1. US investment grade spreads have returned to pre-pandemic levels. What are your expectations for spreads in 2021?

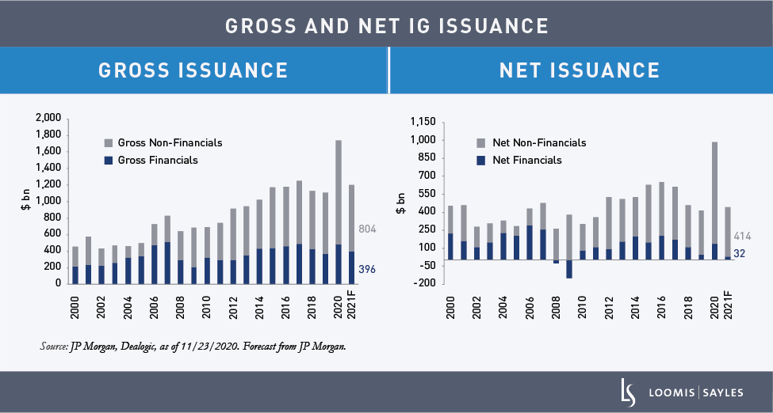

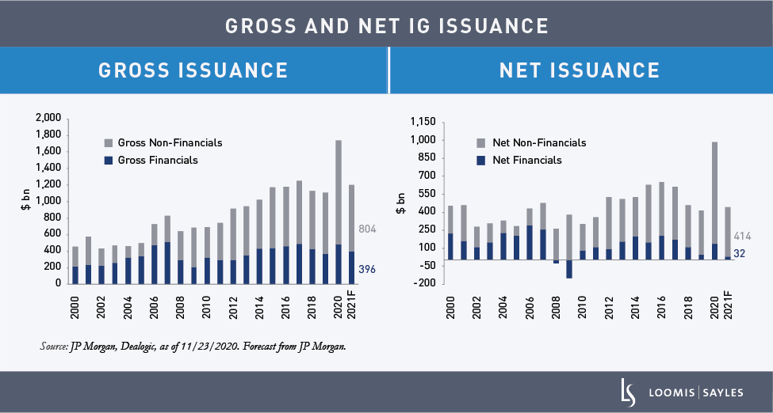

We remain constructive on the outlook for the investment grade (IG) bond market. While recognizing that valuations may appear full relative to historical levels, we think IG spreads can continue to grind modestly tighter in a recovery scenario. We expect the IG market to benefit from the rollout of the COVID-19 vaccine, an improving economy and additional fiscal support. We also anticipate a gradual but steady improvement in credit fundamentals as companies focus on balance sheet repair. Strong supply/demand technicals should also remain a tailwind in our view. Corporate bond issuance may decline meaningfully in 2021 following last year’s deluge, and we expect investors to continue to flock to US credit, which currently offers relatively higher yields versus developed markets in Europe and Asia.

2. What areas of the market look attractive?

COVID-19-impacted industries continue to offer additional spread relative to the market, but even the most stressed issuer’s bond spreads have tightened materially. We believe credit selection remains imperative. We prefer credits with better-than-average liquidity and manageable maturity profiles. Our focus, however, is shifting toward what companies will do with cash and debt that was built up during the height of the pandemic. We currently favor companies and industries that are showing a willingness and ability to repair their balance sheets. Rating agencies remained lenient throughout 2020, opting to take a wait-and-see approach in many cases, but we expect them to take a harder line as 2021 progresses.

3. What are some key risks you’re watching? Is there anything you’re worried about?

Over the next 12 months, we view the biggest risks to be:

-

Widespread, significant lockdowns across major regions domestically and abroad as COVID-19 cases spike;

-

Weaker-than-expected additional stimulus under the Biden administration; and

-

A poorly executed rollout of the vaccine and/or efficacy rates that are worse than expected.

Even if the recovery plays out as we expect, companies may fail to follow through on deleveraging with an improving economic environment, ample liquidity and animal spirits running high. In particular, a potential resurgence in mergers and acquisitions could slow balance sheet repair and lead to higher-than-anticipated new issuance.

MALR026669

Market conditions are extremely fluid and change frequently.

This blog post is provided for informational purposes only and should not be construed as investment advice. Any opinions or forecasts contained herein reflect the

subjective judgments and assumptions of the authors only and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. Information, including

that obtained from outside sources, is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or

redistributed without authorization. This information is subject to change at any time without notice.