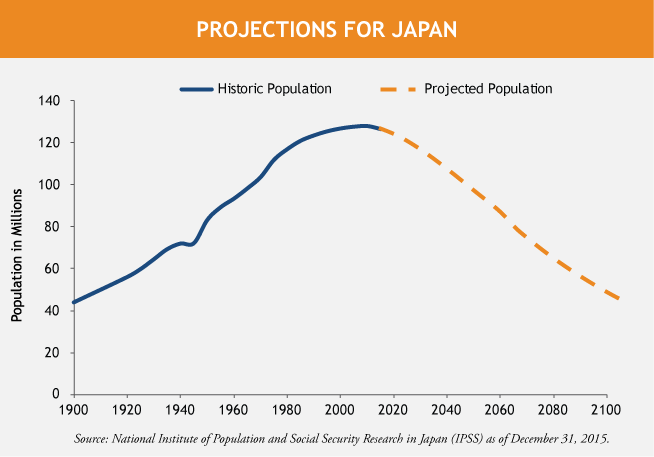

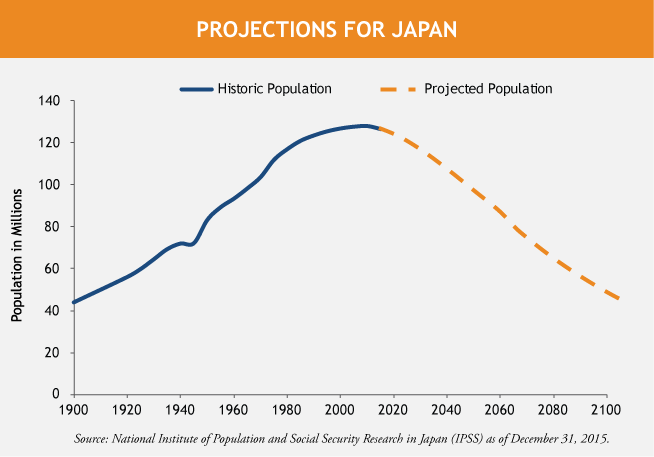

For many analysts, it’s difficult to be positive about Japan over the long-term given its demographic headwind. The old-age dependency ratio may rise by 70% by 2050. The government has forecast that the population may halve within 70 years.

Although the population is only falling 0.3% per year so far, the impacts are already being felt:

- High school class sizes have dropped by 1/3 since 1990

- Over 8 million akiya - empty houses - in rural areas

- More than 100,000 Japanese leave their jobs each year to care for elderly or sick relatives and many remain unemployed

Despite Japan's demographic challenges, I see several significant bright spots which bode well for the future.

Five reasons to be excited about Japan right now:

- Corporate governance continues to improve. This is really good news for all investors in Japanese stocks, not the least of which are Japanese people saving for retirement. Dividend payout ratios have been rising; companies have been increasing the number of non-executive directors; and companies appear genuinely focused on raising return on equity (ROE).

- Many top executives at Japan’s largest banks are upbeat. Capital spending by small business (capex) has been picking up since late last year –following Prime Minster Abe’s encouragement to boost wages and capex. The loan quality of banks has been strong, with minimal risks from China’s economic weakness. While so far the impact of Abenomics on GDP and inflation has been disappointing, one finance executive I recently met with described the business environment as "the best it has been in the last 20 years."

- The mood among Tokyo real estate executives is currently positive. The dominant landlord in Marunouchi (the central business district) reported only 2% vacancy, which should result in rising rents. Apartment prices are rising modestly in Tokyo but still look cheap. It is currently possible to get an 800 square foot apartment 5 minutes by subway from the central business district for $500,000, which is less than half of the Manhattan median price of $1.1 million.

- Chinese spending power has been boosting the Japanese economy through tourism and tour groups. The country has also started to attract back-packers from South Korea and other Asian neighbors. Japan now feels genuinely cheap –a delicious sit-down lunch in central Tokyo can be found for under $10. ‘Love hotels,’ which rent rooms by the hour to amorous couples, are being converted to hostels to meet this new demand.

- Prime Minister Abe: no illusions about the scale of the challenge. He is determined to take action now. One example is his focus on encouraging greater female participation in the workforce. Starting next year, companies will be required to publish their current and target percentage of women in management positions. Subsidized daycare slots have increased. In 2014, Mizuho Financial appointed a chairwoman who is a former minister of economic and fiscal affairs. Even 10 years ago, it would have been unthinkable for one of the major Japanese banks to have a female chairperson.

MALR014443

Market conditions are extremely fluid and change frequently.

This blog post is provided for informational purposes only and should not be construed as investment advice. Any opinions or forecasts contained herein reflect the

subjective judgments and assumptions of the authors only and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. Information, including

that obtained from outside sources, is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or

redistributed without authorization. This information is subject to change at any time without notice.