We expect European investment grade bonds to post slightly positive excess returns in 2020. We believe the sector stands to benefit from healthy supply and demand balances, likely offsetting tight valuations and weakening fundamentals.

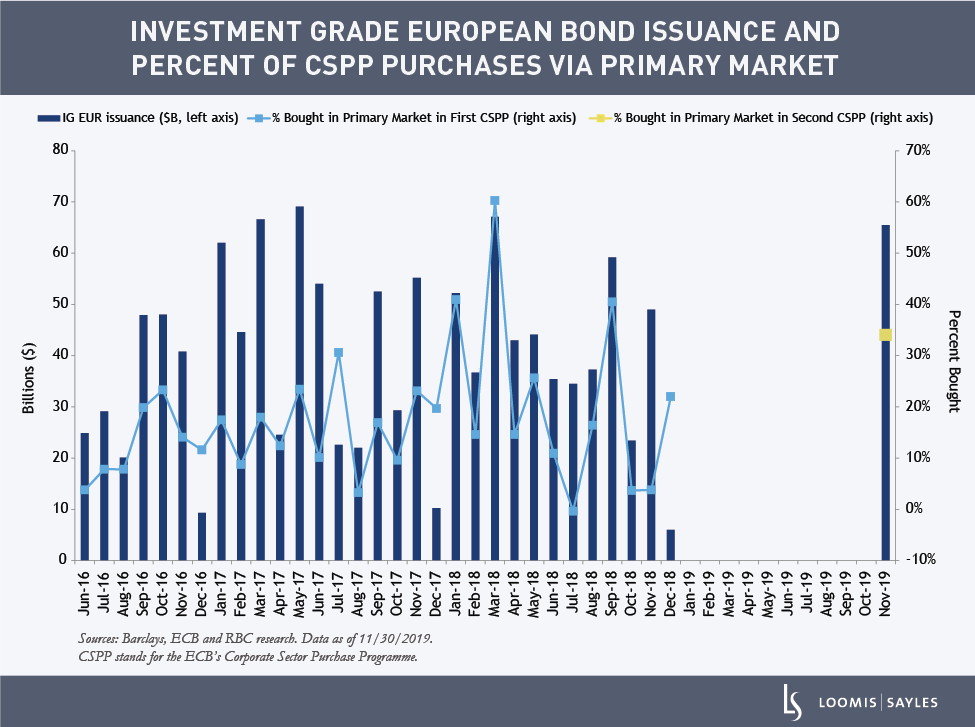

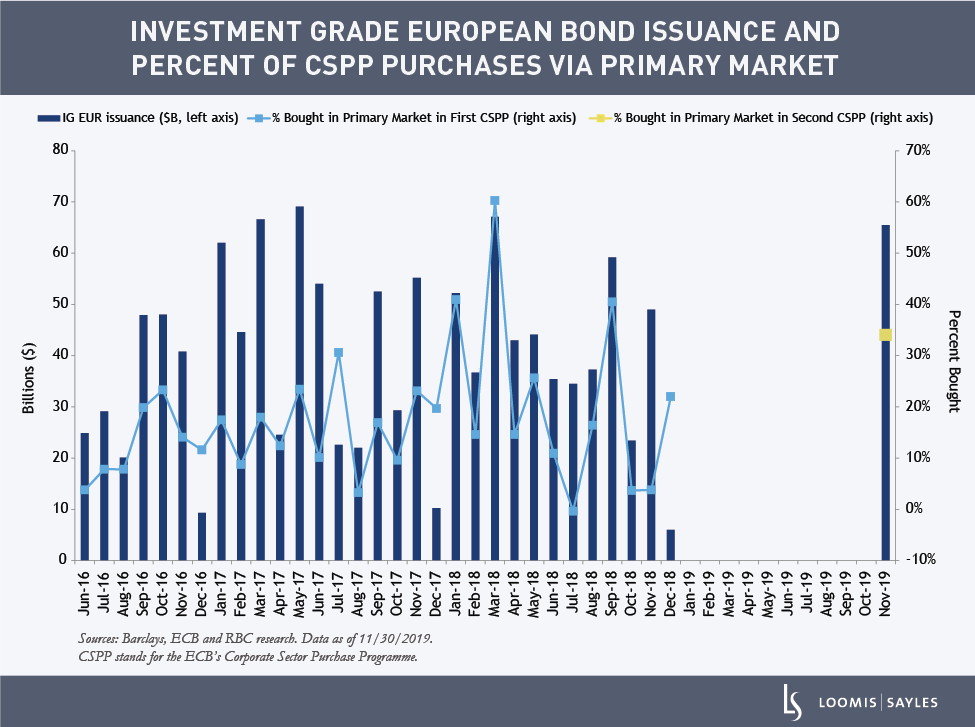

Technical factors provided a tailwind for the sector in 2019 and we expect this trend to continue into 2020. Rates are close to multi-year lows, which could prompt record inflows, and the European Central Bank has re-launched its Corporate Sector Purchase Programme.

As macro weakness weighs on corporations, we have seen fundamentals deteriorating, with revenue and EBITDA[1] growth declining. During 2019, our analysts’ outlooks for profit margins, leverage and free cash flow deteriorated. In our view, European investment grade valuations are stretched after a strong 2019. The sector appears expensive relative to the US-dollar investment grade market, and the cost to hedge for Japanese investors has increased. With the ECB increasingly active in the primary market, new-issue concessions will likely remain low in 2020.

[1] Earnings before interest, taxes, depreciation and amortization.

MALR024676

Past performance is no guarantee of future results.

Market conditions are extremely fluid and change frequently.

This blog post is provided for informational purposes only and should not be construed as investment advice. Any opinions or forecasts contained herein reflect the

subjective judgments and assumptions of the authors only and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. Information, including

that obtained from outside sources, is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or

redistributed without authorization. This information is subject to change at any time without notice.