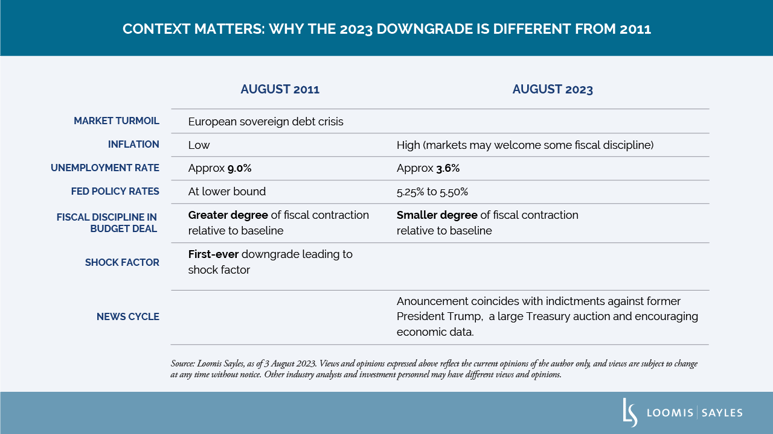

On 1 August, Fitch Ratings announced it was cutting the long-term rating of US Treasurys one notch from AAA to AA+, but switching its outlook from negative to stable.[i] To many, the move recalled memories of when the S&P downgraded US Treasurys in August 2011. The market response to the downgrade in 2011 was dramatic, with a large stock market selloff and, paradoxically, a rally in long Treasurys. So far, markets seem to have had a fairly minor reaction to the Fitch downgrade. Perhaps markets had seen the writing on the wall. I think few would dispute the reasons Fitch cited for the downgrade. Here, I share my take on Fitch’s reasoning and highlight key differences between this event and the S&P downgrade of 2011.

Key Drivers of the Downgrade

- Fitch expects high and rising budget deficits (as a percentage of GDP) over the near-term.

My take: Congressional Budget Office (CBO) projected federal budget deficits seem grim. For all the fretting about deficits in the 1980s and the early 1990s, projected deficits have gotten chronically worse. I think the CBO’s projections may be too optimistic because it assumes that all tax cuts will expire as currently scheduled by law, but that may not happen.

- Fitch projects a steady rise in the ratio of public debt to GDP.

My take: CBO released a thirty-year projection ("extended baseline") of the debt-GDP ratio on 28 June. The federal public debt was 98% of GDP in fiscal year (FY) 2022. CBO expects the ratio to rise to 115% in FY 2032, which would be a record high in just a decade. CBO projects it will continue to rise to 181% in FY 2053. I expect it to keep rising, except if the rise were to trigger a financial crisis before the ratio got that high. Fitch noted that the current debt-GDP ratio in the US is more than 2.5x times higher than the median of both AAA and AA rated countries. In fact, the US currently has one of the highest debt-GDP ratios of any sovereign government regardless of credit rating.

- Fitch sees the medium-term fiscal challenges as being unaddressed by the political leadership.

My take: The challenges include: the exhaustion of the Social Security Trust Fund (by 2033) and Medicare's Hospital Insurance Trust Fund (by 2035); the prospect of renewal of some of the tax cuts that have expired or are scheduled to expire in 2025; increases in entitlement spending; the potential impact on the deficit if a recession occurs; and rapidly rising interest costs for the federal government. The chart below from CBO released on May 12 shows how federal net interest outlays, as a ratio to GDP, are rising rapidly and are currently expected to exceed their prior peak by the end of the decade.

- In Fitch's view, there has been a steady deterioration in standards of governance over the last 20 years, including on fiscal and debt matters.

My take: The repeated debt-limit political standoffs and last-minute resolutions have contributed to the maladies described above and have eroded confidence in fiscal management. I agree with ratings agencies that brinkmanship on default is not the way a top-rated government behaves. But I think a more serious issue is political dysfunction and a lack of cooperation to address fiscal issues and reduce the federal fiscal imbalance. The government lacks a medium-term fiscal framework, unlike most peers, and has a complex budgeting process. These factors, along with several economic shocks, tax cuts and new spending initiatives, have contributed to successive debt increases over the last decade. Additionally, there has been only limited progress in tackling medium-term challenges related to rising social security and Medicare costs due to an aging population.

Downgrading the prospects of a smooth budget process

The federal government’s fiscal year 2024 starts on 1 October, and it needs a budget or a continuing resolution to operate. Both parties remain divided in both chambers of Congress, and the vote margins are likely to be very small. In my view, the Fitch downgrade raises the risk of a federal shutdown in October.

The hardliners among House Republicans generally want more fiscal austerity, and the downgrade is likely to deepen their conviction. I believe no Democrats are likely to vote for austerity measures, so it could take just about every Republican to pass a budget. The House must pass something for negotiations to start with the Senate. Once the Senate reaches a bipartisan agreement, I expect enough votes in both parties to pass a budget. But the House must pass something first. If Speaker McCarthy is unable to gather enough Republican votes to pass a budget or a continuing resolution, the House could get stuck with an impasse, and a shutdown could happen. In other words, we could be in for more political dysfunction. In my view, Speaker McCarthy will need to use all of his diplomatic skills to navigate a closely divided House.

The direct economic impact of a federal shutdown might be small, but in a fragile economy, a shutdown could damage business and consumer sentiment, creating more risk for a potential downturn.

[i] https://www.fitchratings.com/research/sovereigns/fitch-downgrades-united-states-long-term-ratings-to-aa-from-aaa-outlook-stable-01-08-2023?mkt_tok=NzMyLUNLSC03NjcAAAGNUyBtQ0ljFMFq_j7Rsln3pr1K-tBY9X2hdIyhOZ-l3_W3Nhaf4BA-kiBTK57Uo_r-x6iSNQ8TTuml2tq5WO0dof-roffZ-axGCUfog-DvffVO2m5RvQ

MALR031490

Market conditions are extremely fluid and change frequently.

Market conditions are extremely fluid and change frequently.

This blog post is provided for informational purposes only and should not be construed as investment advice. Any opinions or forecasts contained herein reflect the

subjective judgments and assumptions of the authors only and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. Information, including

that obtained from outside sources, is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or

redistributed without authorization. This information is subject to change at any time without notice.