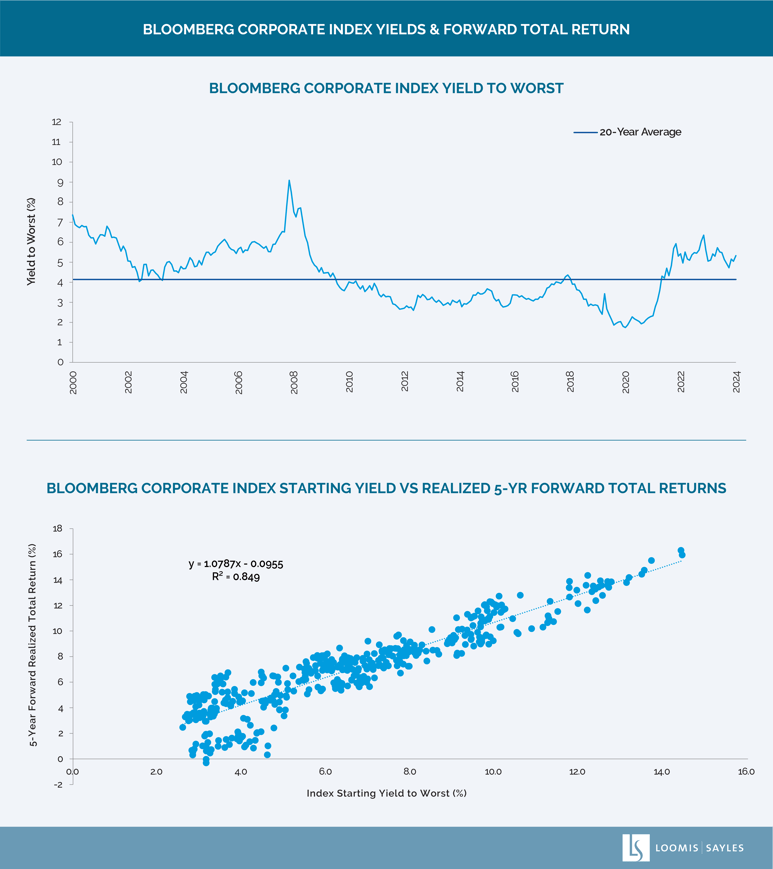

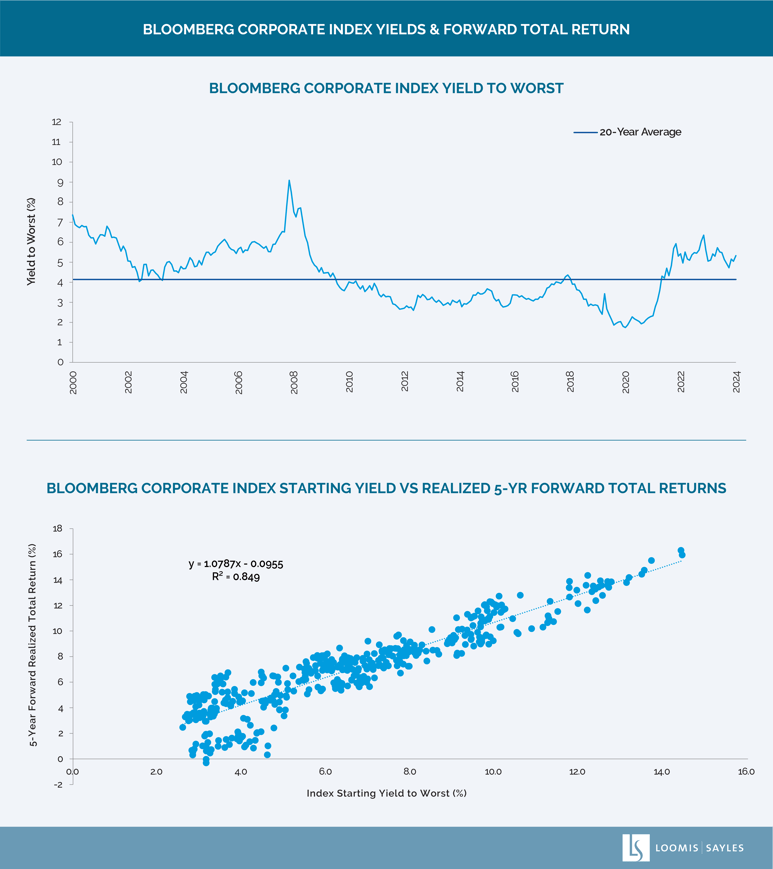

1. US credit markets faced a peculiar juxtaposition during 2024: tight credit spreads coupled with historically high all-in yields. Could this scenario persist in 2025?

There is potential for this scenario to persist. And while tight spreads may warrant some caution, they also reflect a more constructive macroeconomic outlook driven by US economic resilience, a healthy corporate landscape and a Federal Reserve (Fed) easing cycle that is now underway. If recession is avoided and the cycle is extended—our macro team’s base case—the stage is set for credit investors to potentially earn attractive returns despite the perceived valuation challenges.

For benchmark-aware investors, this scenario sets up an interesting dynamic of challenges and opportunities. On one hand, investors are not being compensated as much in spread to take certain risks. But, if you're disciplined in your research and investment approaches, then more compression and less dispersion across sectors, maturities and credit qualities could make it easier when seeking to avoid issuers with relatively weaker underlying credit fundamental profiles. We think the resilience of corporate health—a defining theme in 2024—could support this prospect.

After a challenging 2023, corporate earnings rebounded in 2024, helping to bolster credit fundamentals. Companies demonstrated ongoing balance sheet discipline and prudent management strategies, which resulted in credit upgrades outpacing downgrades by a more pronounced margin—an unexpected positive following a broad normalization trend post-COVID.

Chart data source: Bloomberg, as of 31 December 2024.

Used with permission from Bloomberg. The chart presented above is shown for illustrative purposes only. Any opinions or forecasts contained herein reflect the current subjective judgments and assumptions of the author only, and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. This information is subject to change at any time without notice.

Indices are unmanaged and do not incur fees. It is not possible to invest directly in an index.

Past performance is no guarantee of future results.

2. Do you believe the Federal Reserve’s cutting cycle will end up eroding demand for credit?

Similar to 2024, we think elevated all-in yield levels should continue to drive demand dynamics for credit markets early in 2025. One reason we believe yields could remain elevated is the recent moderation in expectations surrounding future cuts. If you couple that with where credit spreads are currently, or even at the lower end of their recent ranges, we believe it suggests corporate yields around 5% could be possible going forward. As we've seen in the market during the past couple of years, this elevated yield has been relatively attractive to a broad part of the corporate bond investor base. We believe this demand dynamic, coupled with the uptick in optimism seen recently around US growth resilience and its trajectory, could present an attractive backdrop and support credit markets.

