Editor’s Note: Every year, Loomis Sayles features outlooks from our sector teams — teams composed of traders, analysts, strategists and portfolio managers immersed in their respective sectors of the fixed income market. We asked each sector team three questions that drill into key themes in their sectors. We will publish views from each sector team over the next few weeks.

To set the stage, we’re starting with Craig Burelle, Senior Macro Strategies Analyst, and his views on the macro backdrop in 2022.

1. Let’s start with a topic dominating the conversation these days—inflation. What’s your view on the path of inflation this year? How do you expect the Federal Reserve to respond?

In our view, much of the inflation debate hinges on whether inflation will ease once supply chain disruptions subside. Very little about 2021 was “normal,” and we believe supply chain disruptions have distorted recent inflation data. With COVID-19 cases surging globally and demand remaining strong, we think supply chain disruptions are likely to linger until the second half of 2022. If these distortions clear up, we expect core PCE inflation to settle into a range between 2.0% and 2.5%.

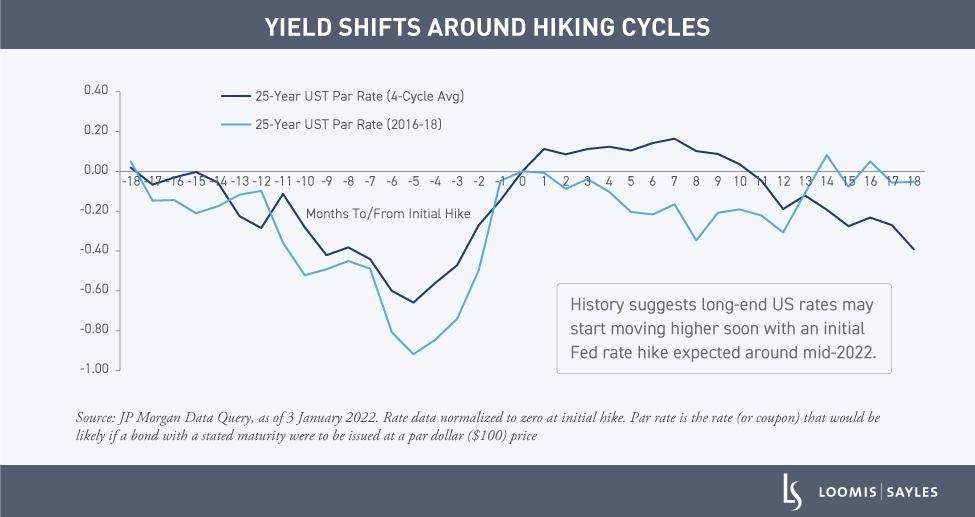

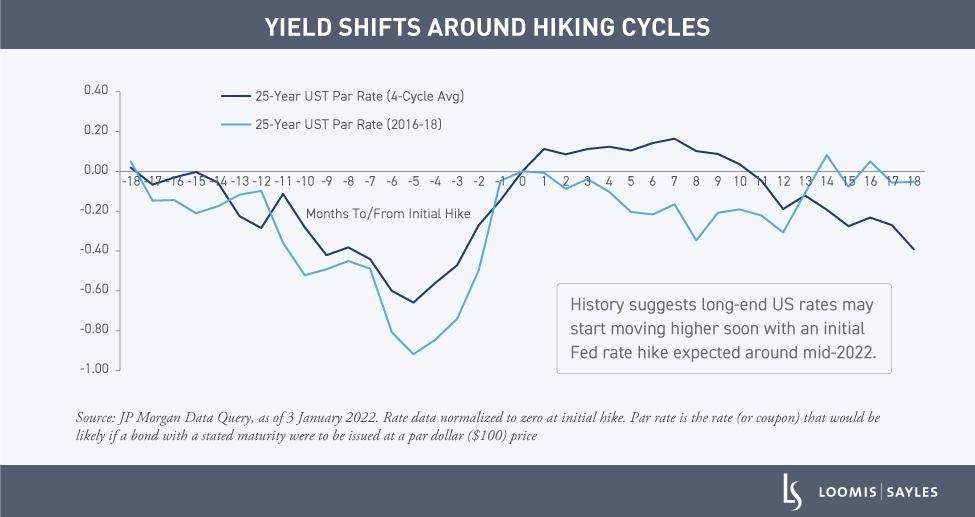

The December FOMC (Federal Open Market Committee) meeting revealed a hawkish pivot in its policy approach. The Fed appeared more concerned that high inflation is no longer transitory and signaled a more aggressive path for policy rates. As a result, we expect the Fed to respond to higher inflation with four rate hikes in 2022, starting near the end of the first quarter.

Going forward, we’ll be watching how inflation trends relative to the Fed’s 2022 core PCE inflation outlook, which is currently at 2.7%. We view this as a critical threshold that could determine how aggressively the Fed hikes rates. If inflation does not start trending down toward 2.7% by the second half of 2022, then we believe the Fed could become significantly more hawkish in 2023.

2. Could a Fed tightening cycle put the global expansion at risk?

We don’t think so. Historically, risk assets have continued to generate positive average total returns as the Fed tightens policy. It’s generally the end of policy tightening when returns start to get shaky.

We see several macro drivers that should help fuel the global expansion for months to come:

- Risk appetite remains healthy.

- Wage growth will likely draw participants back into the workforce, improving labor market health.

- Corporate health appears strong, and we believe it will remain meaningfully stronger than it was during the last hiking cycle. Consumer savings and demand are high, which should support corporate profits and keep leverage down.

- We expect most global central banks to remove accommodation slowly, which should help financial conditions from getting too restrictive.

That said, investors may want to fasten their seatbelts. Asset valuations are generally rich and we anticipate market swings as the market reprices Fed expectations.

3. Which asset classes are positioned to perform well in this environment?

We think bond investors can seek to harvest carry in this environment. In our view, risk assets can still offer opportunity, particularly among US equities, high yield credit and levered loans. However, we believe security selection will be critical for distinguishing quality securities that could help drive potential alpha.

[1] PCE: Personal Consumption Expenditures Price Index, a measure of inflation.

MALR028334

Past performance is no guarantee of future results.

Indices are unmanaged and do not incur fees. It is not possible to invest directly in an index.

Information, including that obtained from outside sources, is believed to be correct, but Loomis Sayles cannot guarantee its accuracy.

Market conditions are extremely fluid and change frequently.