1. What’s your view of EM debt fundamentals? How do you think the sector will weather a Federal Reserve tightening cycle?

In the case of EM sovereign debt, we expect a theme of performance dispersion in 2022. Elevated commodity prices should provide support for a variety of exporters across the Middle East, Africa and Latin America. While aggregate EM debt levels remain elevated relative to history, the 2021 global growth recovery supported declines and we expect debt to stabilize near these lower levels in 2022. We believe debt vulnerabilities do exist in a handful of high yielding sovereigns, however these special situations have been well televised to the market. Importantly, the space could benefit from a strong supportive technical backdrop—some market participants expect declining gross issuance to lead to more than a five-year low in net supply. Limited net new supply, and growth resilience underpinned by export demand, should provide a constructive backdrop for select EM countries.

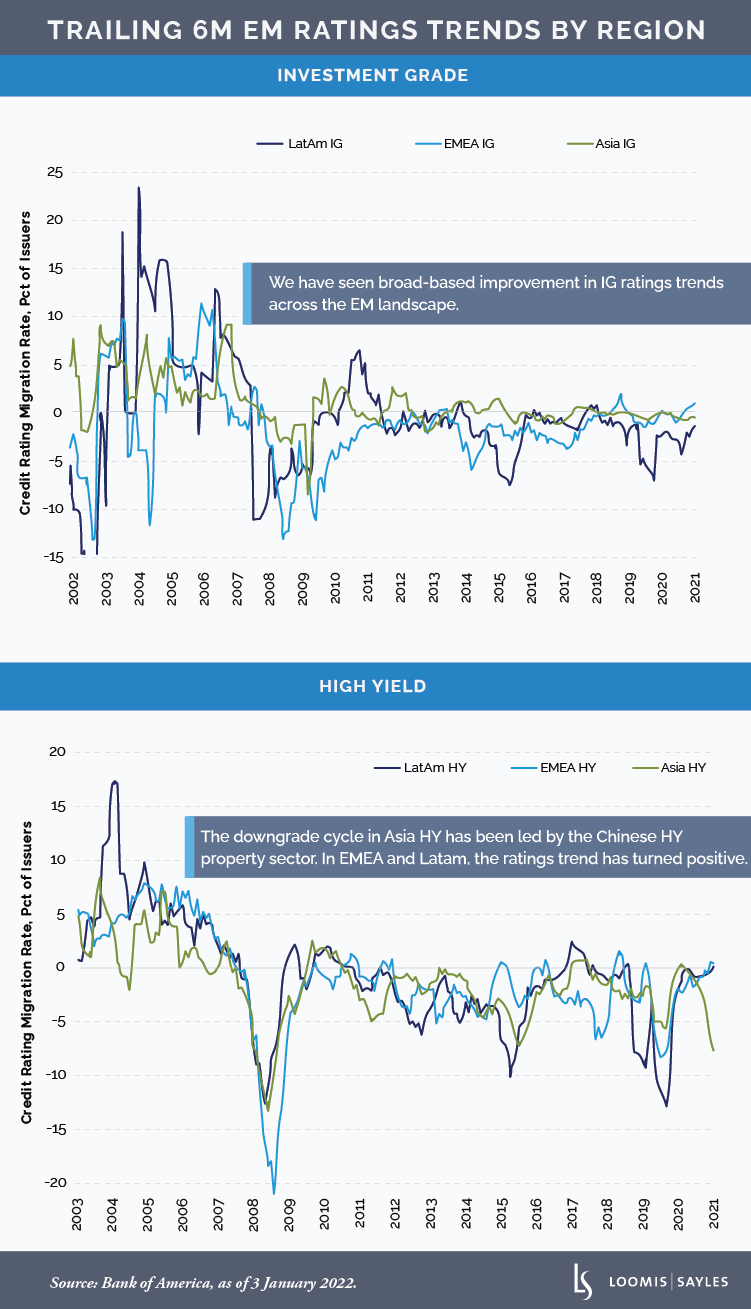

In the case of EM corporate debt, following a rise in leverage after the initial global shutdown in March 2020, corporates rapidly recovered in 2021. Corporate de-leveraging efforts were led by issuers in commodity linked sectors—metals and mining, oil and gas, chemicals, and pulp and paper. The positive de-leveraging trend extended to less volatile segments of the market, including technology, media and telecommunications and consumer. As we have seen in the developed markets, consumption has been recovering across the emerging markets and we expect to see further normalization into 2022. The balance sheet improvement has largely translated into a stabilization in credit rating trends, a positive signal given the wave of downgrades experienced in 2020. From a default perspective, within the EM corporate high yield (HY) space, expectations are for a slightly elevated level of 3.9%.[i] However, it is important to note that this level is mainly driven by the Chinese HY property space, which has been experiencing a structural shift. Outside of China HY, EM corporate HY default rates should remain benign. In our view, EM corporate credits are well positioned ahead of the upcoming Fed hiking cycle. The fundamental prospects remain firm with commodity prices elevated. Improvements in domestic and external demand should help support earnings in 2022.

2. In 2022, how might expectations for slower growth in China impact economies in EM Asia?

We forecast China will likely grow about 5% in 2022. The expected growth deceleration is a byproduct of policy action to reshape the economy. While it will likely cause pockets of pain in selected markets, we believe growth improvements across a variety of emerging Asian economies should drive solid performance within the corporate space. Broadly speaking, we expect growth to be supported by India, Indonesia, Malaysia, the Philippines, Vietnam and Bangladesh. Asia’s growth, excluding