Many companies took advantage of Federal Reserve and European Central Bank policy actions to add a significant amount of liquidity to their balance sheets. This added liquidity should help companies survive in a slow-growth world. As you can imagine, conditions really depend on the industry. The technology, communications, and consumer non-cyclical industries have seen record cash flow due to COVID-19. However, the situation remains extremely challenging for airlines, hotels, casinos, cruise lines and certain retailers. In addition, we are seeing a significant amount of defaults in the energy space at very low recovery rates.

Credit spreads have significantly tightened since April. We see a number of risks on the horizon, but central banks and fiscal responses are swamping the market with liquidity. Based on the number of companies pursuing a vaccine and preliminary results, the market is expecting anti-viral medication or vaccine approval in 2020, with pre-COVID consumer behavior resuming by the third quarter of 2021. On top of the vaccine development uncertainty, we have China/US tensions, a US election where the senate race is arguably more important than the presidential race, and UK/EU negotiations.

Lower-quality credits have significantly lagged the overall market. Near term, we may see a rally in more idiosyncratic lower-quality credits versus high quality and overall market beta. Over the long term, we believe significant volatility will return once central banks and fiscal measures are dialed back. The liquidity injection has likely left a lot of zombies in the credit market. It should be fun operating in these markets as we try to navigate the next 24 months in our view.

At the beginning of 2020, your systematic regime models warned of a period of heightened volatility and uncertainty. What are the models telling you now?

Most of our systematic regime models exited equity and credit markets at the end of February and stayed defensive through mid-April. Since then, despite mediocre growth prospects and continued virus concerns, we believe Fed action and trillions of dollars of fiscal stimulus have helped markets remain calm and unperturbed. Our models have participated in the global rally across all assets, albeit at below-average leverage.

We use a variety of alternative data sources to extract alpha from linear and non-linear relationships. After a brief pause, our layoffs model is currently showing an accelerating trend again ahead of the earnings season. Precious metals and US Treasurys, both flight-to-quality assets, have seen inflows and the VIX[1] remains elevated at roughly 3 times normal levels. Despite the rally, there are signs of caution and our models continue to allocate to risk-mitigation strategies. With the upcoming elections, Trump's acknowledgement on July 21 that the coronavirus will get worse before it gets better, massive valuation gaps and a lack of breadth in the rally, we see plenty of reasons why volatility may stay at heightened levels for the foreseeable future.

Emerging market assets benefited from the tremendous second-quarter rally. Do you think momentum remains in favor of EM assets? Where are you seeing opportunity?

Our EM signals indicate that momentum remains positive due to broadly accommodative monetary policy, which is suppressing cross-asset volatility. However, valuations continue to deteriorate on the heels of a 20% swing from the Q1 trough, bringing year-to-date returns marginally positive.

Looking ahead, China stands out for its already remarkable recovery. The latest EM data point to a rebound in activity through July elsewhere, though Latin America is lagging behind. Alternative daily data trackers confirm a continued recovery from the April trough. But we are seeing a number of EM countries still struggling to contain the spread of COVID-19.

While virus proliferation will likely prevent a return to normal levels of activity, indicating the worst is yet to come for EM fiscal balances, we believe stimulus is dominating the narrative. Markets appear to expect the global economy to continue re-opening in the second half of 2020, supported by monetary and fiscal policy from March 2020 onward.

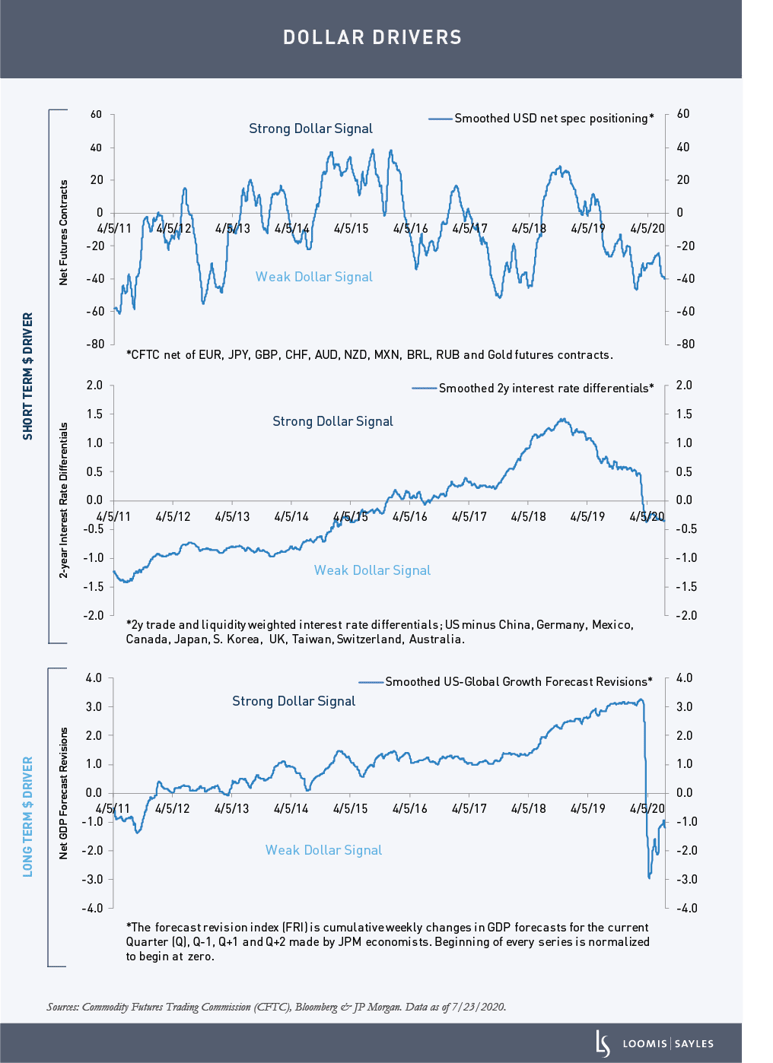

Going forward, we believe EM returns will likely be driven by the dollar. Generally, a weaker dollar is a positive driver for EM performance and the dollar is trending toward a structural bear market. Below, we highlight some key dollar drivers to monitor. Short-term factors (positioning and rate differentials) signal a weaker dollar. A key long-term factor (the US/non-US growth differential) has been choppy. We believe in order for EM to outperform developed markets, we would need to see continued non-US growth outperformance in the next phase of the global recovery.

[1] The Cboe Volatility Index® (VIX® Index) is a measure of market expectations of near-term volatility conveyed by S&P 500® Index stock index option prices.

MALR025782

The chart presented above is shown for illustrative purposes only. Some or all of the information on this chart may be dated, and, therefore, should not be the basis to purchase or sell any securities. The information is not intended to represent any actual portfolio. Information obtained from outside sources is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or redistributed without authorization.

Market conditions are extremely fluid and change frequently.

This blog post is provided for informational purposes only and should not be construed as investment advice. Any opinions or forecasts contained herein reflect the

subjective judgments and assumptions of the authors only and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. Information, including

that obtained from outside sources, is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or

redistributed without authorization. This information is subject to change at any time without notice.