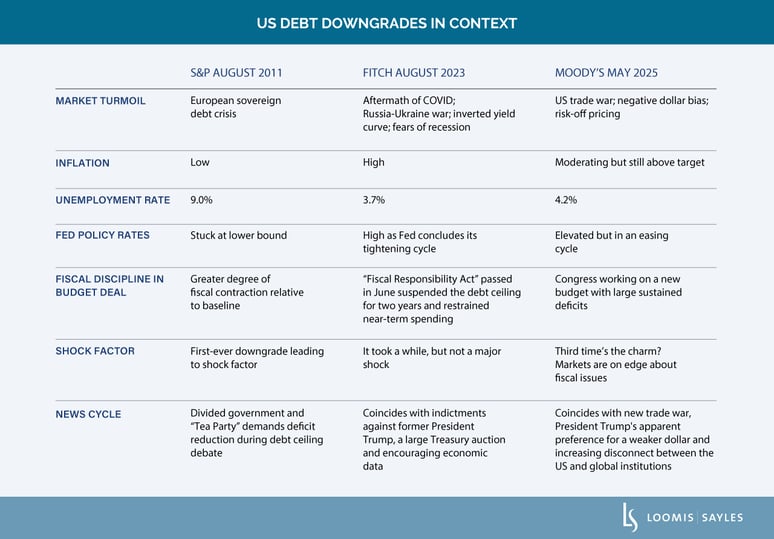

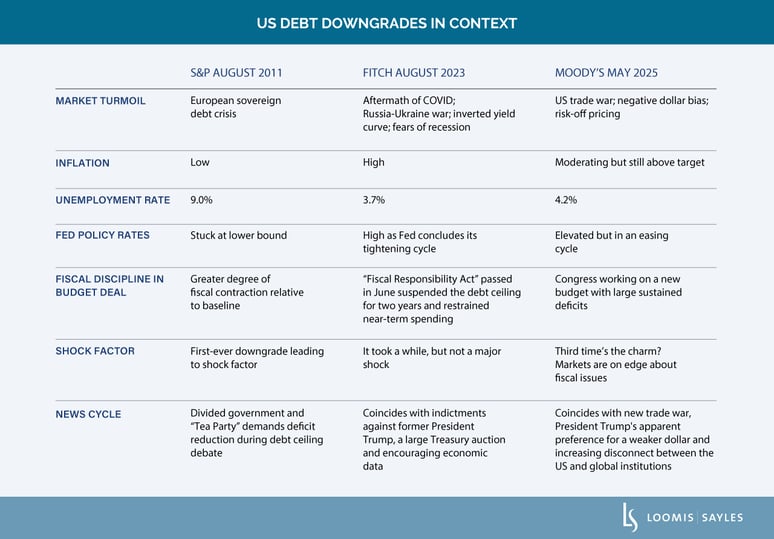

Moody’s downgrade of US Treasury debt from AAA to AA1 had been well foreshadowed, but the timing surprised us—we thought they would wait until Congress passed a budget. Moody’s cited well-known concerns that Fitch highlighted in its 2023 downgrade: rising US government debt and interest payments, repeated debt ceiling confrontations and failure to address long-term imbalances. If the move had happened in isolation, the markets may have shrugged the news off. However, coming on top of tariff anxiety, an approaching debt ceiling deadline and a new budget bill making its way through Congress, long-duration Treasury yields rose significantly.

Following the downgrade, the US House of Representatives made quick work of passing the budget bill. US fiscal policy has moved to the forefront of market consciousness. It appears that markets have revived the “sell America” theme of de-dollarization and diversification as the ratio of the public debt to GDP heads for a record high. In a fragile US economy already rocked by tariffs and elevated uncertainty, we will be watching to see how fiscal policy influences the Federal Reserve’s monetary policy decisions and, ultimately, the credit cycle. While the rating agencies may be slow to downgrade US Treasury debt again, financial markets won’t be slow in rendering their own judgment.

SAIFthsgplzw

Market conditions are extremely fluid and change frequently.

This blog post is provided for informational purposes only and should not be construed as investment advice. Any opinions or forecasts contained herein reflect the

subjective judgments and assumptions of the authors only and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. Information, including

that obtained from outside sources, is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or

redistributed without authorization. This information is subject to change at any time without notice.