3. You seem fairly constructive on credit markets as we enter 2025. What risks could undermine your outlook?

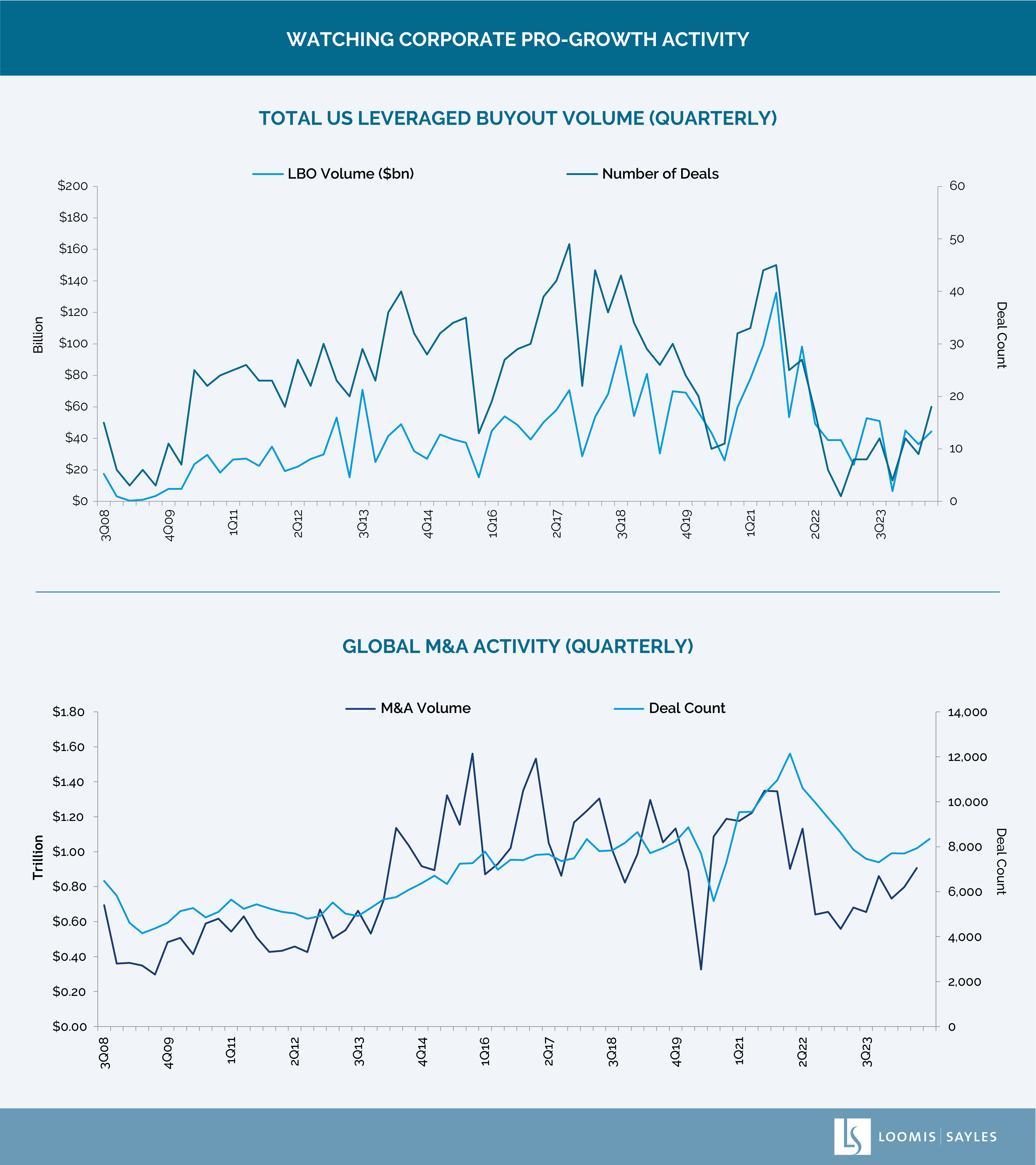

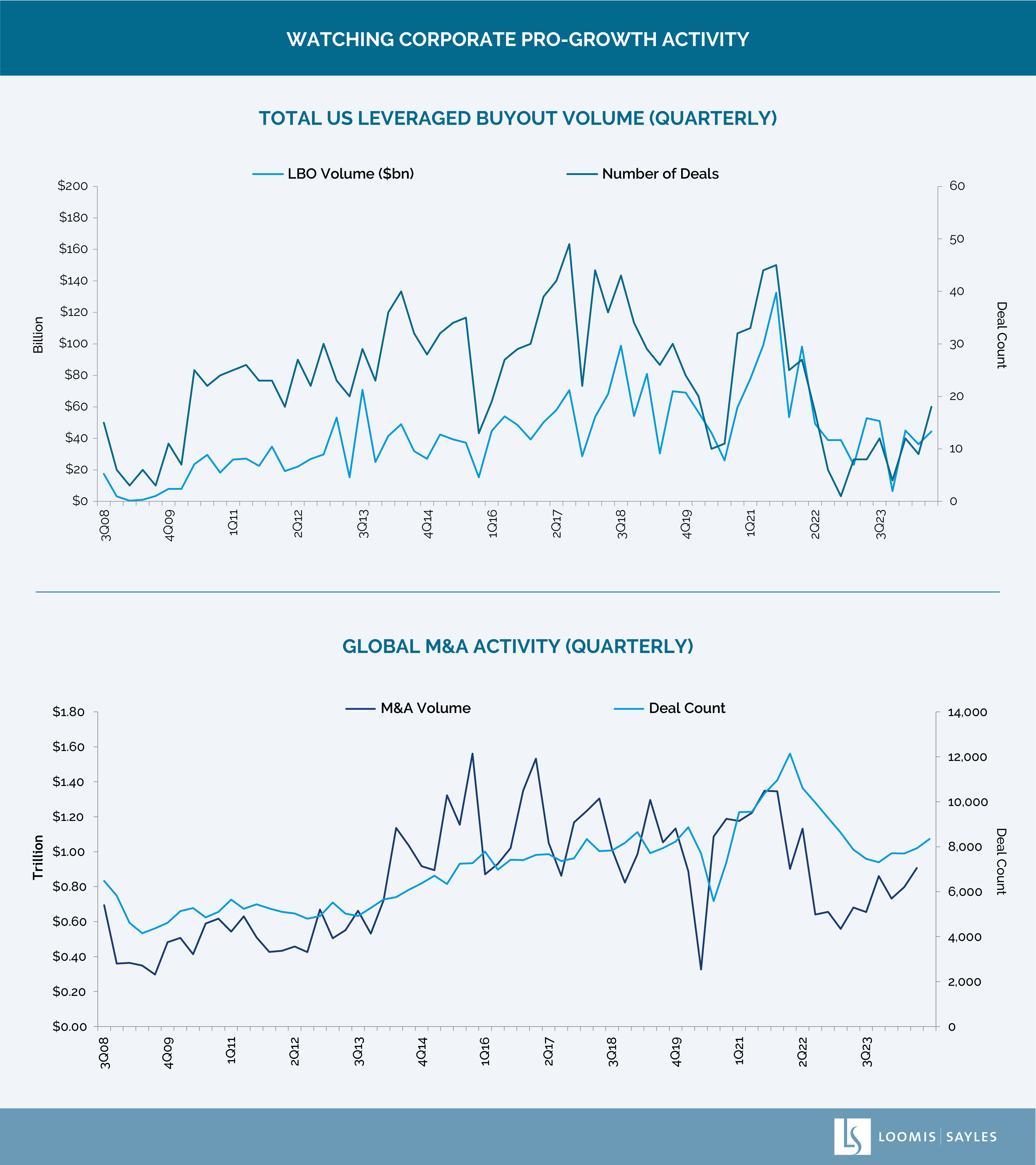

One potential risk on our radar is an upswing in merger and acquisition (M&A) announcements and the impact of related issuance on corporate debt growth and leverage. So far, the volume of M&A activity hasn't materially weakened credit health in the overall market. That said, we are watchful of the potential for continued optimism around US growth, coupled with the prospect for a more muted regulatory regime out of Washington. We think both could prompt issuers to pursue pro-growth activity, including re-leveraging M&A. If that were to happen, and there were less focus on balance sheet restraint and more on debt growth, we believe it could create an environment that erodes underlying corporate fundamentals.

Chart sources: LBO data sourced from S&P Capital IQ as of 30 September 2024; M&A data sourced from Bloomberg as of 30 September 2024.

Used with permission from Bloomberg. The chart presented above is shown for illustrative purposes only. Any opinions or forecasts contained herein reflect the current subjective judgments and assumptions of the author only, and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. This information is subject to change at any time without notice.

Past performance is no guarantee of future results.

WRITTEN BY:

Devon McKenna, CFA, Portfolio Manager & Strategist

SAIFaqcf1m5w