1. You’ve had a multi-year history with a major automaker. How has the relationship evolved?

For decades, our credit analysts have met frequently with this major global automaker to discuss material fundamental credit issues. Material ESG factors have become an increasing part of the conversation over time. Initially, we met with senior finance management representatives and the investor relations team; over time, the company’s head of sustainability and other staff members joined the dialogue.

During our years of ESG engagement with this automaker, we have discussed governance practices such as the composition, qualifications, and selection of candidates to its board of directors. Our engagement has also addressed the company’s labor relations, with its massive unionized global workforce, as well as the robustness of its cybersecurity initiatives, which were designed to protect the company’s intellectual capital, facilities, and customer information. Not surprisingly, we have dedicated more time over the years to reviewing the automaker’s electric vehicle strategy as worldwide regulatory standards related to light vehicle tailpipe emissions and fuel economy tighten and consumers grow more concerned about climate change.

2. Which ESG factors has your engagement concentrated on recently?

Environmental factors have grown more and more material to the investment thesis, and our engagement reflects that. Specifically, in recent years we have focused our efforts on monitoring

the company’s:

- Compliance with 2020 and 2021 emissions requirements in Europe

- Increased disclosures, including the Sustainability Accounting Standards Board‘s (SASB) Transportation Standards and the Task Force on Climate-Related Financial Disclosures (TCFD) Climate Change Scenario Report.

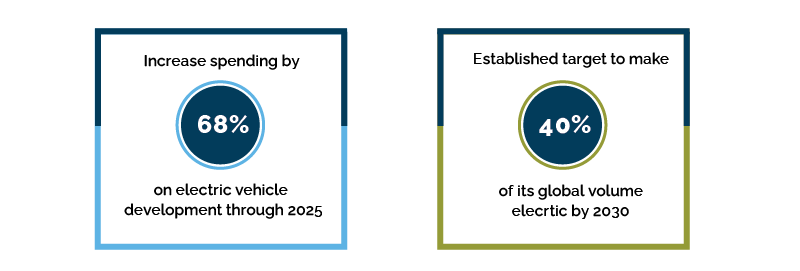

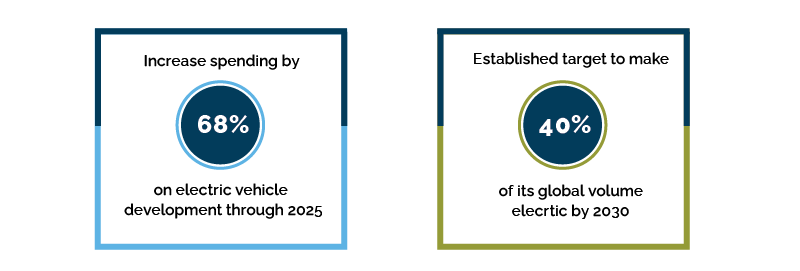

Most importantly, we have continued to engage with management regarding its growing commitment to electrify the fleet and reduce reliance on producing vehicles with internal combustion engines. In two significant steps toward these goals, the automaker recently revealed plans to increase spending on electric vehicle development by 36% through 2025 and has established a target to make 40% of its global volume all electric by 2030.

3. What is one positive outcome of the engagement?

Over the years, we have recognized significant improvement in the company’s ESG-related disclosures. We believe our engagement and that of other investors prompted the company to bring its disclosures in line with market best practices. We have also seen changes in the composition of the company’s board, to include additional expertise on new areas of business. Additionally, our engagement has allowed us to objectively measure the progress that the automaker has achieved in transitioning its business model to electric vehicles to address climate change concerns.

MALR027926

Market conditions are extremely fluid and change frequently.

Past performance is no guarantee of, and not necessarily indicative of, future results.

Other industry analysts and investment personnel may have different views and opinions. Investment recommendations may be inconsistent with these opinions. There is no assurance that developments will transpire as forecasted, and actual results will be different. Data and analysis does not represent the actual or expected future performance of any investment product. We believe the information, including that obtained from outside sources, to be correct, but we cannot guarantee its accuracy.