The severity of the current economic downturn has surpassed that of the global financial crisis (GFC). The Atlanta Fed GDPNow indicator is estimating an annualized decline in real GDP growth of approximately -35% in the second quarter.[1] That number is shocking, but the economy appears to be stabilizing and starting to recover. We now believe we are entering the credit repair phase of the credit cycle, where the private sector shifts toward saving and deleveraging.

As we enter credit repair, we are wary of using the GFC as a benchmark for the path to recovery. We see several key reasons that suggest this time will be different:

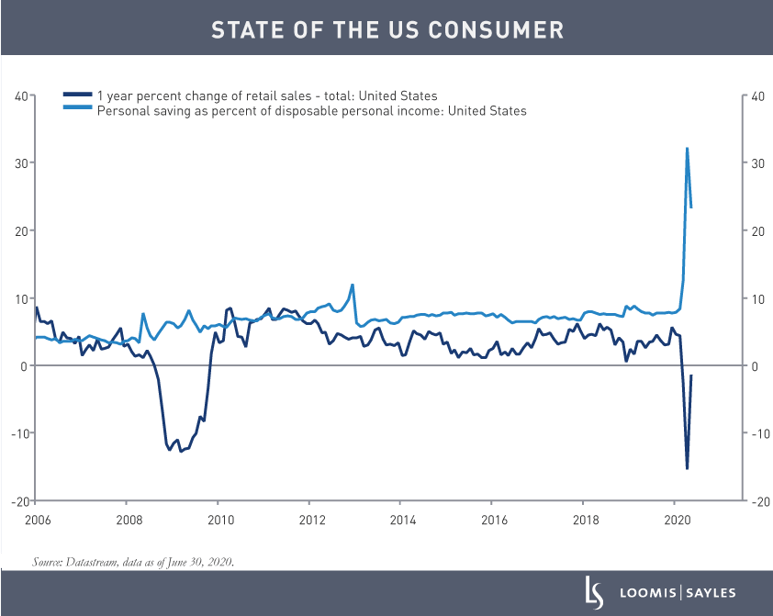

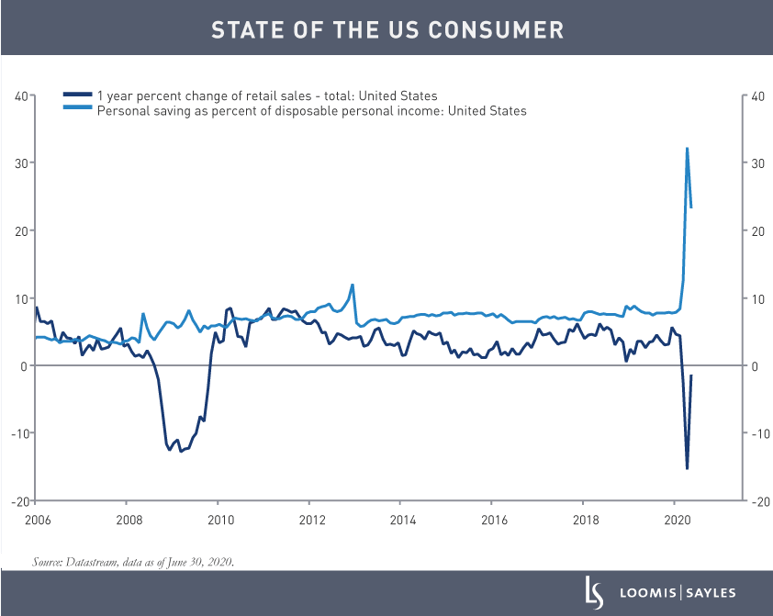

- Fiscal policy. Fiscal response to try to fill the gap in profitability and incomes has been massive and more coordinated than it was in the GFC. The response came very quickly, was very aggressive, and appears to be working. By the end of 2020, we expect a budget deficit around 17% of US GDP, compared to 10% in 2009 during the GFC. With unemployment insurance offering an additional $600 per claimant per week, many people are making more income on unemployment insurance than they did from their wages prior to the COVID-19 crisis. Household savings have surged from the government transfers. We expect households to spend these savings and drive retail sales out of the deep hole we just hit.

