Aspects of consumer asset-backed securities (ABS) seem to be a lightning rod for negative press. Media scrutiny is not unwarranted—consumer ABS played a role in the global financial crisis and some may feel uneasy about the sector after a pandemic-induced recession. Just a few weeks ago, the Wall Street Journal reported on an uptick in subprime auto borrowers more than 60 days past due on their loan payments.[i] However, I believe the TransUnion data cited in the article paints a misleading picture. Here’s why:

- The data doesn’t account for seasonal and pandemic-related trends. Delinquencies typically tick up in January and February due to holiday spending. What’s more, loans to subprime borrowers have declined since the pandemic began, shrinking the pool of active subprime borrowers. Both of these factors would push the delinquency rate higher.

- Subprime borrowers typically have credit scores ranging from 580 to 669. TransUnion’s definition of subprime goes further and includes deep subprime borrowers with scores that skew the data to the downside.

- Credit scores can change. The TransUnion data measures the number of delinquent borrowers against the number of active subprime borrowers at that time. Therefore, it wouldn’t capture loans that migrated to a higher credit tier, but would capture underperforming loans that fell from a higher tier, which can distort the data. Standard industry practice is to use vintage analysis to track the performance of the same consumers and loans through the life of each loan.

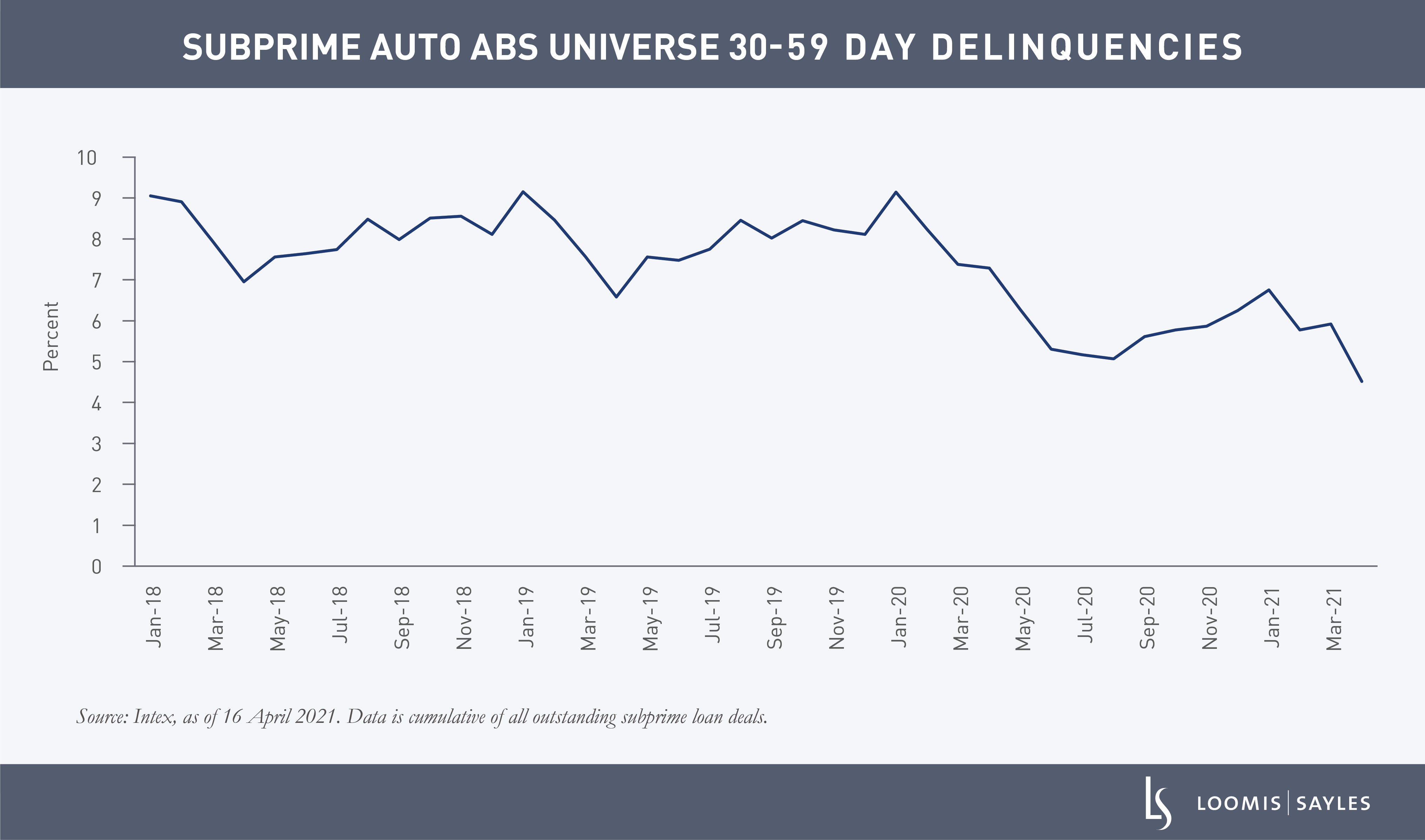

Despite what the TransUnion data suggests, most subprime auto lenders have been reporting declines in delinquency rates when compared to pre-pandemic levels. In March, subprime auto ABS delinquencies and losses fell further and prepayments jumped higher, likely benefiting from delayed tax refunds and government stimulus payments. Looking at consumer-related debt more broadly, most sectors have been holding up well. Total consumer debt outstanding is up a modest 2.7% year over year,[ii] and performance has improved in auto loans, credit cards, consumer loans, and student loans.

Careful lending, careful spending

It appears that both borrowers and lenders have been careful during the pandemic. Outstanding balances in bank and private-label credit cards are down 14.6% and 13.4% year over year, respectively, indicating that borrowers avoided leveraging up.[iii] Meanwhile, issuers have tightened up on lending and tilted their lending toward higher-quality borrowers. For example, lending to subprime auto loan borrowers is down 16% year over year.[iv] Underlying these trends is a K-shaped recovery among consumers. Lower-wage consumers were hit hardest by the recession and have experienced slower job recoveries compared to higher-wage earners. While savings levels have been strong, 40% are currently held by the highest income quintile.[v]

