’s relationship with the US (and other countries, like Australia) has fundamentally changed. While China emphasizes that it will continue to open up its economy, it is increasingly focused on self-reliance, which is reflected in decreasing imports and a growing share of exports from domestically owned firms. I believe this structural shift could reduce the economic boost that China has historically provided to its trading partners. We believe China will continue its long-term plans to achieve self-sufficiency, especially in the technology sector where it aims to produce approximately 70% of the semiconductors it uses by 2025.

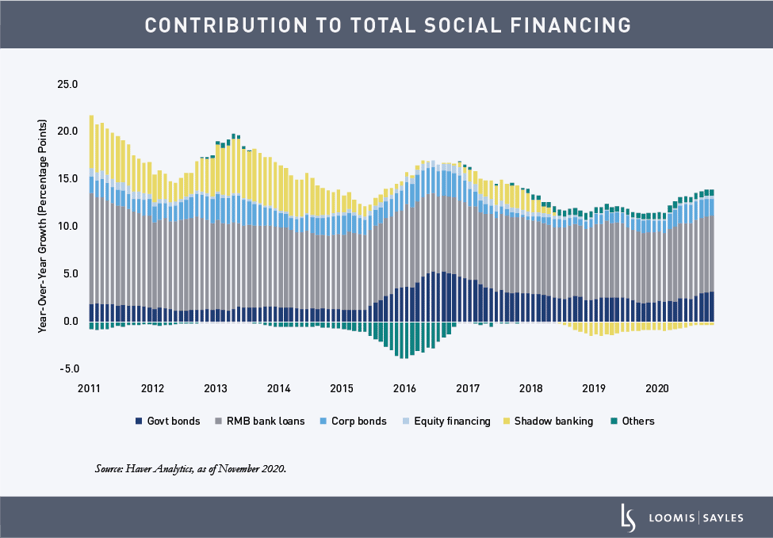

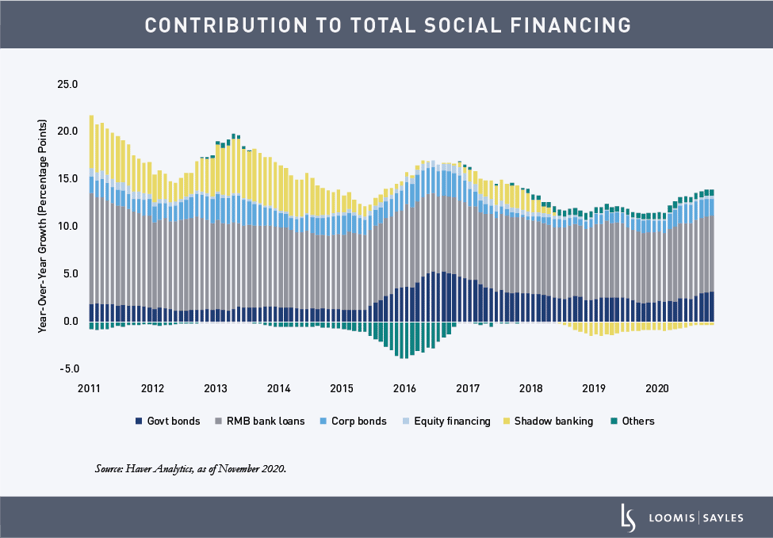

3. A shift away from shadow banking

Having a keen interest in ensuring financial stability, China has curtailed shadow banking in an effort to reduce systemic financial risk. But private enterprises (especially small- and medium-sized firms) tend to rely more on shadow banking channels for their financing needs. As a result, private investment has somewhat struggled to keep up the momentum. China’s private sector represents more than 60% of GDP growth and approximately 80% of jobs. We believe this sector will need improved access to financing to sustain the recovery.

Credit growth on watch

Going forward, I think credit growth will be an important variable to watch. Accelerating credit growth has been a key driver of China’s recovery thus far. However, Chinese authorities have signaled a gradual withdrawal of supportive policies in 2021 to keep the macro leverage ratio stable. I believe this will lead to a slowdown in credit growth. It remains to be seen if China can sustain its momentum with tighter credit conditions.

MALR026492