This blog post was initially published on December 18. On December 21, the US Congress agreed to a $900 billion stimulus package. This post has been edited to reflect our updated views.

We believe the American consumer has come through the pandemic in surprisingly good shape—at least until now. The resilience of the economy, government stimulus checks and an elevated savings rate have allowed people to keep up with their payments on car loans, student loans and credit card bills. But we are starting to hear from lenders that lower-income borrowers are struggling. These borrowers have exhausted their savings and unemployment benefits are potentially coming to an end for many in December. As a result, delinquencies have begun ticking up. Additional federal stimulus should help, but we believe the situation could still deteriorate while consumers wait for the new benefits to kick in. We are watching all developments closely for the impact they could have on the asset-backed securities market.

How we got here

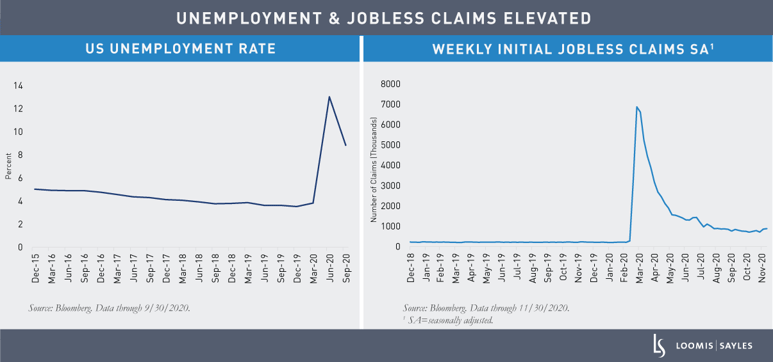

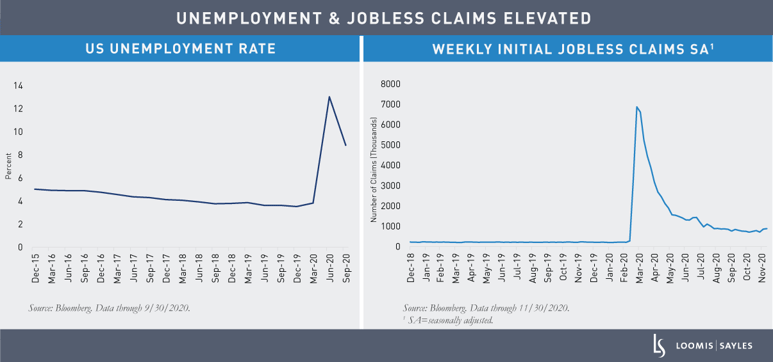

The US economy shrank dramatically in the second quarter and most forecasters expected a slow recovery. Instead, the US bounced back sharply in the third quarter. A number of factors contributed to the rebound. Many businesses quickly figured out how to operate remotely and allow non-essential employees to work from home. The first round of government stimulus—legislation that gave more than $2 trillion to individuals and businesses—did its job. And the savings rate soared, in part because there were fewer places for Americans to spend their money. For lenders, the impact was easy to see: consumers kept current on their payments to a degree few anticipated. More recently, we are seeing indications that the recovery may be losing steam. Weekly jobless claims in early December hit their highest level since September as a surge in COVID-19 cases forced governors and mayors to impose new restrictions. After months of negotiations, the US Congress agreed on a $900 billion relief package on December 21. We believe an additional package will be critical to lower-income Americans, whose finances may already be stretched to the breaking point.

A K-shaped recovery

The COVID-19-induced downturn has imposed a disproportionate burden on those at the lower end of the income spectrum in our view. These people are more likely to have lost their jobs because of damage done to industries like hotels and restaurants, and are less likely to have had savings to fall back on. Lenders are hearing from these borrowers that the cash cushion from the first stimulus is gone. Seasonal factors aren’t helping. Typically at this time of year, people focus more on holiday spending than on paying bills. The new stimulus package under consideration is smaller than the first, but should still help cash-strapped consumers. The upshot: a new stimulus package would provide some much-needed relief to consumers who had run out of support.

When the pandemic began, there was a debate about the shape of the eventual recovery. Would it be V-shaped, implying a quick snapback, or U-shaped and more gradual? A new letter, K, has entered the discussion. A K-shaped recovery is an uneven one in which some industries and some groups— such as lower-income Americans—get left behind. That is what we will be watching for in the months ahead.

The encouraging news on vaccines should lead to a better US economy and a healthier US consumer later in 2021. Until then, we believe a new fiscal support package should help carry consumers through. We will be monitoring delinquency rates, extension rates and talking to issuers to get a better handle on the path forward.

MALR026520

Used with permission from Bloomberg Finance L.P. This material is for informational purposes only and should not be construed as investment advice. Information obtained from outside sources is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or redistributed without authorization.