What to watch

Things seem to be looking up for consumers. The US has made rapid progress with COVID-19 vaccinations, which should help the economy return to full capacity in a matter of months. However, there may be side effects once forbearance and moratoriums end. Here’s what I will be watching:

- Low-wage earners. Government stimulus payments helped support low-wage earners through the worst of the pandemic, but they may need more once rent and mortgage moratoriums are lifted later this year. Many renters and homeowners may not have the income or savings to pay off back payments when they come due.

- Federal student loan debt. Did you know that the amount of student loans in forbearance currently exceeds the total outstanding debt in private label credit card and consumer loans combined? This is an area to watch, especially as the federal government debates the issue of student loan forgiveness. From an ABS perspective, the forbearance of federal debt has been positive for borrowers who also have private student loans (most use the private market to finance the balance of payments not covered with federal loans). In general, the private student loan market has seen lower delinquencies, steady prepayments and forbearance levels return to historical norms. When federal forbearance programs end, the private student loan market may see an uptick in delinquencies and a slowdown in prepayments.

- Credit scores. Credit scores have improved overall, which suggests consumers are doing better. But some scores may have been artificially elevated because of how credit accommodations are applied. For example, in cases of forbearance, when an account has a balance but no scheduled payment due, it can make the payment history appear better than it would under ordinary circumstances. This highlights the importance of looking at an issuer’s process for underwriting loans and knowing what data sources they’re using to score loans.

[i] Risky Borrowers Are Falling Behind on Car Payments, Wall Street Journal, 5 April 2021.

[ii] Source: Equifax, 31 March 2021.

[iii] Source: Equifax, 31 March 2021.

[iv] Source: Equifax, 31 March 2021.

[v] Goldman Sachs, Pent-Up Savings and Post-Pandemic Spending (Briggs/Mericle), 15 February 2021.

MALR027203

Market conditions are extremely fluid and change frequently.

This blog post is provided for informational purposes only and should not be construed as investment advice. Any opinions or forecasts contained herein reflect the

subjective judgments and assumptions of the authors only and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. Information, including

that obtained from outside sources, is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or

redistributed without authorization. This information is subject to change at any time without notice.