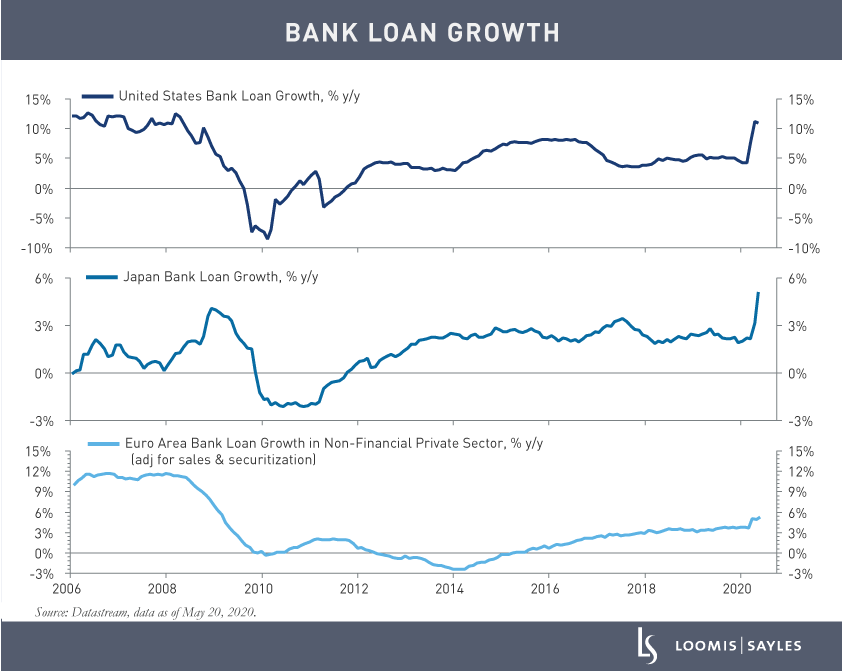

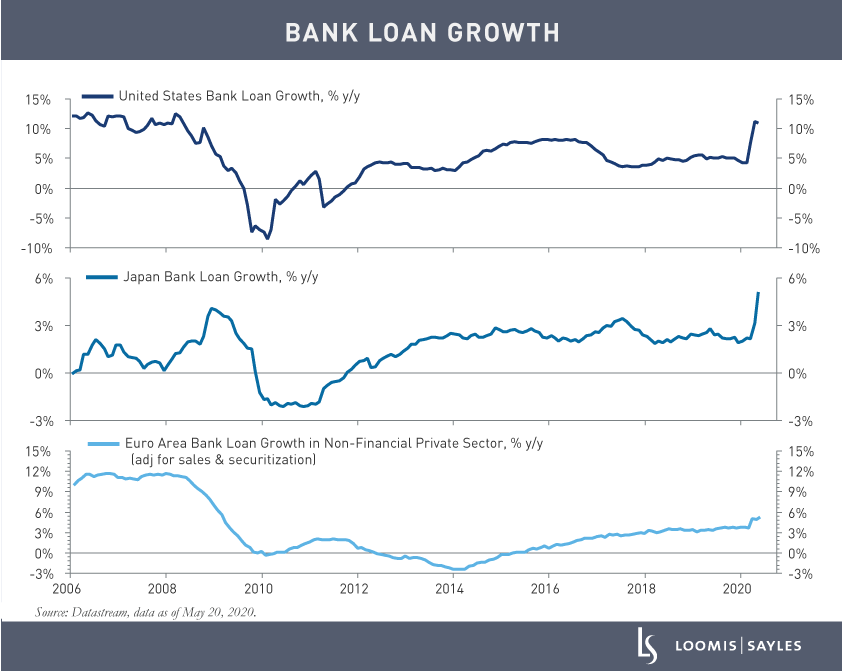

- Liquidity vs. solvency. We believe we are recovering from a liquidity crisis, rather than the massive solvency crisis that ignited the GFC. The GFC centered on housing and huge leverage in the shadow banking system. This time, the household sector balance sheet is in much better shape and the global banking sector appears less leveraged and in a better position to handle the current crisis. US debt as a share of household income is now less than 100% compared to a peak of 135% in 2007. Currently, banks are healthier and extending loans. Credit growth is surging because fiscal policy efforts globally have included loan guarantees, providing liquidity to the corporate sector. In the GFC, credit growth contracted, which contributed to the solvency crisis in 2008 and beyond.

- Market psychology. The current crisis was precipitated by a natural disaster rather than wrongdoing or excessive risk taking. There is no moralizing about coming to the rescue of the private sector, unlike the GFC when people railed against the fraud at the banks. Government entities have sent a clear message that they’ll do whatever it takes. Markets are generally forward-looking and have been well supported with fiscal and monetary policy, in our view.

