1. Loans are often overlooked when investors are hunting for yield. Why is that, and how do loan yields compare to other categories?

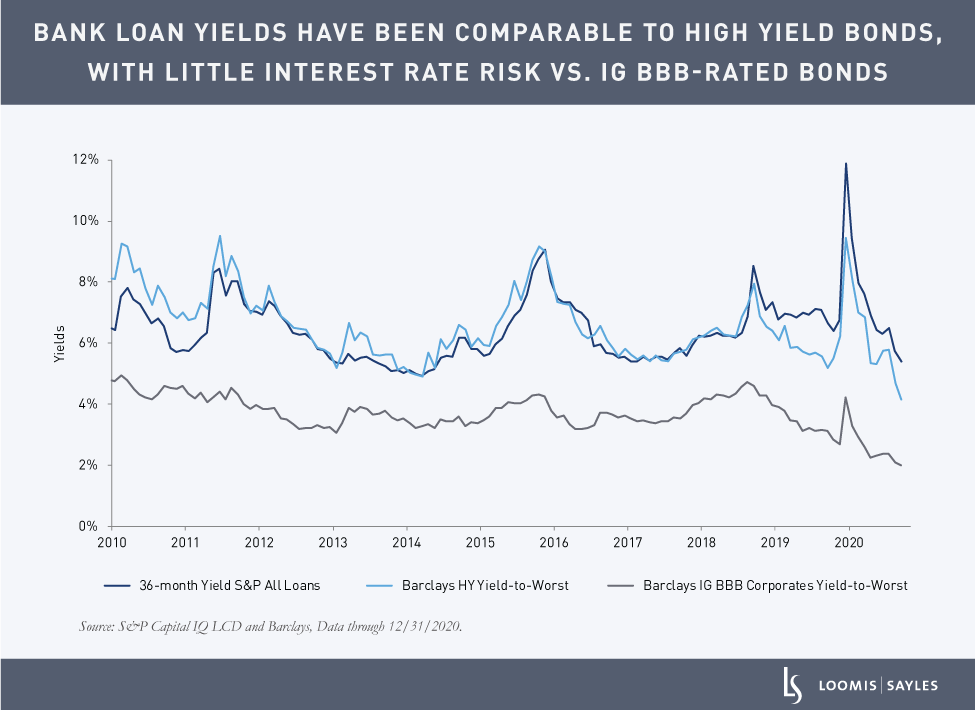

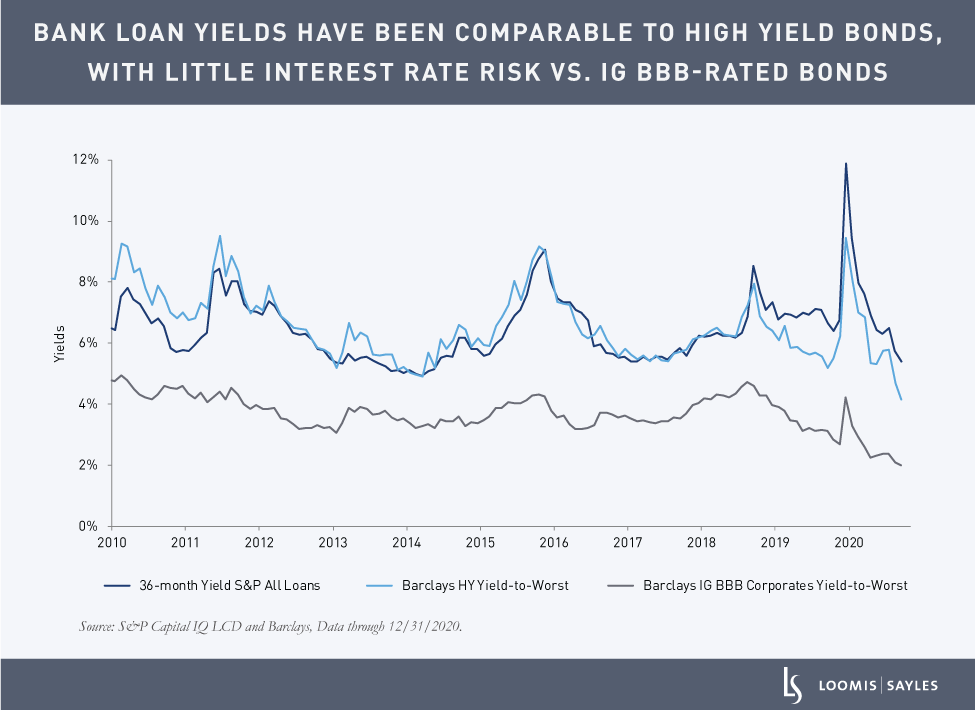

We think investors have been taught to think of loans as a bet on rising rates, while high yield bonds are typically viewed as a yield play and investment grade (IG) corporates are often considered a safer choice with a lower yield. But with rates expected to be low for a while, we think income-focused investors should view loans as one of several yield plays. Loans typically have short average lives, so when they are priced at a discount, their yields can be similar to or greater than the yields on high yield bonds priced over par. And while IG corporates may have little credit risk compared to high yield, when rates are this low, they typically offer limited yield and have relatively high interest rate risk. Loans have a floating coupon, so they currently offer an advantage in both yield potential and rate risk over investment grade bonds. Meanwhile, loans’ seniority and security make them structurally more insulated from credit risk than most high yield bonds. We think loans deserve a place in any investor's hunt for yield.

2. Loans’ default rates have been lower than many expected in 2020. What are you expecting in 2021?

Default rates across credit were generally lower than people feared, but that does not imply the pandemic was not a big economic shock. In our view, default rates were lower because the companies in the syndicated loan market and the high yield market are typically large enough to have levers they can pull—such as high cash balances, revolving lines of credit and cost cuts—to gain the liquidity needed to get through a short, sharp downturn. We think investors may have thought loans were going to small companies. However, most borrowers in the loan market are actually quite large, and large companies mostly did surprisingly well in 2020.

As we look forward to the rest of 2021, we see plenty of cash and credit availability for most of the companies we follow. Balance sheets suggest these companies can survive without a strong recovery, which may explain why prices have bounced back so strongly. Frankly, for the companies we lend money to, we see very few defaults coming this year. We do not see the balance sheets of most of the companies we have not lent to, but we believe it would be reasonable to model average default rates of about 2%-4%. Assuming the pandemic will recede this year, we believe this estimate is a starting point for thinking about index returns.

3. What role could collateralized loan obligations (CLOs) play in the loan market this year?

CLOs have accounted for the majority of loan demand for some time. That is because loans have been steady enough in their repayment potential that levered structures, such as CLOs, can be built around loans and can potentially deliver attractive returns all the way to the bottom of those structures. CLOs do not have to sell when prices decline because they have stable capital, so they have been a stabilizing force on loan prices. CLOs have shown to be robust investment vehicles. CLOs have historically survived under stress during recessions, the global financial crisis and the COVID-19 pandemic. Therefore, we expect CLO demand to remain strong in 2021 as investors continue to hunt for yield, which should support demand for loans rated above CCC.

MALR026597

Any investment that has the possibility for profits also has the possibility of losses.

Past market experience is no guarantee of future results.

Indices are unmanaged and do not incur fees. It is not possible to invest directly in an index.

Market conditions are extremely fluid and change frequently.