Beta, delta, omicron. Each emerging variant of the SARS-COVID-2 virus (the virus that causes COVID-19) sparks some market uncertainty as investors brace for the potential impact. It’s important to pay attention to new variants, but I think investors should plan for a longer-term scenario: a prolonged transition from pandemic to endemic conditions. According to the CDC, endemic viruses maintain a constant presence in the absence of intervention. The common cold is one example. COVID-19 is likely to become endemic, but not until public health agencies can safely lift all interventions. Below, I’ll explain why this process could take a long time and share the potential implications for the global economy.

What would endemic COVID-19 look like?

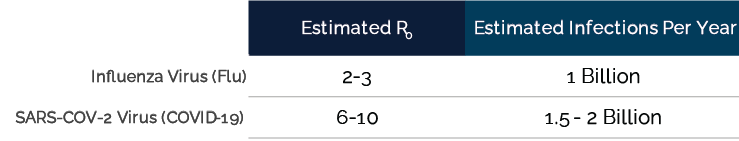

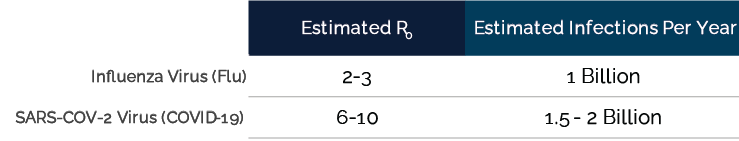

Since COVID-19 burst on the scene, people have compared it to the flu, a common virus endemic to the human population. This table captures how COVID-19 might compare to the flu if all public health interventions were lifted today:

Source: https://www.npr.org/sections/goatsandsoda/2021/08/11/1026190062/covid-delta-variant-transmission-cdc-chickenpox, published 11 August 2021. These estimates were published before the omicron variant emerged. The transmission rate of the omicron variant is not yet known, but is expected to be more transmissible than previous variants.

The estimated infections seem comparable at first glance, but it’s important to remember that the global population has far more immunity to the flu. Right now, the low level of natural and vaccine-elicited immunity to COVID-19 means that a large percentage of the population is still vulnerable to the virus. Consider how difficult it was to manage the 265 million confirmed COVID-19 cases worldwide during the past two years.[i] This number is far below the estimated 1.5-2 billion annual cases that could occur under normal conditions. Most countries do not have the hospitals, equipment or medical staff to handle the number of COVID-19 cases that could occur after a permanent and successful reopening.

The estimated infections seem comparable at first glance, but it’s important to remember that the global population has far more immunity to the flu. Right now, the low level of natural and vaccine-elicited immunity to COVID-19 means that a large percentage of the population is still vulnerable to the virus. Consider how difficult it was to manage the 265 million confirmed COVID-19 cases worldwide during the past two years.[i] This number is far below the estimated 1.5-2 billion annual cases that could occur under normal conditions. Most countries do not have the hospitals, equipment or medical staff to handle the number of COVID-19 cases that could occur after a permanent and successful reopening.

To build public immunity and bring the potential number of cases down to manageable levels, I believe there needs to be a more coordinated effort to increase vaccine access and uptake around the world.

How could the transition impact the economy?

In my view, it will take time to achieve the immunity needed for a successful global reopening. I foresee a long transition to endemic conditions, marked by trends and disruptions like these:

- Lackluster or short-lived spurts of economic growth as variants come and go

- Persistent capacity impairment

- Continued supply chain issues, rolling from sector to sector

- Increasing businesses concentration

- Higher working inventories

- Demographic shifts

- Reduced worker availability

- Continued deglobalization/ more regionalization

- Migration away from urban centers

During this transition, I believe global growth will remain below full potential, with unevenness among countries due to demographics, vaccine uptake, types of vaccines available, mobility and more. Inflation could continue to surprise to the upside. The Federal Reserve, other central banks and investors may have to recalibrate their expectations accordingly.

[i] Source: World Health Organization, https://www.who.int/publications/m/item/weekly-epidemiological-update-on-covid-19---7-december-2021

MALR028295

The estimated infections seem comparable at first glance, but it’s important to remember that the global population has far more immunity to the flu. Right now, the low level of natural and vaccine-elicited immunity to COVID-19 means that a large percentage of the population is still vulnerable to the virus. Consider how difficult it was to manage the 265 million confirmed COVID-19 cases worldwide during the past two years.

The estimated infections seem comparable at first glance, but it’s important to remember that the global population has far more immunity to the flu. Right now, the low level of natural and vaccine-elicited immunity to COVID-19 means that a large percentage of the population is still vulnerable to the virus. Consider how difficult it was to manage the 265 million confirmed COVID-19 cases worldwide during the past two years.