In our view, the corporate health outlook remains solid as we mark the third anniversary of the CANDIs survey. This quarter’s results show an improvement over last quarter’s six-month forward outlook, with corporate resilience strengthening and positive momentum broadening across more sectors. While corporate health may not be as strong as it was a year ago, we expect stability will persist, consistent with the late stage of the economic expansion. Consensus earnings estimates for the S&P 500 Index are optimistic, but even potential downward revisions to 2025 forecasts are, in our view, unlikely to disrupt the overall stability we’re observing across the corporate landscape.

In this blog, we’ll explore the survey’s key findings related to input costs, pricing power, profit margins and credit outlooks—highlighting where we believe risks remain and where optimism appears to be building.

|

About the CANDIs Once a quarter, we survey Loomis Sayles’ credit research analysts to assess their bottom-up views of approximately 30 different industries. We quantify their responses using a proprietary tool known as the CANDIs—an acronym for Credit Analyst Diffusion Indices (click here to learn more). The process culminates in a forum that combines our credit analysts and top-down global macro strategists to discuss the CANDIs’ output through the lens of the credit cycle. The results can be an indicator of how key corporate health metrics may trend over the next six months. |

Input costs climb as supply chain pressures resurface

A key challenge that many industries continue to face is the rise in input and supply chain costs. This quarter’s survey results indicate that input costs, which had stabilized late last year, have started to trend upward again. We expect this trend will continue over the next six months.

In the retail sector, we saw a shift from input and supply chain costs coming down to now moving higher, adding significant pressure on profitability. Retail companies have been hit especially hard by rising transportation costs. Ocean freight rates for goods on certain shipping routes have spiked, and while many firms have secured contracted freight rates through mid-2025, we see potential for additional cost pressure as recontracting periods approach.

Pricing power weakness paves the way for Fed action

Pricing power, which was strong when we began the survey 12 quarters ago, continues to show signs of weakness. We believe this slack in pricing power played a part in empowering the Fed to cut rates in September and suggests that inflationary pressures should keep easing.

In the manufacturing sector, companies aren’t gaining much pricing power, but they don't seem to be losing it either. However, the services sector is facing a more challenging environment, with pricing power continuing to fall. Looking ahead, this decline in services pricing power could exert additional pressure on profit margins, in our view.

On a positive note, we believe pricing power in the building products and homebuilding sectors are poised to improve in the coming months. The Fed reduced its key policy rate by 75 basis points and we see potential for lower mortgage rates. Housing turnover is expected to increase as the cost to finance a home declines. If the broader economic outlook remains stable and employment levels hold up, as we would expect in this stage of the cycle, a rise in housing starts should occur. Improved demand from both residential and non-residential construction projects could give companies in this space more leverage to pass through costs.

