The US investment grade (IG) corporate bond market is coming off an exceptionally strong year. Declining interest rates coupled with sharply narrower credit spreads contributed to strong absolute and relative returns. The US IG corporate bond market returned 14.54% in 2019 with excess returns of 7.68% versus US Treasurys.[1] We believe these strong results are unlikely to be repeated in 2020.

The combination of steadily growing US and global economies, accommodative central banks and healthy demand for yield—especially from overseas—supported the IG corporate bond market. We believe these trends should continue in 2020. Under our baseline assumptions, US IG corporate bonds should outperform US Treasurys.

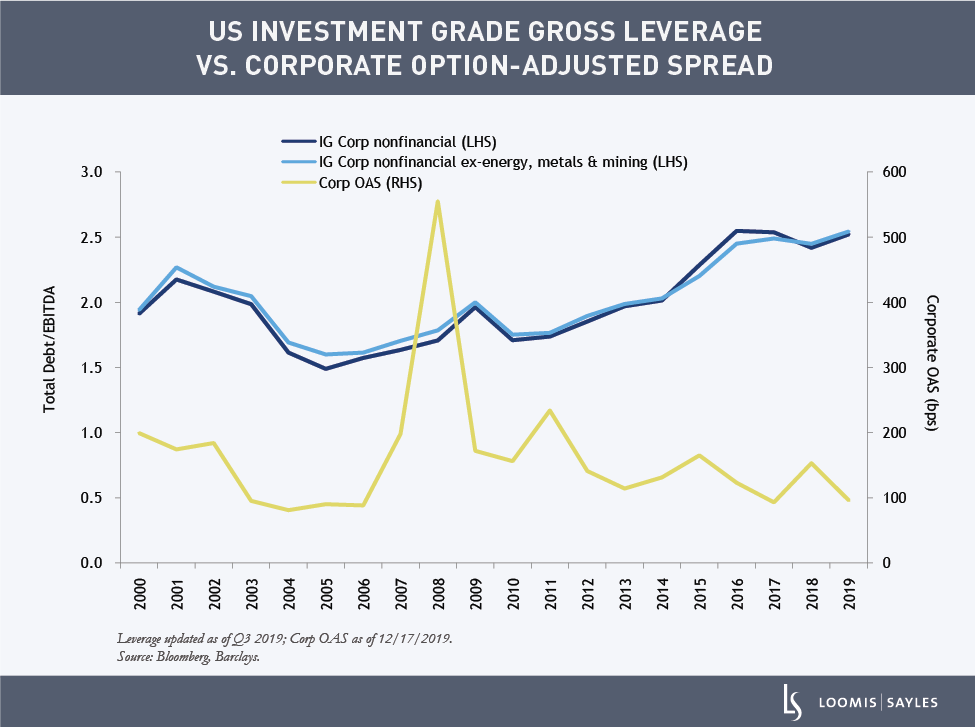

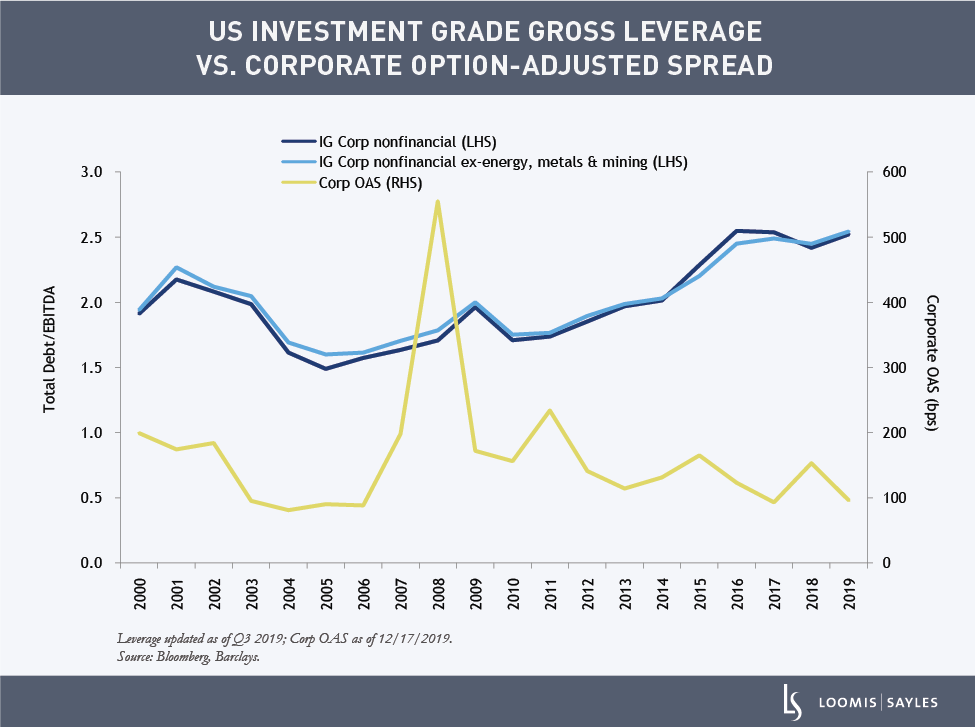

However, there are some worrying signs. IG corporate fundamentals have deteriorated during the past several years, with leverage at multi-year highs, and recent profit margin weakening. On a positive note, the pace of credit deterioration does not appear to be accelerating. Loomis Sayles credit analysts have maintained stable outlooks on the majority of industries they cover (by market value).

We believe the technical picture has been a positive influence on credit spreads and we expect this to continue. On the supply side, net new issuance of fixed-rate corporate bonds declined in 2019 and we expect it to be down again in 2020. On the demand side, US IG corporate bonds should continue to benefit from the “search for yield” by non-US investors, many of whom are facing negative-yielding bonds in their home countries.

IG spreads have declined to below 100 basis points, on the narrow end of the five-year range. We view these spread levels as “fair value,” largely pricing in a continuation of the supportive 2019 backdrop, which is our base case. However, we recognize that at current valuations, there is limited margin for error. The market could be vulnerable to a variety of downside risks, such as further deterioration in credit fundamentals, weaker-than-expected economic growth, rising trade policy uncertainty, and at some point, the perceived impact of the 2020 election.

[1] US investment grade corporate performance represented by the Bloomberg Barclays US Investment Grade Corporate Bond Index. US Treasury performance represented by the Bloomberg Barclays US Treasury Index.

MALR024665

Past performance is no guarantee of future results.