This year began with a volatile start, as many capital markets followed oil prices sharply lower. When oil found its footing in mid-February, markets breathed a sigh of relief. Many investors, though pleased at the recovery, are left with the unsettling notion that these short-term market gyrations trace their roots to long-term structural shifts in the world economy.

Central banks remain key players in global financial markets, but despite their best efforts, global growth has stayed stubbornly sluggish. Neither developed nor emerging markets offer an obvious engine for stronger global growth. The world is trying to digest China’s transition to a consumer-led economy and future implications for globalization, trade and living standards. Around the world, increasingly polarized election results and mounting political stresses are a repudiation of the uninspiring post-crisis recovery and the policymakers at the helm.

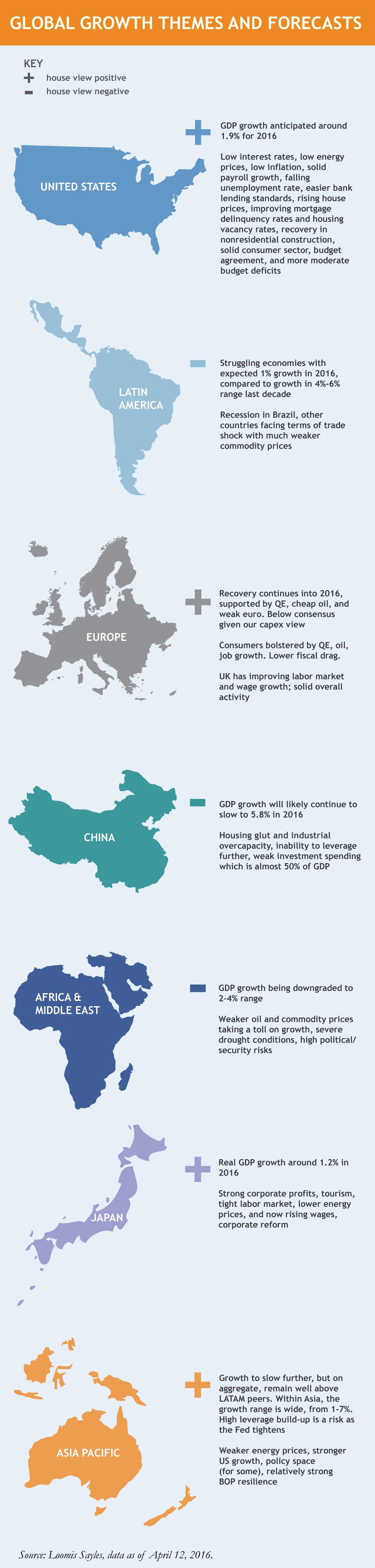

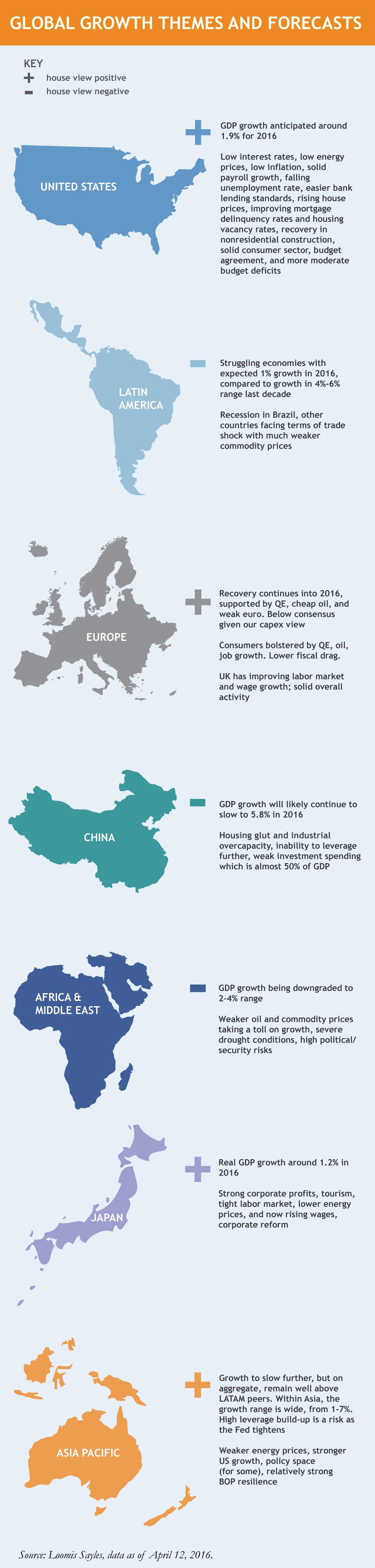

Every quarter, we update our global forecast map. Explore our key themes by region in our latest infographic:

MALR015030

Market conditions are extremely fluid and change frequently.

This blog post is provided for informational purposes only and should not be construed as investment advice. Any opinions or forecasts contained herein reflect the

subjective judgments and assumptions of the authors only and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. Information, including

that obtained from outside sources, is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or

redistributed without authorization. This information is subject to change at any time without notice.