1. In a March blog post, you referred to loans as “stupid cheap." How do fundamentals and valuations look now?

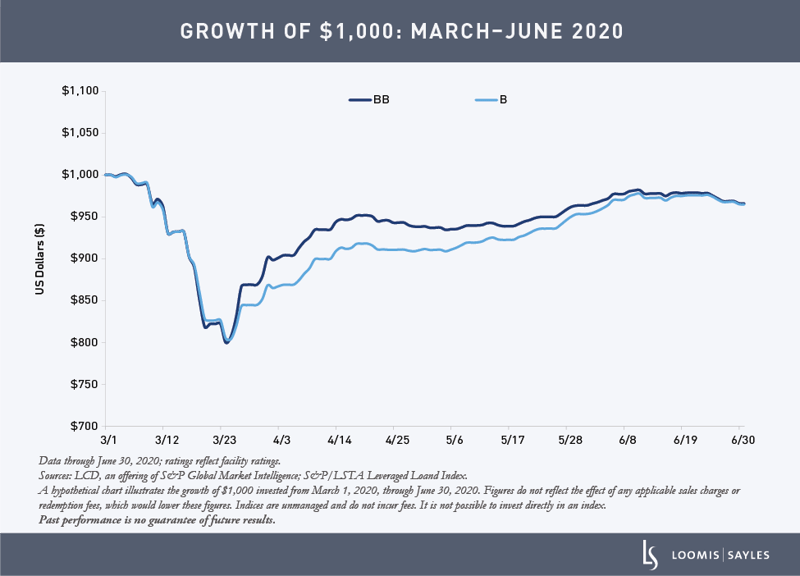

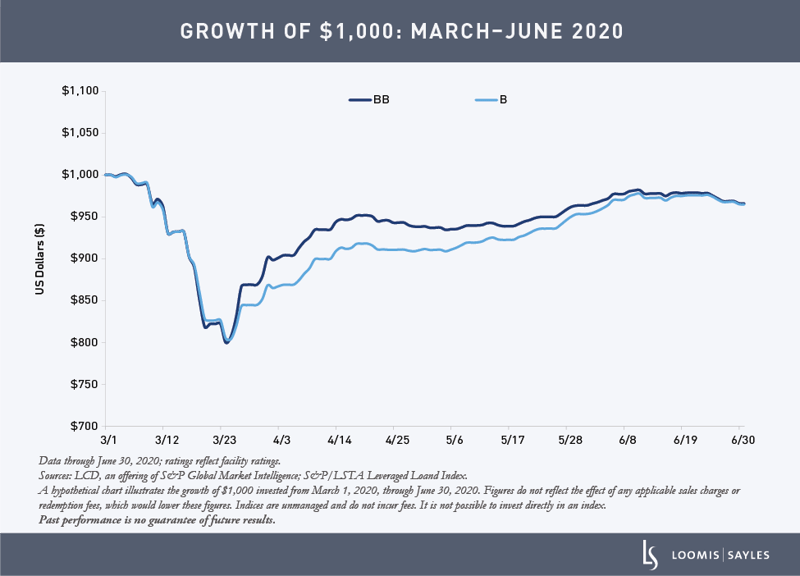

At the time, we asserted that “when people get scared, they often tend to focus less on rational investment prospects and more on feeling better at that moment.” We believe that sentiment drove loans to “stupid cheap” levels in March. Since then, we’ve seen the majority of the loan market bounce back to higher valuations based on fundamentals, not emotion, and the gap between BB and B-rated loans has nearly evaporated. We have thoroughly assessed the ability of each loan in our portfolios to withstand the liquidity squeeze created by the pandemic and have assigned each loan with an expected recovery pattern. We have been pleased with the results of this analysis and feel strongly that most of the loans we own have the liquidity to survive a significant period of pandemic-related challenges. Importantly, we expect a large proportion of our loans to have sharp V-shaped recoveries once the recession subsides, even in a U-shaped economic recovery. We maintain our longer-term view that science will win, the virus will be beaten back, and monetary and fiscal stimulus will ultimately lead to growth.

2. At the height of the crisis, you saw three different roads back to par, with market recovery in 6-12 months the most likely. Has the recent market activity changed your view?

Markets tend to recover 6 months before fundamentals justify that recovery. So when we said 6 to 12 months, we thought the fundamentals might merit enthusiasm 12 to 18 months from March and markets might anticipate that between September of 2020 and March of 2021. The sharp market recovery immediately after our comments was a surprise to us, but it does not change the rationale for our original 6-12 month comment. Loosely, we imagined fundamentals could be more encouraging between March and September of 2021 as anti-viral medications, vaccines, and behavioral changes show efficacy. So, while positive momentum among risk assets continued building in the second quarter, we also expect volatility between here and normalization.

Since the end of March, fiscal and monetary policy measures have created much of the updraft across markets, including the loan market. More recent anticipation of a potential vaccine and reopening activity has bolstered markets further. The news flow from here is likely to be much more mixed, particularly as US and global markets begin to digest data related to the gradual process of reopening. We expect sentiment in the loan market to generally correlate with that of overall risk markets as companies are tested.

Despite persisting volatility and uncertainty, we continue to believe there are several roads back to par for most loans. Important to these scenarios is our belief that, for the vast majority of loans, companies have long-term values that fully cover the outstanding loan debt we hold. With respect to the risk of a default cycle, about 6.4% of the loan market matures before the end of 2022. While this is a modest proportion of the market, it bears watching as it could lead to increased refinancing risk if the pandemic's effects stretch out further than we expect.

3. You indicated in March you had been improving quality in your portfolios since the third quarter of 2018. Have you continued this trend?

While our conservative strategies have always reflected relatively high quality, and therefore did not need much change, we started improving quality in our more aggressive strategies in the second half of 2018 in anticipation of the next recession. Demand for higher-quality bank loans, particularly from institutions, has been robust through past downturns, and having better-rated loans to sell would likely give us ammunition to reinvest in loans with higher return potential moving out of a downturn. We believe that we are now in that recession, and that we will eventually move into an expansionary phase. But due to the lack of forced selling in the bank loan market, buying value can be challenging. Our goal is to discriminate between winners and losers in the post-pandemic world, and to sell our higher-quality loans in our more aggressive strategies if value becomes available as investment sentiment swoons.

MALR25686

Indices are unmanaged and do not incur fees. It is not possible to invest directly in an index.

Past performance is no guarantee of future results.

Information, including that obtained from outside sources, is believed to be correct, but Loomis cannot guarantee its accuracy.