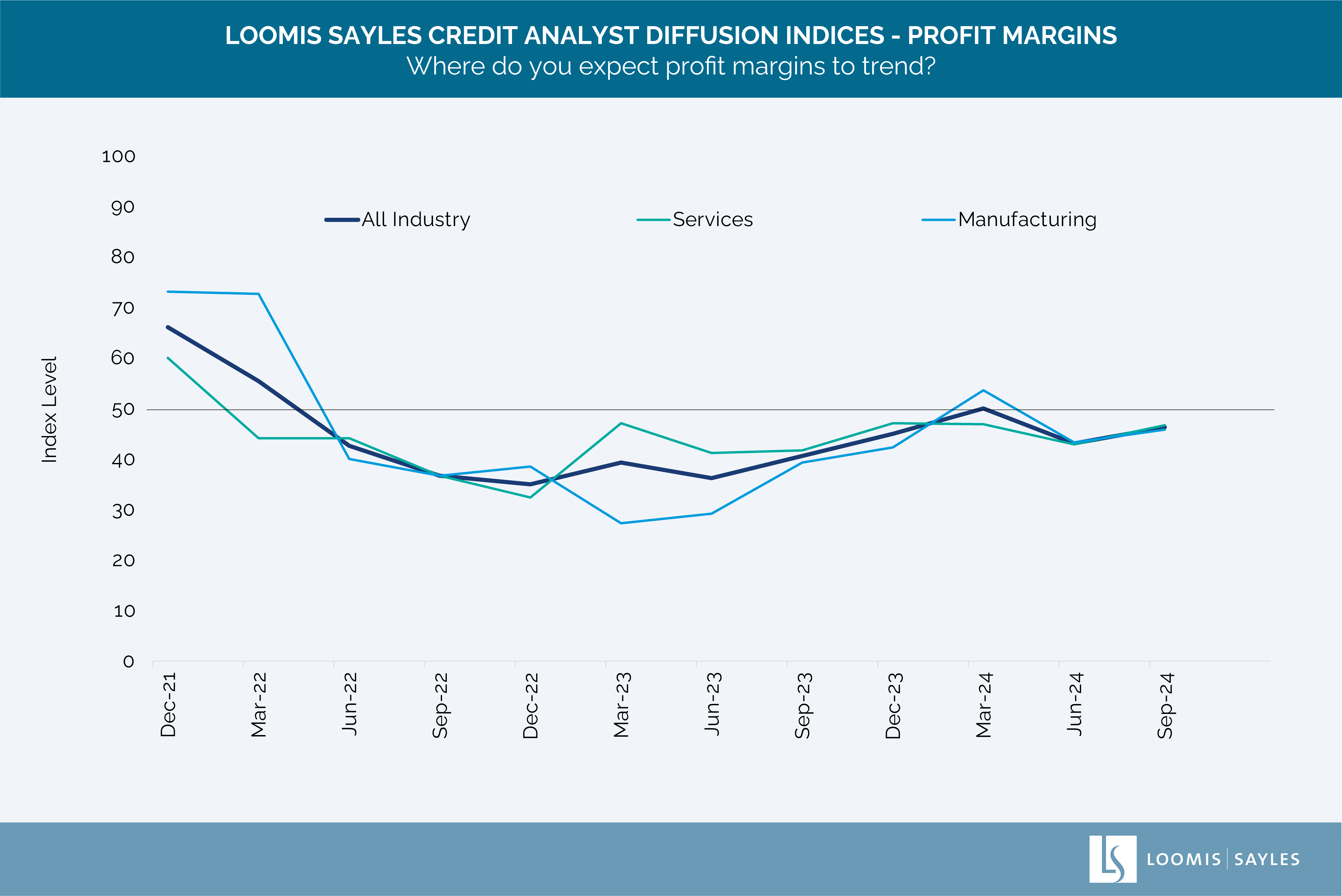

Broadening sector growth lifts outlook for profit margins

Expectations for profit margins remained somewhat pessimistic, but this quarter’s survey results show a positive bounce compared to last quarter. While our analyst group does not expect significant margin expansion, this rebound is an encouraging sign. The outlook for profit margins has improved in key sectors like technology, banking, energy exploration and production, and integrated oils. In our view, this development supports the idea that earnings growth is broadening across a wider range of industries.

Chart source: Loomis Sayles Credit Analyst Diffusion Indices, as of 18 September 2024. For the profit margins component, readings above 50 indicate a rising trend. The chart presented above is shown for illustrative purposes only. Some or all of the information on this chart may be dated, and, therefore, should not be the basis to purchase or sell any securities. The information is not intended to represent any actual portfolio. Information obtained from outside sources is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or redistributed without authorization.

Our group, however, is less optimistic than consensus estimates, which currently forecast a 12.5% year-over-year growth rate for S&P 500 EPS in 2025.[i] While consensus historically reflects lofty expectations, we anticipate earnings growth closer to 10% in our best-case scenario. That said, if earnings growth lands within a more modest 7-10% range, we believe it would still be favorable for the market, benefiting both corporate bondholders and overall corporate health.

Bank recovery signals a brighter credit outlook

One of the more encouraging signs we see in this quarter’s survey is the improvement in industry outlooks across services and manufacturing. While the trend has been somewhat bumpy over the past few quarters, we are now seeing a clear upward trajectory, aligning with our soft-landing thesis.

A key change worth noting is the improvement in the outlook for US banks. Net interest income, which accounts for the bulk of bank earnings, had been shrinking until last quarter but has now begun a shallow recovery. We view this as a significant positive for the banking sector. Additionally, investment banking revenues are on the mend, credit costs are stabilizing, and bond yields could potentially decline, which would reduce banks’ unrealized losses on securities. Furthermore, banks, who tend to be cautious with their public remarks, have lately been delivering reasonably optimistic messages. Given that US financials are critical to the functioning of the broader system, we believe this recovery is an encouraging sign for the broader economy.

Sustaining stability as growth moderates

Although corporate health may not be as robust as it was a year ago, we expect it to remain stable, consistent with the later stages of an economic expansion. We are cautiously optimistic about the broader economic outlook and have confidence that the current cycle has more room to run, especially if the Fed can continue reducing rates toward a neutral stance without causing disruption to the labor market. We believe as long as these conditions hold, corporate health and broader economic stability should remain intact, even as growth moderates.

[i] Source: Bloomberg, data as of 12 November 2024.

8655219.1.1

Market conditions are extremely fluid and change frequently.

This blog post is provided for informational purposes only and should not be construed as investment advice. Any opinions or forecasts contained herein reflect the

subjective judgments and assumptions of the authors only and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. Information, including

that obtained from outside sources, is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or

redistributed without authorization. This information is subject to change at any time without notice.