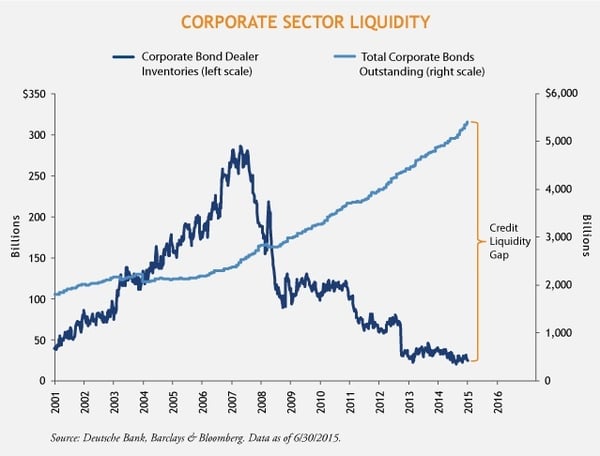

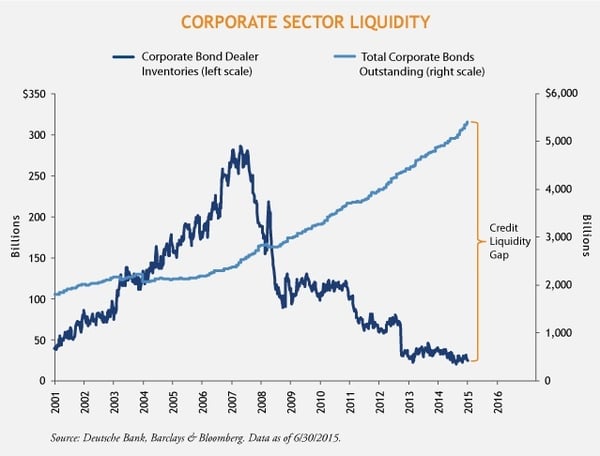

Sharply lower dealer inventories and rising levels of outstanding corporate debt have created a significant liquidity gap in credit markets, as illustrated in the chart below.

Regulatory changes enacted in the wake of the global financial crisis sparked several structural changes:

- Banks have reduced risks associated with their proprietary trading desks. Historically, proprietary trading desks worked two ways: agency trading, when a bank matched buyers and sellers, and principal trading, when the bank itself took the other side of the trade (a source of secondary market liquidity pre-crisis). Due to the Volcker rule, passed as part of the Dodd-Frank financial reform act, and Basel III reforms from the Bank for International Settlements, principal trading is more onerous and less profitable, so banks primarily engage in agency trading. As a result, banks are less willing to bridge temporary supply and demand imbalances, giving rise to larger price and liquidity swings.

- The bond market has grown since the crisis, and its buyer base has evolved. Corporate bond issuance has doubled since December 2007, fueled by low interest rates, central bank quantitative easing and high demand. Additionally, large institutional buyers, such as insurance companies, sovereign wealth funds and liability-driven investors, purchase new issues and hold them until maturity, functionally draining market liquidity.

- Since secondary supply is scarce, yield-starved investors have flocked to the primary market, often oversubscribing new issues. With bond investors tending to crowd the same sectors and issues, markets trend up strongly with decent liquidity yet are prone to rapid, sharp corrections.

In our view, these structural changes magnify price moves and prolong the return to normal market conditions.

MALR013669

Market conditions are extremely fluid and change frequently.

This blog post is provided for informational purposes only and should not be construed as investment advice. Any opinions or forecasts contained herein reflect the

subjective judgments and assumptions of the authors only and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. Information, including

that obtained from outside sources, is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or

redistributed without authorization. This information is subject to change at any time without notice.