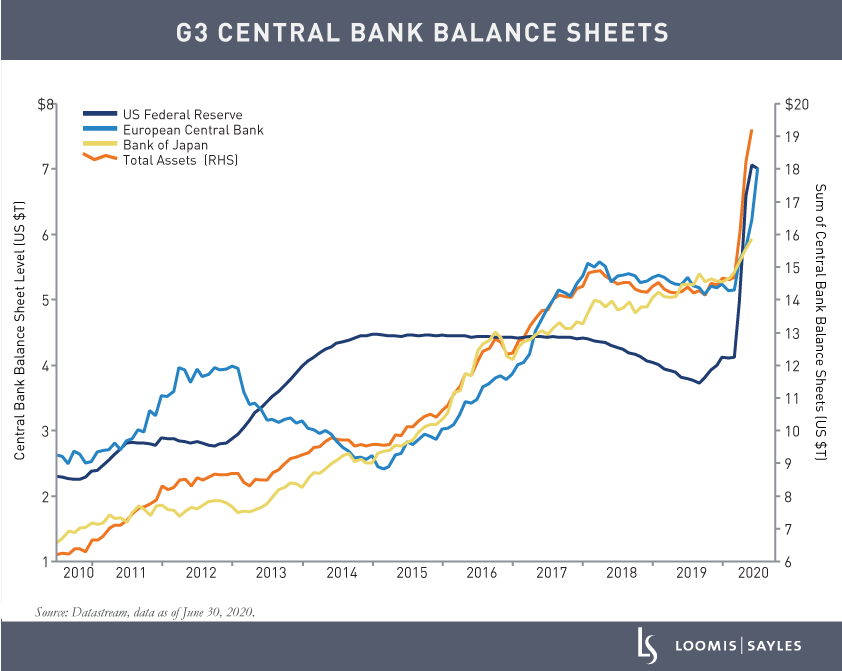

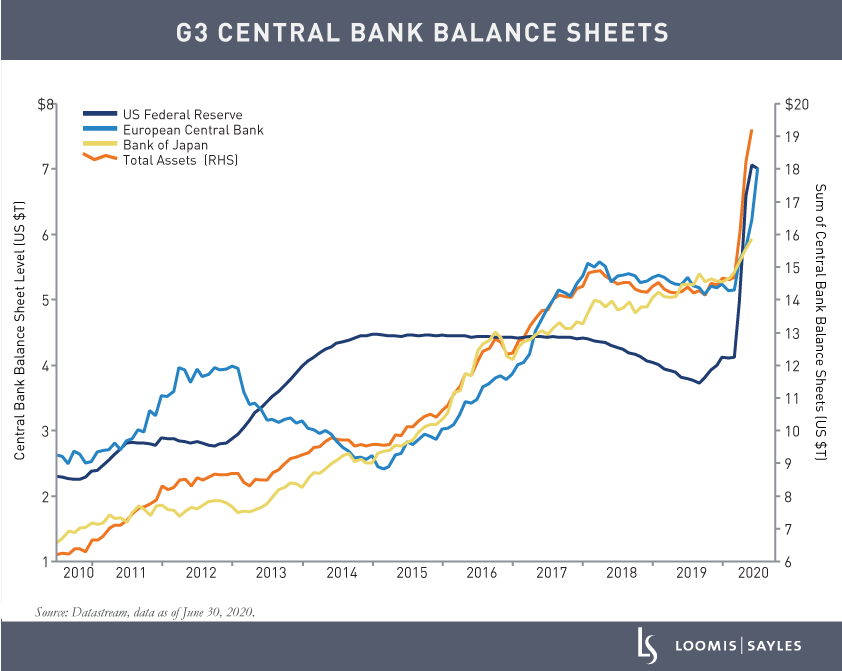

- Monetary policy. Unconventional monetary policy is now mainstream. The Federal Reserve and many other global central banks are pursuing aggressive quantitative easing (QE) policies and extending purchases to many private assets such as corporate bonds. We have seen asset markets react quickly and positively, discounting an eventual recovery in profits and incomes. In the era of the GFC, QE was very unconventional and many people were worried about central bank monetization and inflation. Inflation never materially accelerated after 2008, and we do not expect it to rise much after the COVID-19 crisis.

Corporate balance sheets look stretched, but supported

The GFC occurred because of massive leverage in household and bank balance sheets. Today, we believe these balance sheets are in a much better position to withstand the current crisis. Fiscal and monetary policy have been deployed quickly and effectively compared to the GFC.

This time, the corporate sector is the one with the stretched balance sheets. However, banks are extending loans and companies are issuing a lot of debt to maintain liquidity, reduce the risk of insolvency and allow companies to transition to the credit repair phase of the cycle.

For more on our views on the credit cycle and the path to recovery, visit our new landing page.

[1] https://www.frbatlanta.org/cqer/research/gdpnow, as of July 2, 2020.

MALR025639

The charts presented above are shown for illustrative purposes only. Information obtained from outside sources is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or redistributed without authorization.

Past performance is no guarantee of future results.