China, should be around 6% in 2022. The rebalancing of growth within Asia could create interesting opportunities beyond the China opportunity set. We are looking for corporates that benefit from stronger export demand and improving consumption as the global growth recovery continues. We are also keen on issuers in the technology and telecommunications sectors that stand to benefit from the broader theme of digitalization. We believe investments in renewables and green energy also warrant attention.

3. Which areas of the EM debt market look the most attractive to you? Are there any areas you’re watching?

We see attractive opportunities in the EM corporate HY segment. Into the close of 2021, a variety of factors—geopolitical tensions, political noise, policy shifts—pushed spreads wider across a swath of countries. Selected corporate credits in Turkey, Russia, Ukraine, China, Brazil, Chile and Colombia were repriced. We believe this repricing of risk has led to attractive valuations and we see catalysts for spread compression within discrete opportunities. However, we believe security selection will be key. Looking beyond idiosyncratic country factors, we expect the overarching theme of economic normalization to persist. We also see strong opportunities in the sustainable and social bond space. ESG-labeled EM corporate bond issuance experienced a record-breaking year in 2021, with over $78 billion priced. This issuance represents a three-fold increase versus 2020.[ii] As we engage with issuers, and as corporations work to integrate sustainability KPIs (key performance indicators) related to these bonds, we see attractive opportunities across a variety of sectors within this growing segment of the market.

[i] Source: J.P. Morgan, as of 31 December. 2021.

[ii] Source Bloomberg, as of 31 December 2021.

MALR028382

Investment recommendations may be inconsistent with these opinions. There can be no assurance that developments will transpire as forecasted. Data and analysis does not represent the actual or expected future performance of any investment strategy, account or individual positions. Accuracy of data is not guaranteed but represents our best judgment and can be derived from a variety of sources.

Commodity, interest and derivative trading involves substantial risk of loss.

Past market experience is no guarantee of future results.

Market conditions are extremely fluid and change frequently.

Market conditions are extremely fluid and change frequently.

This blog post is provided for informational purposes only and should not be construed as investment advice. Any opinions or forecasts contained herein reflect the

subjective judgments and assumptions of the authors only and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. Information, including

that obtained from outside sources, is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or

redistributed without authorization. This information is subject to change at any time without notice.